- Strategic Education recently reported its second-quarter 2025 results, highlighted by a US$0.60 per share quarterly dividend and continued share repurchases as of the September 15 payment date.

- While revenue and net income both improved year-over-year, the company’s earnings per share missed analyst expectations, even as management reaffirmed its shareholder return commitments.

- We’ll assess how the combination of an earnings miss and ongoing share buybacks influences the company’s investment outlook.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Strategic Education Investment Narrative Recap

To be a shareholder in Strategic Education, you likely believe in the company’s ability to drive sustainable enrollment growth through employer partnerships and education technology, while maintaining disciplined cost management and strong shareholder returns. The latest results, featuring a continued dividend and share buybacks despite an earnings miss, do not appear to materially alter the most important near-term catalyst: the company’s ongoing corporate partnerships. The biggest risk remains potential revenue pressure from regulatory actions in Australia and New Zealand, but this was not directly impacted by the most recent announcements.

The recent update on share repurchases is particularly relevant, as Strategic Education bought back over 325,000 shares this quarter for US$28 million, reflecting a consistent approach to returning capital to shareholders. This buyback activity continued alongside the company’s dividend declaration and reinforces management’s commitment to shareholder returns, a key aspect of its investment narrative, even as earnings per share came in below analyst estimates.

Yet, with regulatory developments overseas potentially affecting future enrollment growth, investors should be aware that...

Read the full narrative on Strategic Education (it's free!)

Strategic Education's narrative projects $1.4 billion in revenue and $164.9 million in earnings by 2028. This requires 4.7% yearly revenue growth and a $52.2 million earnings increase from the current $112.7 million.

Uncover how Strategic Education's forecasts yield a $102.67 fair value, a 31% upside to its current price.

Exploring Other Perspectives

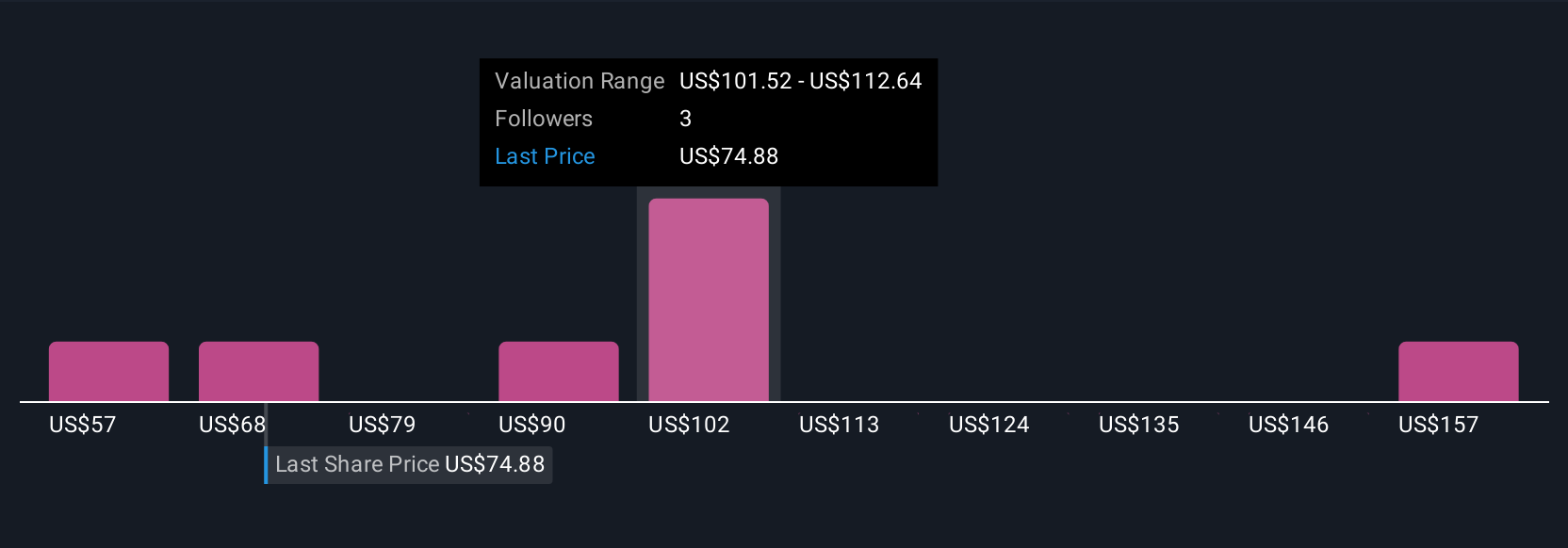

The Simply Wall St Community provided 5 distinct fair value estimates, ranging from US$57.04 to US$154.48 per share. As diverse as these opinions are, the persistent risk of regulatory measures affecting international student enrollment remains an important consideration for the company’s outlook, reminding you to compare a variety of viewpoints before reaching your own conclusion.

Explore 5 other fair value estimates on Strategic Education - why the stock might be worth 27% less than the current price!

Build Your Own Strategic Education Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Strategic Education research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Strategic Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Strategic Education's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com