- Universal Technical Institute recently reported fiscal third quarter results, posting US$204.3 million in sales and net income of US$10.66 million, both higher than the prior year, and raised the lower end of its revenue guidance for fiscal 2025.

- An important development was the lifting of growth restrictions on the Concorde Career Colleges division, allowing for accelerated expansion of programs and campuses ahead of plan.

- We'll examine how this combination of stronger earnings and new growth opportunities at Concorde Career Colleges impacts Universal Technical Institute’s investment outlook.

These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Universal Technical Institute Investment Narrative Recap

Owning shares in Universal Technical Institute means believing in the company’s ability to grow enrollment and expand programs across skilled trades and healthcare, all while managing tight margins and regulatory pressure. The recent Q3 earnings beat and raised revenue guidance support optimism around student start performance, yet they do not fully lessen the near-term risk from increased operational costs tied to new campus and program rollouts, which could squeeze profitability if not carefully controlled.

The announcement that growth restrictions on Concorde Career Colleges have been lifted is particularly timely. With Concorde now able to accelerate program and campus expansion, this development aligns squarely with the business’s main short-term growth catalyst, driving new revenue streams through increased student admissions and broader educational offerings.

But while headline results look strong, investors should be aware that rapid expansion could bring unexpected expenses that...

Read the full narrative on Universal Technical Institute (it's free!)

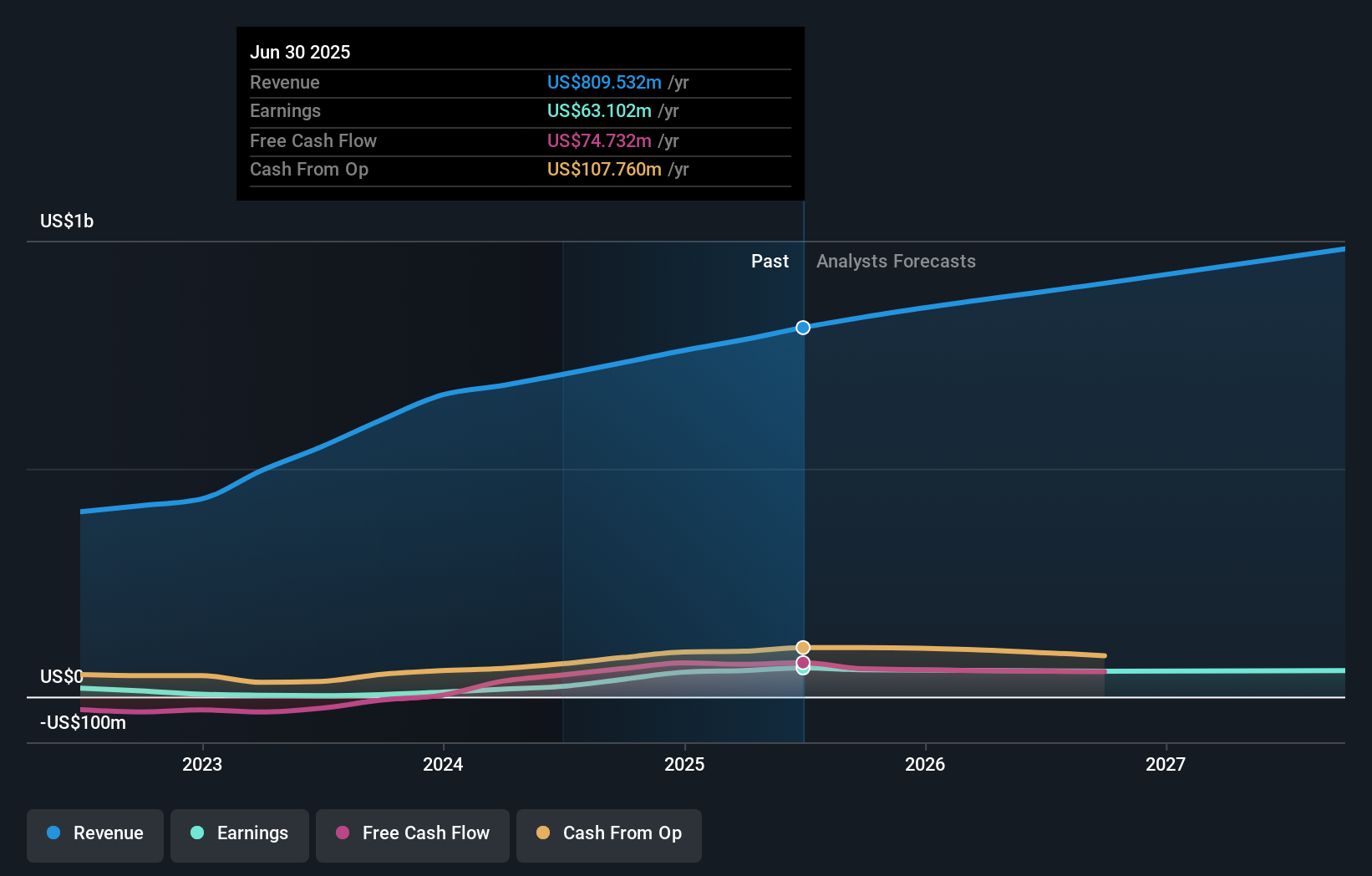

Universal Technical Institute's narrative projects $1.0 billion in revenue and $68.7 million in earnings by 2028. This requires 8.7% yearly revenue growth and an $11.3 million earnings increase from $57.4 million today.

Uncover how Universal Technical Institute's forecasts yield a $37.33 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offer two fair value estimates for UTI between US$27.70 and US$37.33 per share. Many are watching closely how rapid program expansion, especially at Concorde, may affect costs and longer-term margins, inviting you to compare these views with your own outlook.

Explore 2 other fair value estimates on Universal Technical Institute - why the stock might be worth as much as 12% more than the current price!

Build Your Own Universal Technical Institute Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Universal Technical Institute research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Universal Technical Institute research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Universal Technical Institute's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com