- Credit Acceptance Corporation recently reported strong second quarter results, posting year-over-year increases in both revenue (US$583.8 million) and net income (US$87.4 million) for the period ended June 30, 2025, and continued its significant share buyback program by repurchasing 528,462 shares in the quarter.

- This operational performance improvement, along with ongoing capital returns to shareholders, highlights renewed momentum in profitability after a period of previous net losses.

- We'll explore how the sharp rebound in quarterly earnings and active share repurchases impact Credit Acceptance's investment outlook and analyst forecasts.

These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Credit Acceptance Investment Narrative Recap

Owning shares in Credit Acceptance means believing in the resilience of the non-prime auto lending market, as well as the company's ability to rebound in earnings amid volatile loan performance. While the recent jump in quarterly profitability and ongoing buybacks offer confidence in near-term earnings recovery, they do not materially change the key short-term catalyst of stabilizing loan collections or lessen the risk that portfolio credit quality could worsen from prior vintages, impacting future results.

Among the latest company announcements, the extension and improvement of Credit Acceptance's $300 million revolving warehouse facility stands out. By securing longer-dated financing and reduced interest rates, the company shores up funding flexibility, supporting its loan origination capacity, a critical factor as competition intensifies and origination volumes come under pressure.

Yet, despite this progress, investors should stay mindful of ongoing credit quality concerns, especially as...

Read the full narrative on Credit Acceptance (it's free!)

Credit Acceptance's narrative projects $4.5 billion revenue and $504.0 million earnings by 2028. This requires 56.2% yearly revenue growth and a $79.6 million earnings increase from $424.4 million.

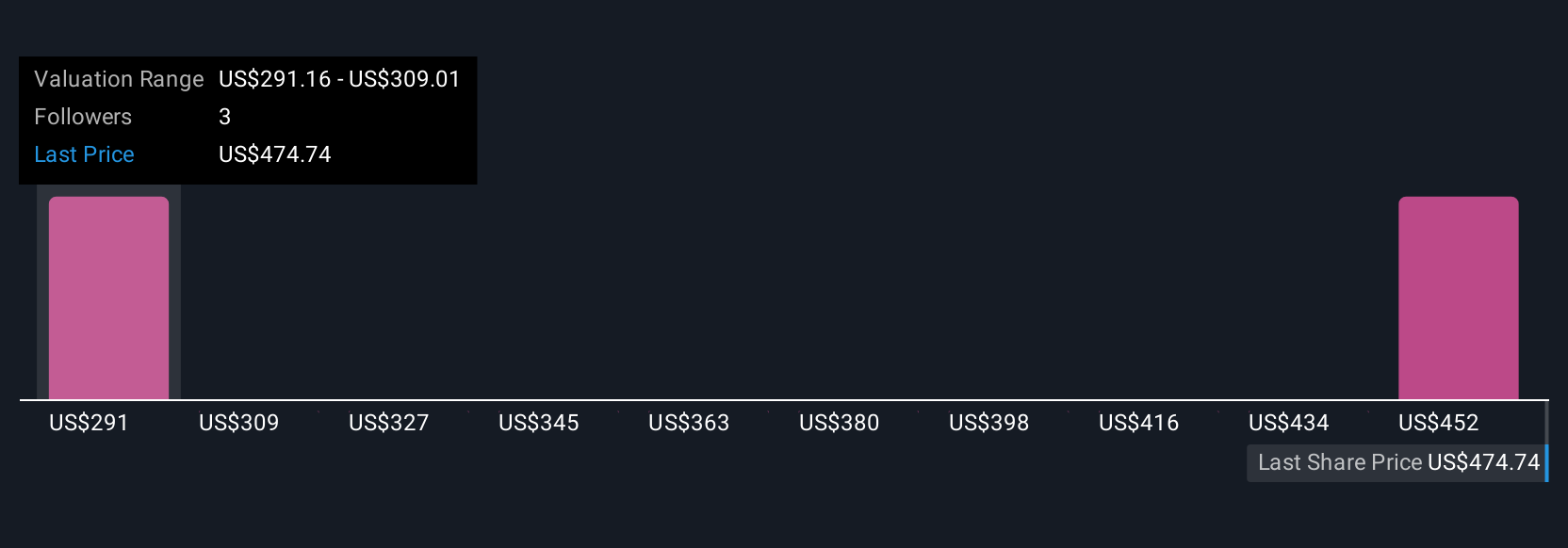

Uncover how Credit Acceptance's forecasts yield a $467.50 fair value, in line with its current price.

Exploring Other Perspectives

Three Simply Wall St Community estimates place Credit Acceptance's fair value between US$284,622 and US$469,667, highlighting a wide range of personal views. While community sentiment is mixed, the company's long-term prospects continue to hinge on improved loan performance across recent vintages, which could affect both profitability and future shareholder value.

Explore 3 other fair value estimates on Credit Acceptance - why the stock might be worth as much as $469.67!

Build Your Own Credit Acceptance Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Credit Acceptance research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Credit Acceptance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Credit Acceptance's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com