- Crown Holdings, Inc. announced its Board of Directors has declared a cash dividend of US$0.26 per share, payable on August 21, 2025, to shareholders of record as of August 7, 2025.

- This dividend declaration, alongside completion of a major share repurchase program totaling over US$407 million, highlights the company's ongoing commitment to returning value to shareholders.

- With the company affirming its dividend and completing a sizable buyback, we’ll examine how these shareholder returns influence the investment narrative.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Crown Holdings Investment Narrative Recap

To be a Crown Holdings shareholder today, belief in the long-term demand for sustainable packaging, alongside confidence in the company's ability to maintain profit growth through operational efficiency and capacity expansion, is key. The recent dividend affirmation and completion of a substantial share repurchase program continue to support the near-term investment narrative, but they do not significantly alter the most immediate catalysts: successful expansion projects and consumer demand resilience. The greatest current risk, persistent margin pressure from high input costs and intense competition, remains unaddressed by these announcements.

Among recent developments, the board’s declaration of a US$0.26 per share quarterly dividend, reaffirmed for two consecutive quarters, stands out. This ongoing commitment to shareholder returns is consistent with expectations tied to Crown’s robust free cash flow generation; however, it does not shift attention away from the need for strong execution in high-growth markets to drive meaningful shareholder value. Contrast that with the persistent risks around margin compression from elevated aluminum prices, which investors should be aware of as...

Read the full narrative on Crown Holdings (it's free!)

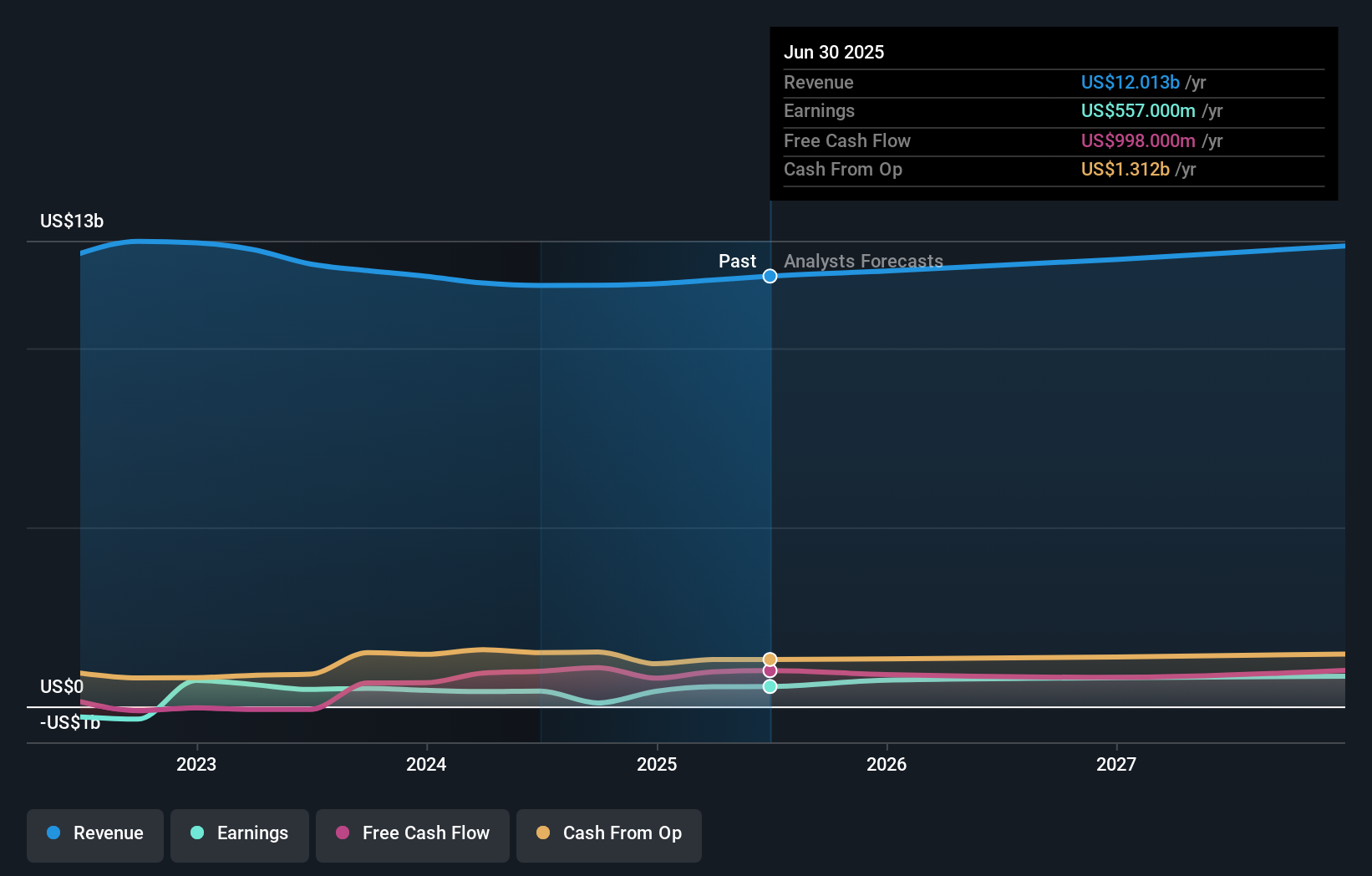

Crown Holdings' narrative projects $13.3 billion revenue and $886.4 million earnings by 2028. This requires 3.3% yearly revenue growth and a $329.4 million earnings increase from $557.0 million currently.

Uncover how Crown Holdings' forecasts yield a $123.36 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Community members at Simply Wall St currently estimate Crown’s fair value in a wide span from US$123 to US$220, based on 2 distinct viewpoints. Despite these differing valuations, ongoing exposure to high input costs remains a crucial factor that could influence whether the company achieves its growth goals, explore these varied perspectives for a fuller picture.

Explore 2 other fair value estimates on Crown Holdings - why the stock might be worth just $123.36!

Build Your Own Crown Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crown Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Crown Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crown Holdings' overall financial health at a glance.

No Opportunity In Crown Holdings?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com