- In July 2025, The Marzetti Company expanded its retail portfolio by launching four new Buffalo Wild Wings-branded hot sauces, available in Original, Chipotle, Habanero, and Blazin’ varieties exclusively on Amazon, with broad retail expansion planned for 2026.

- This exclusive product partnership harnesses Buffalo Wild Wings' strong brand appeal, positioning Marzetti to reach new consumer segments in the competitive condiments category.

- We’ll explore how this high-profile brand collaboration could influence Marzetti’s distribution reach and long-term growth outlook.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Marzetti Investment Narrative Recap

Owning Marzetti stock means believing in its ability to drive growth through strong retail brand partnerships, premium licensing, and efficient operations, despite competitive headwinds in the condiments and dressings space. While the Buffalo Wild Wings hot sauces launch leverages high-recognition branding and could help diversify the consumer base, it does not immediately offset the biggest short-term risk: persistent softness in the foodservice segment and sluggish core dressing volumes, which remains a key challenge for near-term revenue growth.

Of the recent company developments, the official rebranding from Lancaster Colony Corporation to The Marzetti Company stands out as particularly relevant. This formal alignment with Marzetti’s best-known brand could reinforce new product launches like the Buffalo Wild Wings partnership, boosting the company’s profile and supporting its goal to expand addressable retail markets.

But consider, in contrast, the company’s heavy reliance on a few key branded partnerships, a risk that investors should be aware of as…

Read the full narrative on Marzetti (it's free!)

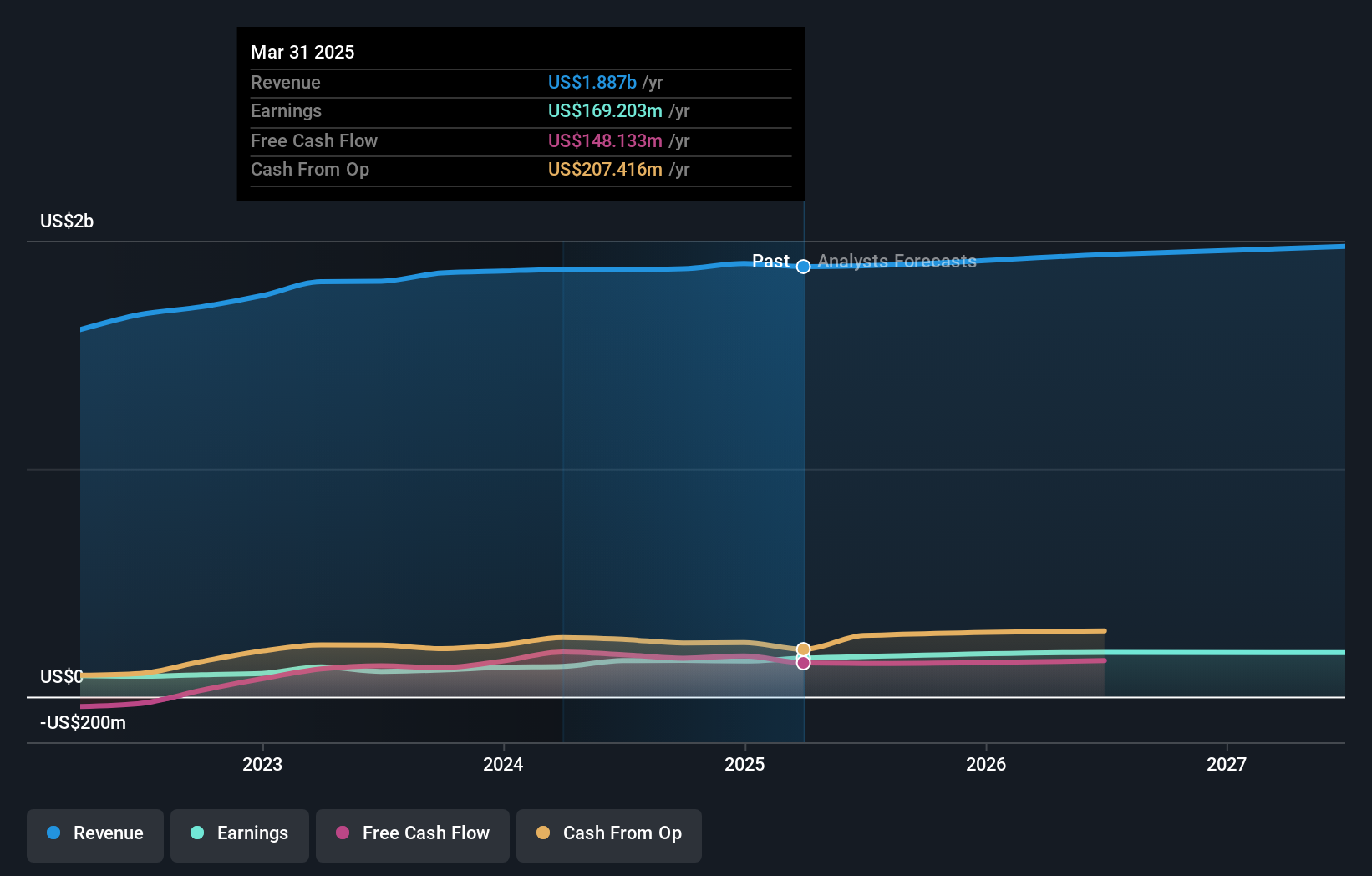

Marzetti's outlook forecasts $2.0 billion in revenue and $212.5 million in earnings by 2028. This requires a 2.5% annual revenue growth rate and a $43.3 million earnings increase from the current $169.2 million.

Uncover how Marzetti's forecasts yield a $194.90 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Fair value estimates from two Simply Wall St Community members cluster between US$129.56 and US$139.54, offering diverse signals on Marzetti’s potential. While numerous voices see different upside limits, many remain watchful regarding Marzetti’s revenue growth outlook amid intensifying retail competition and evolving consumer trends.

Explore 2 other fair value estimates on Marzetti - why the stock might be worth as much as $139.54!

Build Your Own Marzetti Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marzetti research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Marzetti research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marzetti's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com