- Adient reported its third quarter earnings for the period ended June 30, 2025, showing sales of US$3.74 billion and a return to net profitability compared to a net loss last year.

- This marks a turnaround for Adient, as the company posted positive diluted earnings per share from continuing operations after a year of losses.

- We'll explore how Adient's improved earnings and return to profitability this quarter could influence its long-term investment outlook.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Adient Investment Narrative Recap

For anyone considering Adient as an investment, the key narrative centers around its ability to deliver consistent earnings improvement while managing customer demand headwinds and operational challenges, especially in Europe and China. The Q3 return to net profitability is an encouraging sign, but its impact on short-term catalysts and risks is limited since ongoing demand softness from major customers and competition, particularly in China and Europe, remain unresolved. The most relevant recent announcement is Adient’s new mechanical massage seat solution, launched in GAC-Trumpchi’s M8 PHEV model. This innovation directly supports the growth catalyst of program launches in Asia, potentially helping offset demand risks from traditional core customers and providing a new source of revenue. However, given persistent demand uncertainties in China and competitive industry pricing, investors should be aware that even positive earnings can face pressure if...

Read the full narrative on Adient (it's free!)

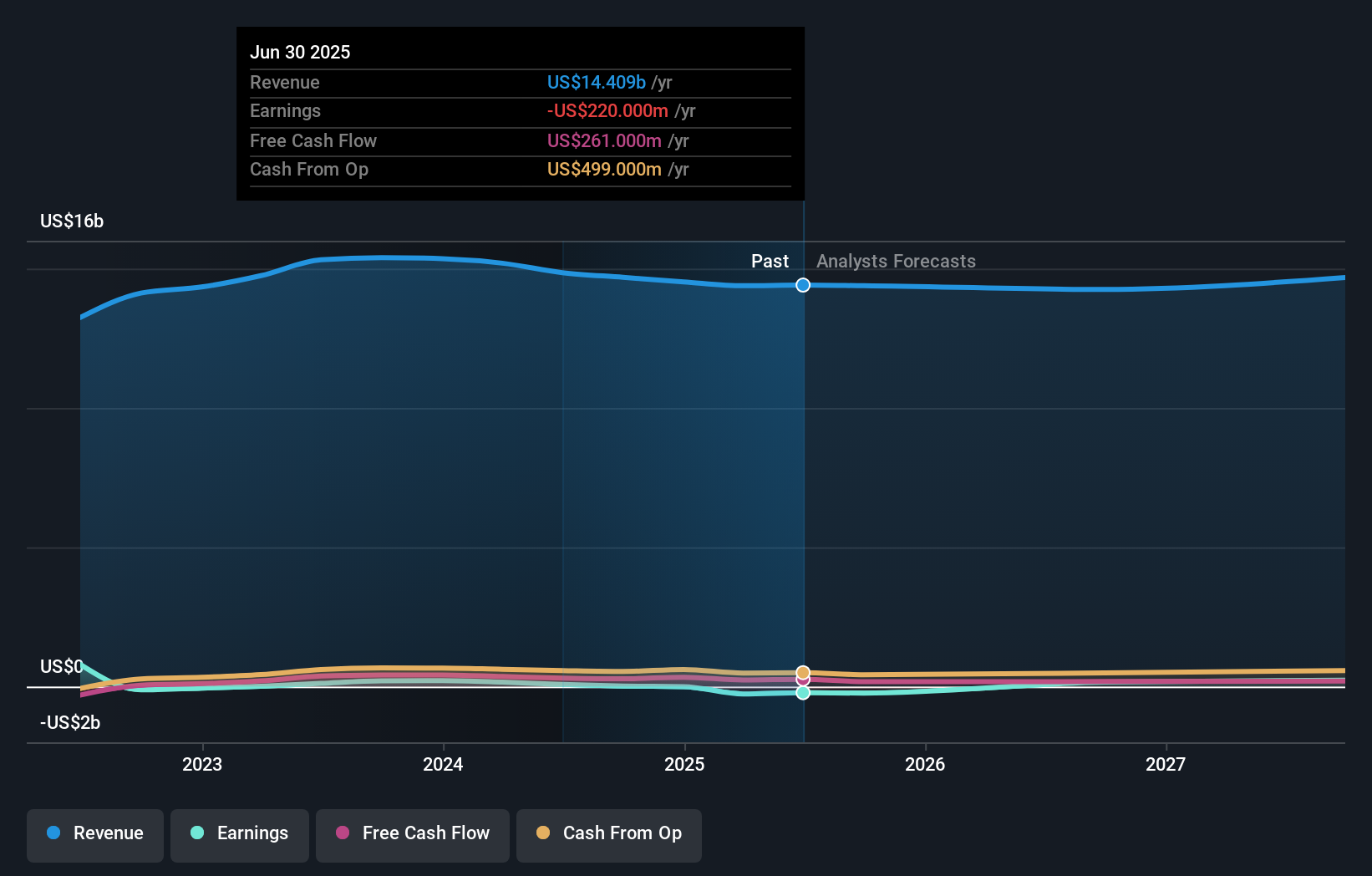

Adient's narrative projects $14.9 billion revenue and $297.1 million earnings by 2028. This requires 1.1% yearly revenue growth and a $564.1 million earnings increase from -$267.0 million today.

Uncover how Adient's forecasts yield a $24.55 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members submitted two fair value estimates for Adient, ranging from US$24.55 to US$31.45. With ongoing headwinds from weak demand in China and Europe, your outlook could shift by considering these varied viewpoints.

Explore 2 other fair value estimates on Adient - why the stock might be worth as much as 37% more than the current price!

Build Your Own Adient Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adient research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Adient research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adient's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com