- Bristow Group Inc. recently updated its earnings guidance for 2025 and 2026, projecting total revenues between US$1.46 billion and US$1.56 billion for 2025 and US$1.62 billion to US$1.74 billion for 2026, while also reporting half-year 2025 sales of US$376.43 million and net income of US$31.75 million.

- These dual announcements provide greater clarity on Bristow’s revenue expectations and profit outlook as the company transitions through long-term contract changes and market expansion.

- We'll explore how Bristow's new revenue outlook may shift expectations around its recurring earnings and contract-driven stability.

These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Bristow Group Investment Narrative Recap

To see long-term value in Bristow Group, investors need to believe in the company's ability to convert robust demand for offshore transport and government service contracts into stable, recurring revenues, even as it tackles ongoing contract transitions. The recent earnings guidance update provides more definition around short-term performance expectations, but it does not materially impact the most important near-term catalyst: the full ramp-up of new long-term government contracts. The biggest immediate risk remains the potential for cost inflation and supply chain constraints affecting aircraft readiness and profit margins, which the updated guidance does not directly resolve.

Among recent announcements, Bristow's half-year earnings release stands out as most relevant to the guidance update, giving concrete numbers on sales (US$376.43 million) and net income (US$31.75 million). This data helps put the revenue forecasts into context for investors focused on recurring earnings and contract-driven visibility, reinforcing how execution on contracts remains the key operational catalyst. Despite the visibility offered by revenue guidance, investors should pay close attention to the risk that persistent supply chain delays could still...

Read the full narrative on Bristow Group (it's free!)

Bristow Group's narrative projects $2.1 billion in revenue and $169.5 million in earnings by 2028. This requires 23.2% yearly revenue growth and a $77.7 million earnings increase from current earnings of $91.8 million.

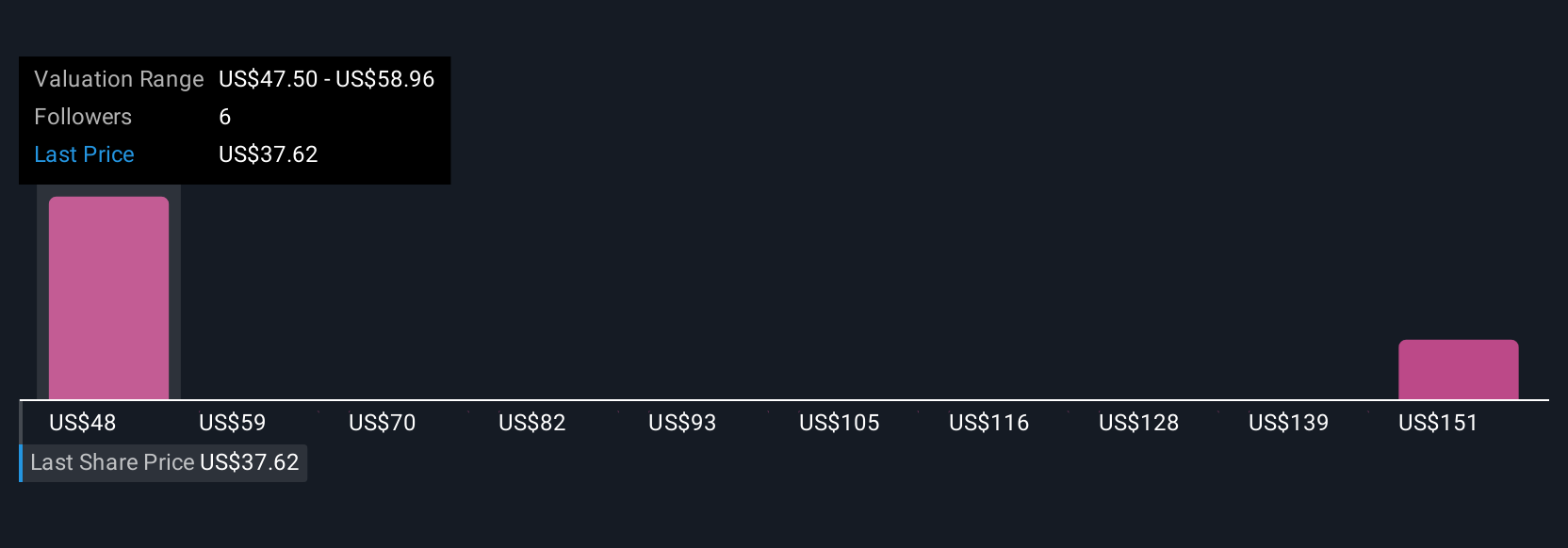

Uncover how Bristow Group's forecasts yield a $47.50 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Bristow Group’s fair value from as low as US$20.02 to as high as US$47.50, reflecting wide-ranging views from just 2 contributors. With supply chain bottlenecks still looming as a critical operational risk, you can compare these diverse opinions to see how differing perspectives may shape expectations for future returns.

Explore 2 other fair value estimates on Bristow Group - why the stock might be worth 48% less than the current price!

Build Your Own Bristow Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bristow Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bristow Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bristow Group's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com