- Perdoceo Education Corporation recently reported second-quarter 2025 results, revealing revenue of US$209.58 million and net income of US$41.03 million, along with increases in both basic and diluted earnings per share compared to the prior year.

- The company also announced a 15.4% increase in its quarterly dividend, authorized a new US$75 million share buyback program, and provided improved full-year guidance, highlighting management's confidence in long-term performance and growth stemming from enrollment gains and recent acquisitions.

- We'll explore how Perdoceo Education's dividend increase signals management's confidence and may impact the investment case going forward.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Perdoceo Education Investment Narrative Recap

To be a shareholder in Perdoceo Education, you need to believe that ongoing enrollment momentum, enhanced by acquisitions like the University of St. Augustine, and disciplined cost management can translate into consistent growth, despite competition and regulatory risks. The latest results affirm recent enrollment gains, but the most important catalyst remains the company’s ability to sustain broad-based, organic growth; reliance on acquisitions still poses the biggest risk, and this news does not materially change that risk profile for now.

The newly authorized US$75 million share buyback program stands out, signaling management’s intention to return capital to shareholders while balancing investment in academic and technology improvements. This move is especially relevant as it dovetails with ongoing efforts to drive earnings growth and buffer against uncertainties around future enrollment or regulatory changes, which are key areas for investor attention.

In contrast, investors should be especially aware of how any unexpected shift in regulations or Title IV funding could...

Read the full narrative on Perdoceo Education (it's free!)

Perdoceo Education's narrative projects $987.8 million revenue and $179.9 million earnings by 2028. This requires 8.7% yearly revenue growth and a $25.5 million earnings increase from $154.4 million today.

Uncover how Perdoceo Education's forecasts yield a $40.00 fair value, a 28% upside to its current price.

Exploring Other Perspectives

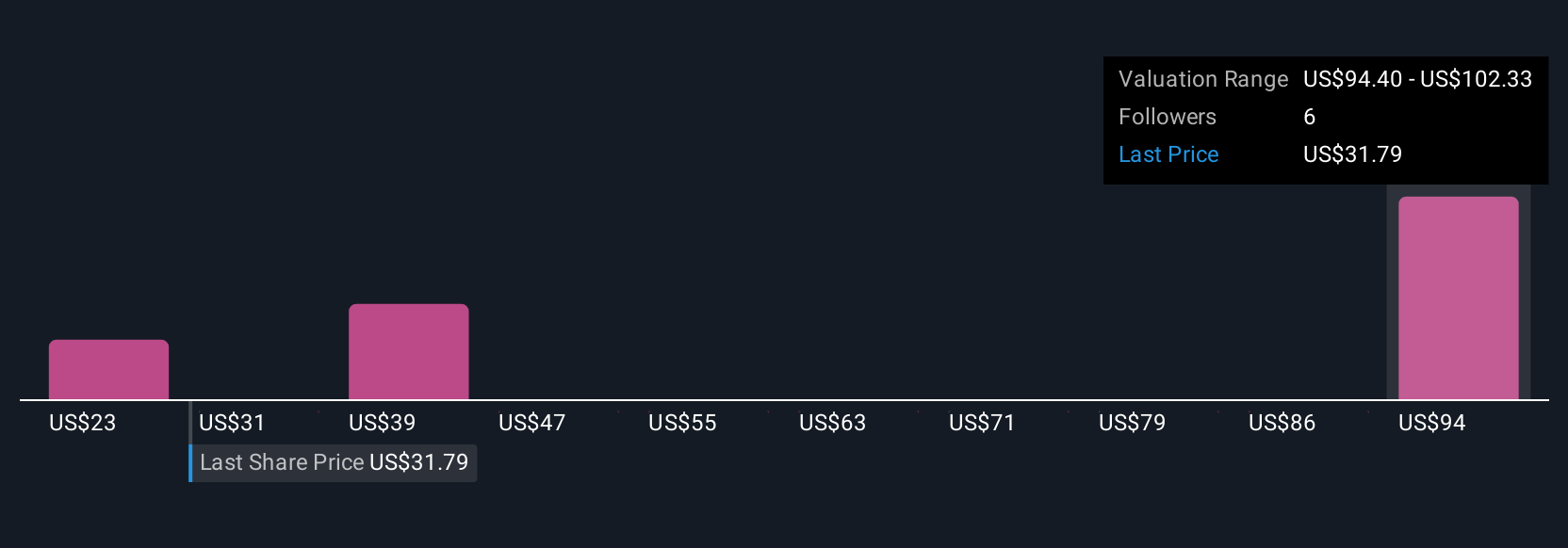

Four unique fair value estimates from the Simply Wall St Community range widely, between US$22.97 and US$101.48 per share. While some expect continued growth from enrollment gains, views differ sharply on future earnings potential, so it’s worth exploring several alternative opinions before drawing conclusions.

Explore 4 other fair value estimates on Perdoceo Education - why the stock might be worth 27% less than the current price!

Build Your Own Perdoceo Education Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Perdoceo Education research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Perdoceo Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Perdoceo Education's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com