NetApp (NTAP) recently announced the integration of Amazon FSx for NetApp ONTAP as an external storage option on Amazon AWS, enhancing its cloud capabilities. This development is part of a broader strategic focus, aligning with market trends towards data management and cloud integration. Over the last quarter, the company's stock experienced a 9% price increase. Against the backdrop of a 22% rise in market indices over the past year and various sector movements, NetApp's enhancements, along with recent executive changes and positive earnings, may have provided additional support to its stock performance amidst broader market influences.

Buy, Hold or Sell NetApp? View our complete analysis and fair value estimate and you decide.

The integration of Amazon FSx for NetApp ONTAP into AWS as an external storage option is a significant development for NetApp that aligns well with its narrative of leveraging cloud solutions and product innovations to enhance market positioning. This move is expected to boost revenue and earnings forecasts by capitalizing on the growing demand for cloud and AI solutions. Over the past five years, NetApp's shares have delivered a total return of 171.15%, reflecting strong long-term performance. However, in the past year, the company has underperformed both the US market, which rose 22.4%, and the US Tech industry, which gained 0.6%.

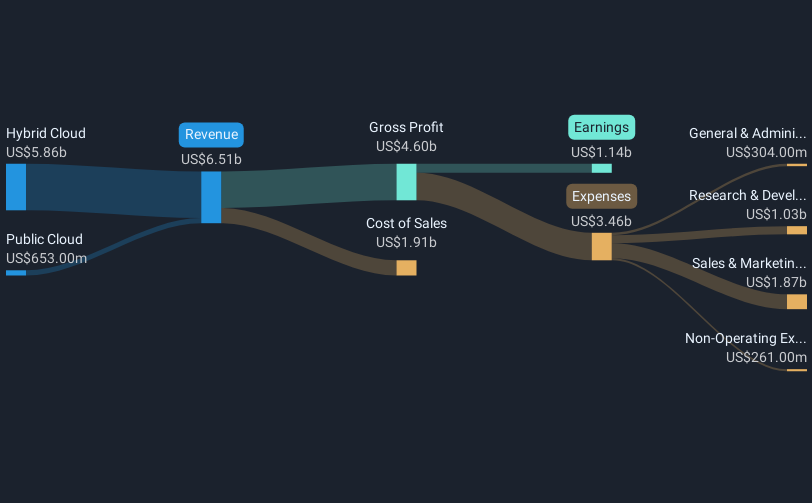

With a current share price of US$103.33, NetApp's stock is trading at a discount to the consensus analyst price target of US$115.07, suggesting potential upside if earnings and revenue growth materialize as expected. Analysts foresee a revenue growth of 4.3% annually with profit margins improving slightly over the next few years, supported by strategic costs controls and divestitures. This growth, coupled with improvements in sales execution and innovations in cloud offerings, are critical elements that could validate the analyst consensus. If the company achieves the projected earnings of $1.4 billion by 2028, trading on a price-to-earnings ratio of 19.3x, it would position NetApp toward realizing its price target.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com