Market forces rained on the parade of Kimberly-Clark Corporation (NASDAQ:KMB) shareholders today, when the analysts downgraded their forecasts for this year. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative. At US$137, shares are up 9.1% in the past 7 days. It will be interesting to see if this downgrade motivates investors to start selling their holdings.

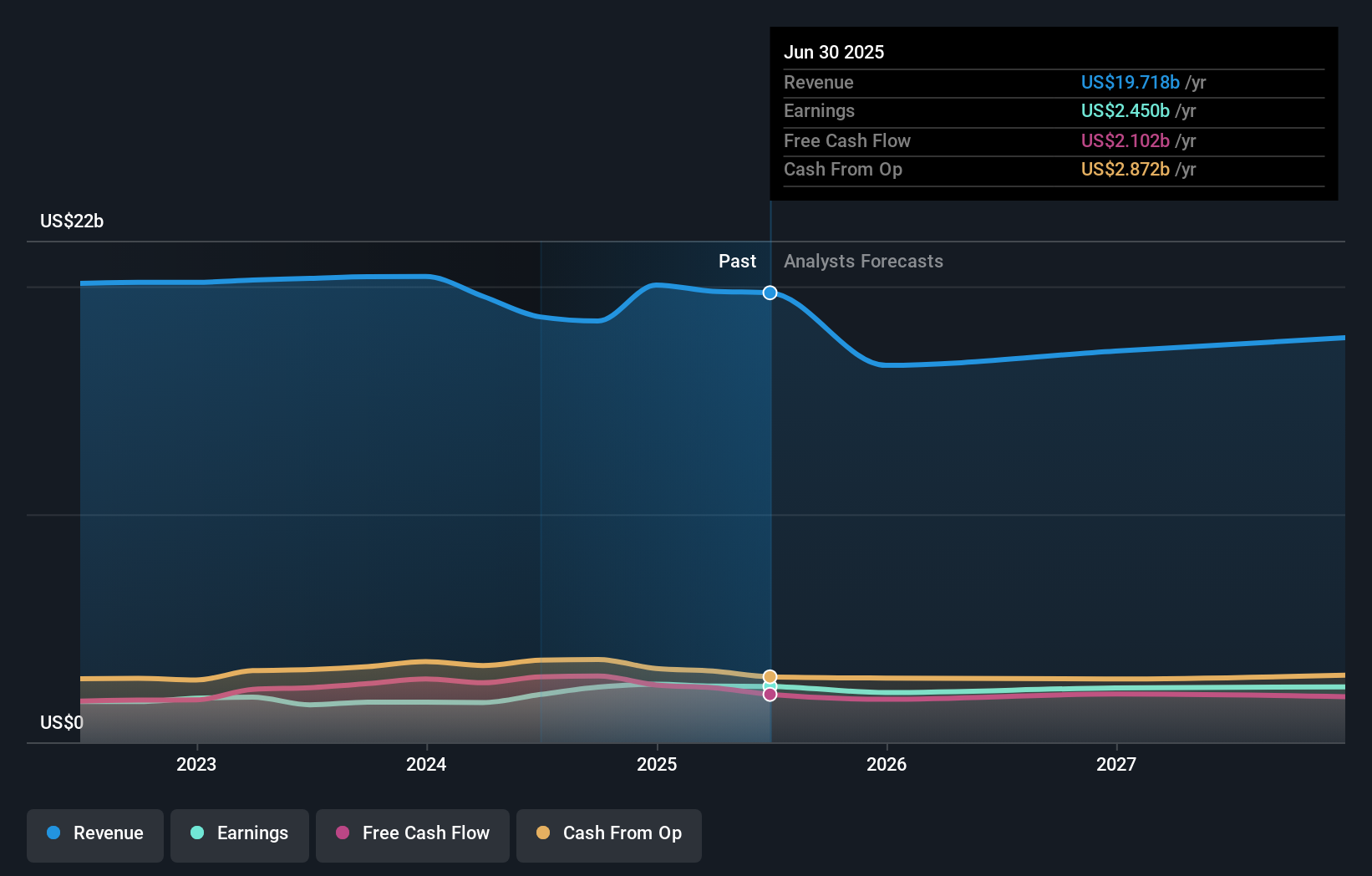

Following the downgrade, the consensus from 14 analysts covering Kimberly-Clark is for revenues of US$17b in 2025, implying a considerable 16% decline in sales compared to the last 12 months. Statutory earnings per share are anticipated to decline 15% to US$6.25 in the same period. Previously, the analysts had been modelling revenues of US$19b and earnings per share (EPS) of US$6.31 in 2025. So there's been a clear change in analyst sentiment in the recent update, with the analysts making a measurable cut to revenues and reconfirming their earnings per share estimates.

Check out our latest analysis for Kimberly-Clark

The consensus has reconfirmed its price target of US$142, showing that the analysts don't expect weaker sales expectationsthis year to have a material impact on Kimberly-Clark's market value.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that sales are expected to reverse, with a forecast 30% annualised revenue decline to the end of 2025. That is a notable change from historical growth of 0.7% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 2.8% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Kimberly-Clark is expected to lag the wider industry.

The Bottom Line

The most obvious conclusion from this consensus update is that there's been no major change in the business' prospects in recent times, with analysts holding earnings per share steady, in line with previous estimates. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Kimberly-Clark's revenues are expected to grow slower than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Kimberly-Clark after today.

Unfortunately, the earnings downgrade - if accurate - may also place pressure on Kimberly-Clark's mountain of debt, which could lead to some belt tightening for shareholders. See why we're concerned about Kimberly-Clark's balance sheet by visiting our risks dashboard for free on our platform here.

You can also see our analysis of Kimberly-Clark's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.