- Bloom Energy reported record second quarter revenue of US$401.24 million and improved margins, while revealing a partnership to deliver its fuel cell technology at select Oracle Cloud Infrastructure data centers in the US within 90 days.

- This combination of strong financial results and a growing presence in the AI data center market has fueled renewed investor interest in Bloom Energy's future prospects.

- We'll examine how the Oracle collaboration enhances Bloom Energy's investment narrative, particularly in light of accelerating AI-driven data center demand.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Bloom Energy Investment Narrative Recap

To be a Bloom Energy shareholder, you really have to buy into the idea that fuel cell technology will remain at the forefront of powering large-scale, always-on data centers, especially as AI expands, and that Bloom can execute quickly enough to capture this growing market. The record quarterly revenues, strong order flow, and Oracle partnership all drive optimism, but the biggest current risk for the business remains cost management and execution, especially around infrastructure build-out and deployment speed. This latest board appointment, while notable for corporate governance, is unlikely to materially shift near-term catalysts or mitigate the immediate infrastructure execution risk investors are watching.

Of all recent announcements, the Oracle collaboration stands out, putting Bloom’s fuel cell systems in the AI data center spotlight. The deal reinforces the short-term catalyst: surging demand for reliable, clean onsite power for hyperscale customers, and underscores Bloom’s opportunity in the digital infrastructure space.

On the flip side, while the growth outlook is bright, investors should also be aware that the company’s exposure to infrastructure timing and cost risks means...

Read the full narrative on Bloom Energy (it's free!)

Bloom Energy's narrative projects $2.6 billion in revenue and $299.4 million in earnings by 2028. This requires 18.9% yearly revenue growth and a $294.9 million increase in earnings from $4.5 million today.

Uncover how Bloom Energy's forecasts yield a $26.42 fair value, a 32% downside to its current price.

Exploring Other Perspectives

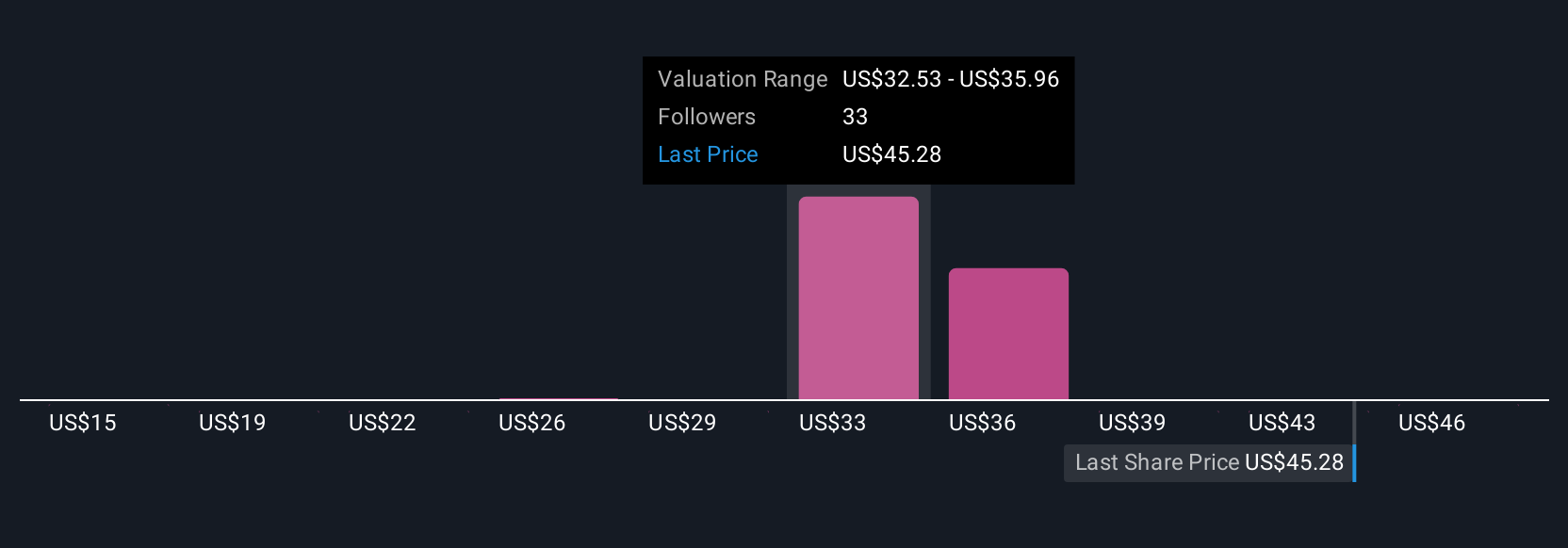

Six estimates from the Simply Wall St Community span US$15.38 to US$49.68 for Bloom Energy’s fair value, showing a wide spread of opinion. With surging AI data center demand presenting a major growth catalyst, consider how these diverging views might factor in execution or deployment risks as you decide where you stand.

Explore 6 other fair value estimates on Bloom Energy - why the stock might be worth as much as 28% more than the current price!

Build Your Own Bloom Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bloom Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bloom Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bloom Energy's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com