- Laureate Education recently reported second quarter results, revealing higher sales and upgraded full-year 2025 revenue guidance driven largely by enrollment growth and favorable currency impacts.

- A standout development is the company's plans to open new campuses in Monterrey, Mexico, and Lima, Peru, underscoring its focus on expanding access to higher education in key Latin American markets.

- We will now examine how Laureate's increased revenue outlook and campus expansion could influence its investment narrative and future prospects.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

Laureate Education Investment Narrative Recap

To believe in Laureate Education as a shareholder today, you need confidence in the company’s ability to drive enrollment growth and deliver consistent revenue expansion through new campus launches and diversified academic programs in Latin America. The recent upgrade to 2025 revenue guidance highlights positive enrollment momentum and currency benefits, which bolster the most important short-term catalyst, student growth and footprint expansion. However, the biggest risk, currency volatility, particularly in Mexico, remains, though the current impact appears mitigated by favorable trends.

Among recent developments, the decision to raise full-year 2025 revenue guidance by US$55 million stands out, closely aligning with the company’s strengthened enrollment and operational execution in both key markets. This raised outlook has direct bearing on investor attention, as it supports the ongoing narrative of organic growth despite currency fluctuations and short-term pressures from campus consolidation impacts.

But investors should be aware, in contrast to the improved guidance, the persistent risk of currency swings in Mexico could still...

Read the full narrative on Laureate Education (it's free!)

Laureate Education's narrative projects $1.9 billion in revenue and $297.8 million in earnings by 2028. This requires 7.1% yearly revenue growth and a $11 million earnings increase from $286.8 million today.

Uncover how Laureate Education's forecasts yield a $26.50 fair value, a 12% upside to its current price.

Exploring Other Perspectives

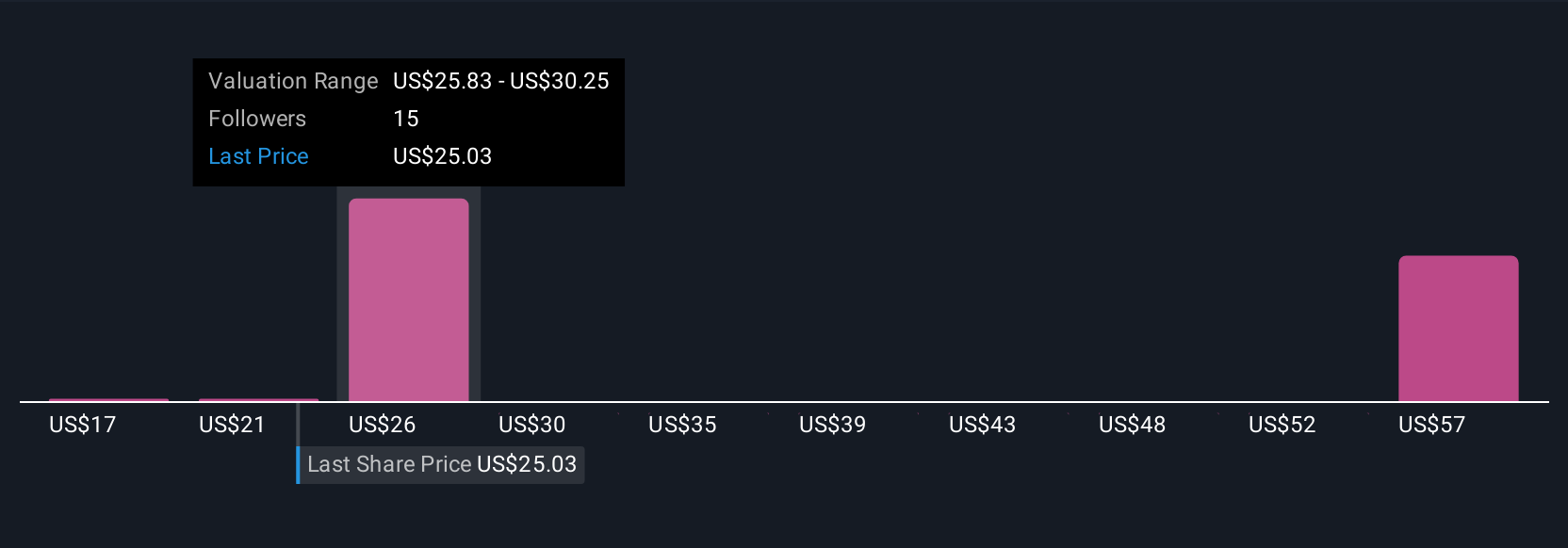

Four members of the Simply Wall St Community estimated Laureate’s fair value between US$17 and US$60.73 per share. While student demand is increasing, you may want to review how much each viewpoint accounts for shifting currency conditions and their potential effect on future results.

Explore 4 other fair value estimates on Laureate Education - why the stock might be worth over 2x more than the current price!

Build Your Own Laureate Education Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Laureate Education research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Laureate Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Laureate Education's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com