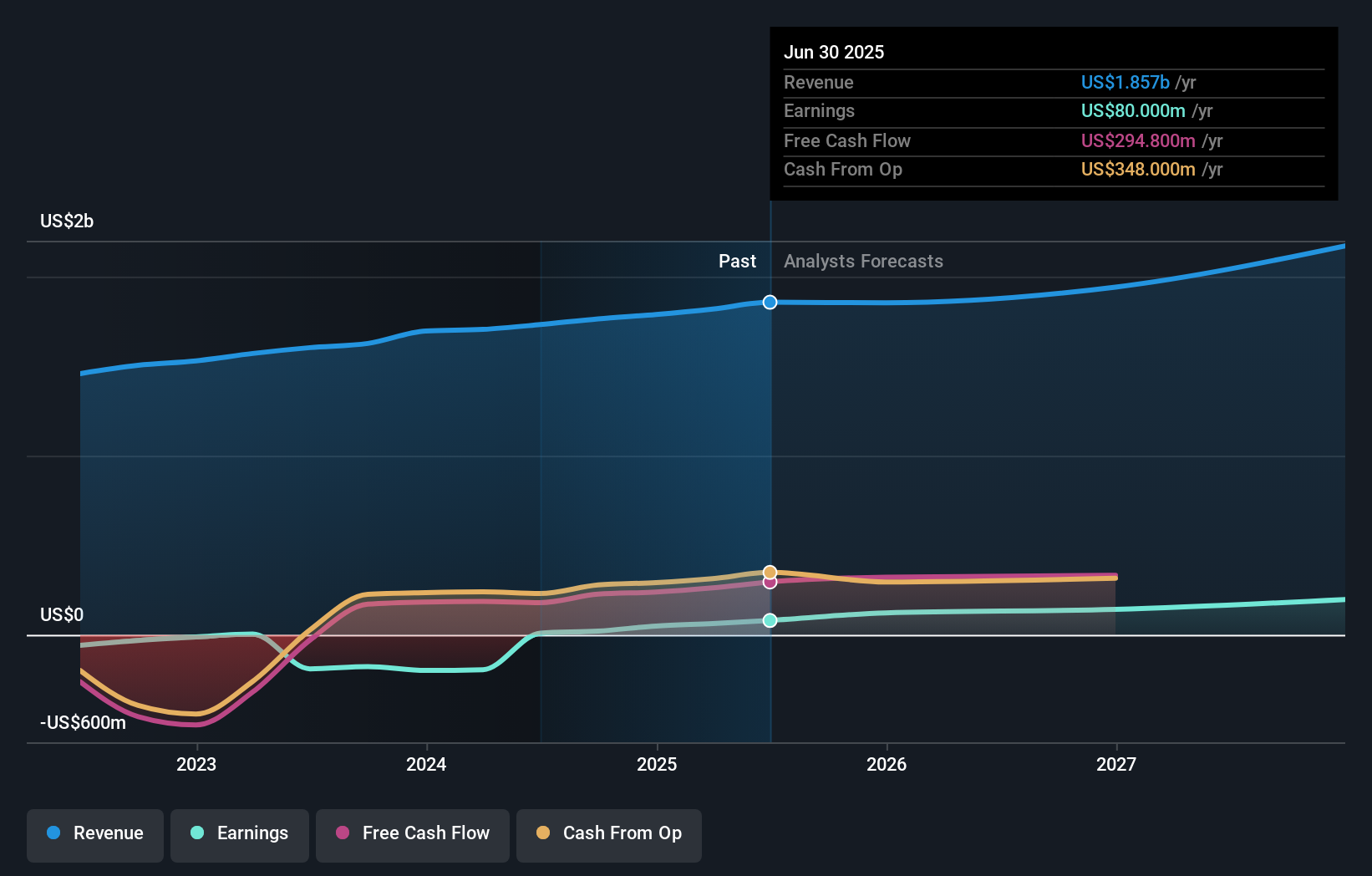

- OPENLANE, Inc. recently raised its full-year 2025 earnings guidance, expecting income from continuing operations of US$132 million to US$140 million, with revised diluted earnings per share guidance of US$0.61 to US$0.66, up from previous projections.

- The company also reported strong second quarter and half-year results, highlighted by substantial year-over-year increases in both revenue and net income, underscoring improving operational performance.

- We'll assess how OPENLANE's sharply upgraded earnings outlook and improving profitability impact its investment narrative and growth prospects.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

OPENLANE Investment Narrative Recap

To be a shareholder in OPENLANE, you need to believe the company can maintain its lead as digital adoption accelerates in the wholesale vehicle auction industry, driving further revenue and profit growth. The recent earnings guidance upgrade is a positive short-term catalyst, signaling improved operational momentum, but it doesn’t eliminate the main challenge: stronger competition from rivals expanding digital platforms, which could impact margins and limit gains if competitive pressures intensify.

The sharp upward revision to full-year 2025 earnings guidance, announced with the latest results, is the most relevant recent development. This substantial increase in expected income and earnings per share highlights management’s growing confidence in profitability, aligning with the company’s ongoing investments in automation and digital tools, which remain central to sustaining OPENLANE’s market share and supporting the current growth outlook.

However, investors should be aware that even as OPENLANE’s profitability rises, there remains the risk of margin pressure from increasing competition if...

Read the full narrative on OPENLANE (it's free!)

OPENLANE's narrative projects $2.0 billion revenue and $203.0 million earnings by 2028. This requires 1.9% yearly revenue growth and a $112.7 million earnings increase from $90.3 million today.

Uncover how OPENLANE's forecasts yield a $26.17 fair value, a 9% downside to its current price.

Exploring Other Perspectives

One member of the Simply Wall St Community valued OPENLANE at US$72.70 per share, far above recent prices. As profitability improves, you may want to consider how market competition could impact future gains before relying on any one viewpoint.

Explore another fair value estimate on OPENLANE - why the stock might be worth just $72.70!

Build Your Own OPENLANE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OPENLANE research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free OPENLANE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OPENLANE's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com