- Reynolds Consumer Products recently announced its second quarter 2025 earnings, reporting sales of US$938 million with net income of US$73 million and reaffirmed expectations for a low single digit decline in net revenues for the rest of 2025.

- The company also expanded its board of directors by appointing Duncan Hawkesby and declared a quarterly cash dividend of US$0.23 per share, reflecting continued focus on governance and shareholder returns amid changing business conditions.

- We'll examine how the weaker net income and cautious revenue outlook impact Reynolds' longer-term growth assumptions and investment thesis.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Reynolds Consumer Products Investment Narrative Recap

To own Reynolds Consumer Products shares, you need to believe in the long-term demand for essential kitchen, storage, and waste solutions, bolstered by product innovation and strong retail partnerships. The recent Q2 earnings report showed steady sales but weaker net income, and the reaffirmed guidance for a modest revenue decline in 2025 does not materially change the company's short-term catalyst: stabilizing volume and margins despite persistent cost pressures. The biggest risk remains ongoing margin compression from higher raw material costs and pressured consumer spending.

Among the latest developments, the company's decision to maintain its quarterly dividend at US$0.23 per share stands out. This move reinforces Reynolds’ current commitment to shareholder returns, even as earnings face short-term headwinds, and provides a measure of continuity for income-focused investors while the company manages through industry challenges.

By contrast, investors should be aware that intense competition from private label store brands could threaten Reynolds’ pricing power if...

Read the full narrative on Reynolds Consumer Products (it's free!)

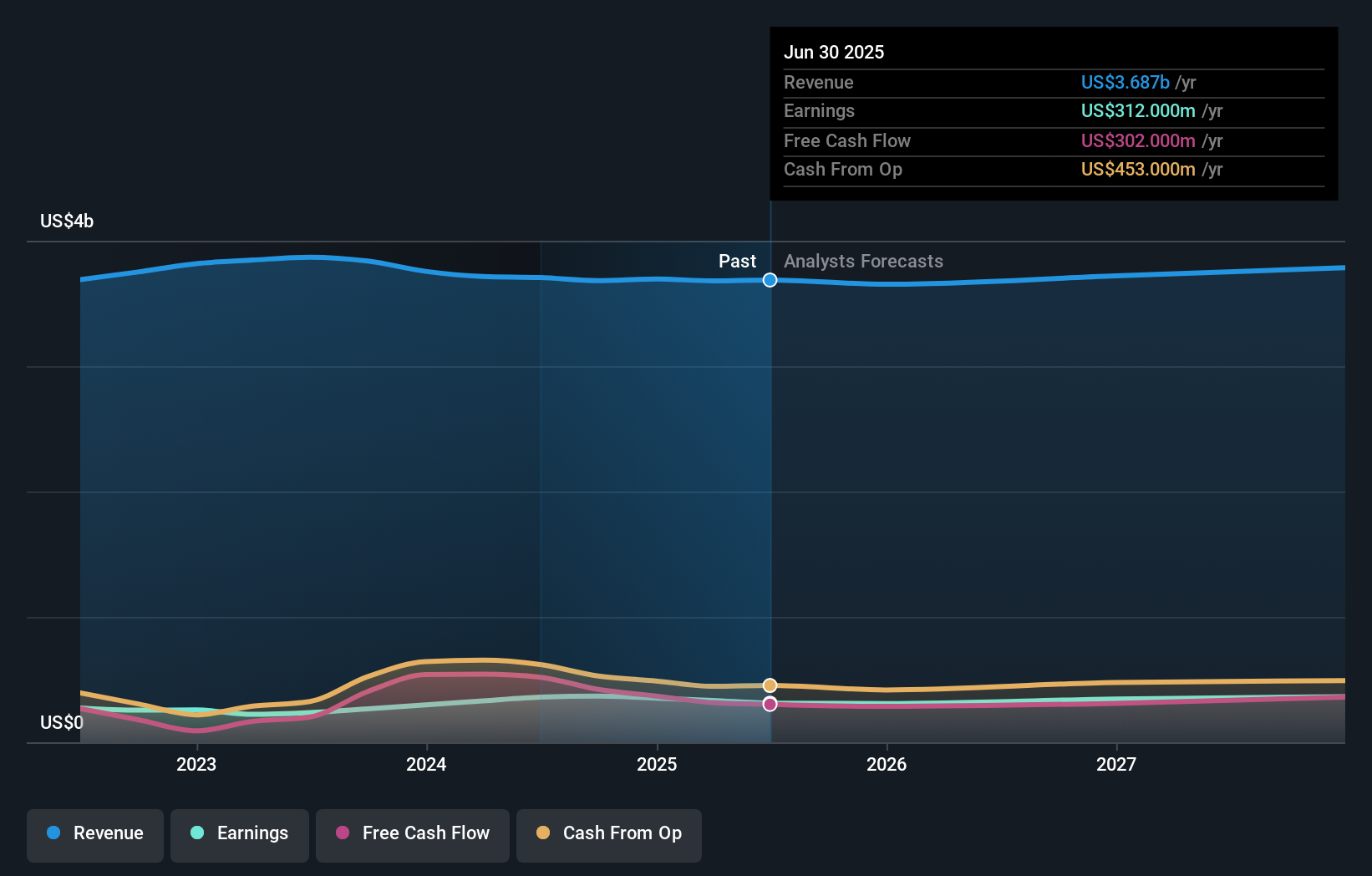

Reynolds Consumer Products' narrative projects $3.8 billion revenue and $383.5 million earnings by 2028. This requires a 1.2% yearly revenue growth and a $71.5 million earnings increase from the current earnings of $312.0 million.

Uncover how Reynolds Consumer Products' forecasts yield a $26.25 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members place their fair values for Reynolds Consumer Products between US$26.25 and US$49.74, with just two opinions reflected so far. This wide gap in estimates highlights varying expectations about the company’s ability to protect margins amid rising input and promotional pressures, see how other investors weigh the risks and rewards.

Explore 2 other fair value estimates on Reynolds Consumer Products - why the stock might be worth over 2x more than the current price!

Build Your Own Reynolds Consumer Products Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Reynolds Consumer Products research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Reynolds Consumer Products research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Reynolds Consumer Products' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com