- Grand Canyon Education, Inc. recently announced its earnings for the second quarter and first half of 2025, reporting net income of US$41.55 million for the quarter and US$113.16 million for the six months, both higher than the same periods last year.

- Year-over-year increases in both net income and earnings per share highlight ongoing operational improvements at the education services provider.

- We'll explore how Grand Canyon Education's improved profitability in the latest earnings report could influence its long-term investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Grand Canyon Education Investment Narrative Recap

To be a shareholder in Grand Canyon Education, one must believe in the company's ability to sustain online enrollment growth and manage operational challenges in a shifting education sector. The recent earnings beat, with net income and EPS up year-over-year, may bolster sentiment for the short-term, but it does not materially offset the largest immediate risk: ongoing sensitivity to changing student financial dynamics and potential federal aid uncertainty.

Among recent announcements, the Q2 2025 earnings report stands out as most relevant, demonstrating year-over-year improvements in both net income and diluted EPS. These results reinforce near-term optimism regarding operating discipline and strong online program adoption, two factors frequently identified as key catalysts for supporting future earnings consistency.

Yet, in contrast to positive headline numbers, investors should be aware that future enrollment and revenue could still face pressure if federal funding policies shift unexpectedly...

Read the full narrative on Grand Canyon Education (it's free!)

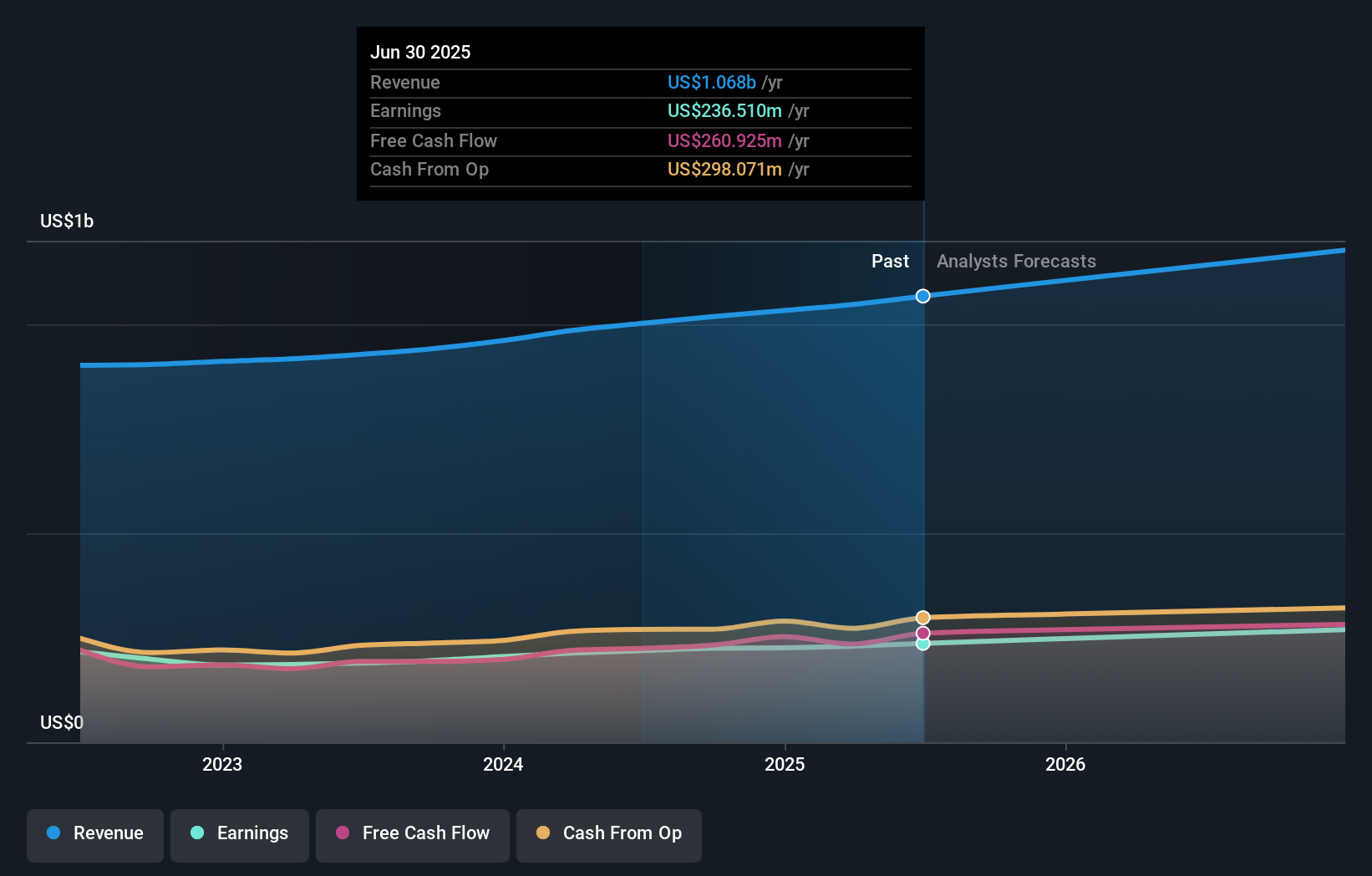

Grand Canyon Education's narrative projects $1.3 billion in revenue and $280.4 million in earnings by 2028. This requires 6.1% yearly revenue growth and a $50.6 million earnings increase from $229.8 million.

Uncover how Grand Canyon Education's forecasts yield a $213.33 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have set fair value estimates from US$213.33 to US$247.89 across 2 perspectives. While improved profitability has drawn attention, uncertainty around federal aid remains a key concern for longer term performance, consider reviewing other viewpoints before forming your outlook.

Explore 2 other fair value estimates on Grand Canyon Education - why the stock might be worth just $213.33!

Build Your Own Grand Canyon Education Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Grand Canyon Education research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Grand Canyon Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Grand Canyon Education's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com