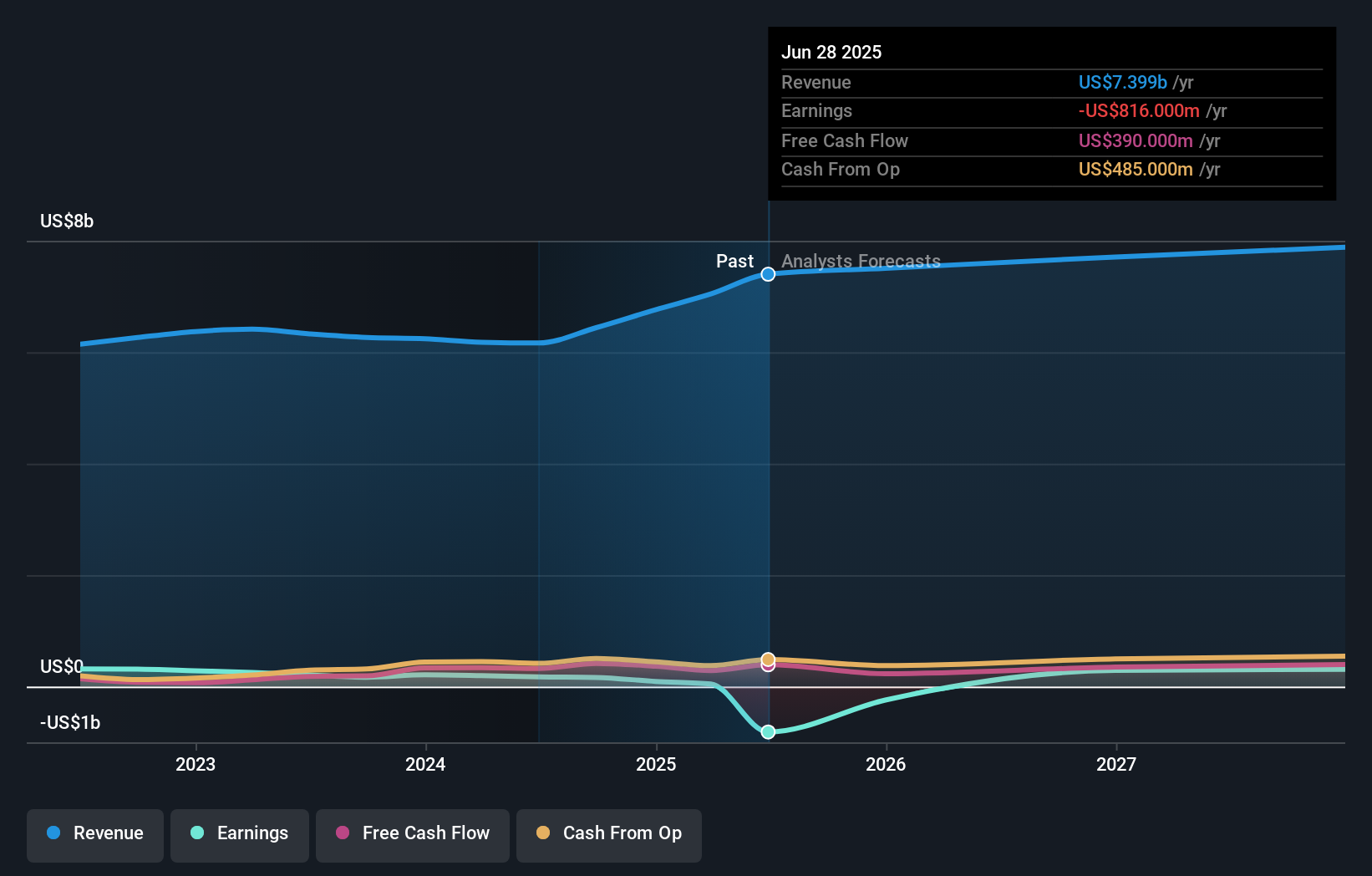

- Resideo Technologies recently reported second quarter 2025 results, showing sales of US$1.94 billion, up from US$1.59 billion a year earlier, alongside a net loss of US$825 million for the quarter.

- Amid these results, the company raised its full-year 2025 net revenue guidance to between US$7.45 billion and US$7.55 billion, signaling management's optimism about future business activity despite recent losses.

- We will now explore how raised revenue guidance, despite sizable quarterly losses, could shift Resideo Technologies' longer-term investment outlook.

These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Resideo Technologies Investment Narrative Recap

To be a shareholder in Resideo Technologies right now, you need to believe the company’s push for higher revenues, supported by increasing demand for smart home products and ongoing cost-saving initiatives, will eventually translate into sustainable profitability. The recent uplift in revenue guidance could be a short-term catalyst, signaling management’s confidence, but the large reported net loss highlights sizeable ongoing risks; notably, competitive threats from larger tech firms and persistent end market softness continue to loom over performance. At this stage, the impact on near-term catalysts appears material, the raised guidance may help boost sentiment, but fundamental questions about earnings power remain.

One of the most relevant recent announcements is Resideo’s upgraded full-year net revenue outlook of US$7.45 billion to US$7.55 billion. This signals management’s belief that product demand is improving enough to support top-line growth, even if sustainable profitability and margin recovery remain open questions, a key point when considering catalysts like new product launches and operational efficiency programs.

In contrast, investors should also be mindful of the risk that heightened competition from Big Tech could accelerate changes in market share faster than...

Read the full narrative on Resideo Technologies (it's free!)

Resideo Technologies' narrative projects $7.9 billion revenue and $565.8 million earnings by 2028. This requires 2.2% yearly revenue growth and a $1.38 billion increase in earnings from -$816.0 million today.

Uncover how Resideo Technologies' forecasts yield a $29.50 fair value, a 3% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate fair values ranging from US$16.02 to US$43.26 on Resideo, spanning three unique perspectives. With competition from major tech entrants a persistent risk, understanding this diversity of opinion can help you weigh multiple angles before making decisions.

Explore 3 other fair value estimates on Resideo Technologies - why the stock might be worth as much as 52% more than the current price!

Build Your Own Resideo Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Resideo Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Resideo Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Resideo Technologies' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com