12 analysts have shared their evaluations of Incyte (NASDAQ:INCY) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 7 | 1 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 5 | 1 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 2 | 0 | 0 |

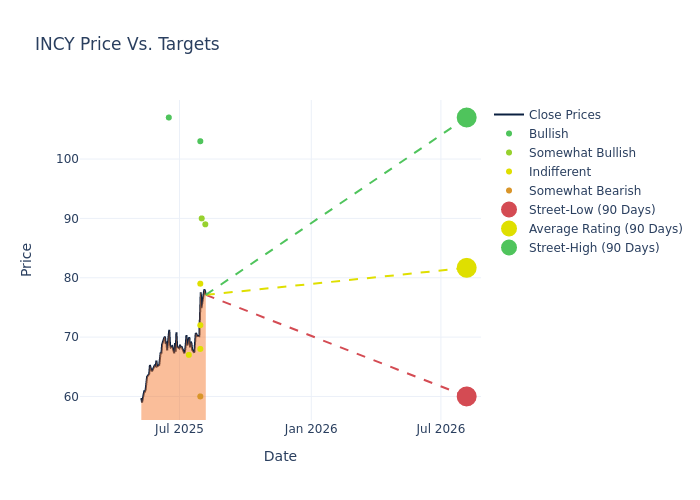

In the assessment of 12-month price targets, analysts unveil insights for Incyte, presenting an average target of $78.0, a high estimate of $107.00, and a low estimate of $60.00. This upward trend is apparent, with the current average reflecting a 15.16% increase from the previous average price target of $67.73.

Analyzing Analyst Ratings: A Detailed Breakdown

An in-depth analysis of recent analyst actions unveils how financial experts perceive Incyte. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Derek Archila | Wells Fargo | Raises | Overweight | $89.00 | $67.00 |

| Luke Sergott | Barclays | Announces | Overweight | $90.00 | - |

| Evan Seigerman | BMO Capital | Raises | Underperform | $60.00 | $52.00 |

| David Lebowitz | Citigroup | Raises | Buy | $103.00 | $88.00 |

| Srikripa Devarakonda | Truist Securities | Raises | Hold | $79.00 | $73.00 |

| Nicholas Holowko | UBS | Raises | Neutral | $68.00 | $62.00 |

| Brian Abrahams | RBC Capital | Raises | Sector Perform | $72.00 | $68.00 |

| Derek Archila | Wells Fargo | Raises | Equal-Weight | $67.00 | $59.00 |

| Jessica Fye | JP Morgan | Lowers | Neutral | $67.00 | $68.00 |

| Stephen Willey | Stifel | Raises | Buy | $107.00 | $75.00 |

| Ashwani Verma | UBS | Maintains | Neutral | $61.00 | $61.00 |

| Srikripa Devarakonda | Truist Securities | Raises | Hold | $73.00 | $72.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Incyte. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Incyte compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Incyte's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Incyte's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Incyte analyst ratings.

Delving into Incyte's Background

Incyte focuses on the discovery and development of small-molecule drugs. The firm's leading drug, Jakafi, treats two types of rare blood cancer and graft versus host disease and is partnered with Novartis. Incyte's other marketed drugs include rheumatoid arthritis treatment Olumiant (licensed to Lilly), and oncology drugs Iclusig (chronic myeloid leukemia), Pemazyre (cholangiocarcinoma), Tabrecta (lung cancer), and Monjuvi (diffuse large B-cell lymphoma). The firm's first dermatology product, Opzelura, was approved in 2021 for atopic dermatitis and 2022 for vitiligo. Incyte's pipeline includes a broad array of oncology and dermatology programs.

Incyte's Financial Performance

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Positive Revenue Trend: Examining Incyte's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 16.46% as of 30 June, 2025, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: Incyte's net margin excels beyond industry benchmarks, reaching 33.32%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Incyte's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 10.33%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Incyte's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 7.0% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.01.

The Basics of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.