- ASGN Incorporated recently reported second quarter 2025 results, with revenue reaching US$1,020.6 million and net income of US$29.3 million, alongside issuing new guidance for the third quarter that projects revenue between US$992 million and US$1,012 million and earnings per diluted share of US$0.82 to US$0.90.

- An interesting detail is that even while ASGN continued its share repurchase program during this period, revenue growth guidance for the coming quarter remains below industry averages, raising questions about future growth rates.

- We'll examine how ASGN's cautious revenue outlook for the next quarter may influence the company's long-term investment narrative.

These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

ASGN Investment Narrative Recap

Owning shares in ASGN means believing in the company’s ability to leverage demand for high-margin IT consulting and technology services even as traditional staffing remains pressured by ongoing market shifts. The recent second-quarter results, with both revenue and net income declining year over year and a cautious third-quarter outlook, reinforce concerns about near-term growth limitations, though these developments appear to have a limited impact on the momentum from federal contract wins, which remains the main catalyst; the biggest risk continues to be prolonged softness in assignment revenues tied to slower hiring and automation trends, which could compress margins if headwinds persist.

ASGN’s ongoing share buyback program was highlighted this quarter, with 200,000 shares repurchased for US$9.5 million, signaling continued capital return despite softer topline trends. While this move offers some downside support, it does not change the fundamental pressure facing legacy staffing operations, especially as revenue growth guidance lags behind sector averages.

Yet, the full story behind ASGN’s exposure to cyclical hiring slowdowns and emerging automation trends is essential information investors should keep in mind before making...

Read the full narrative on ASGN (it's free!)

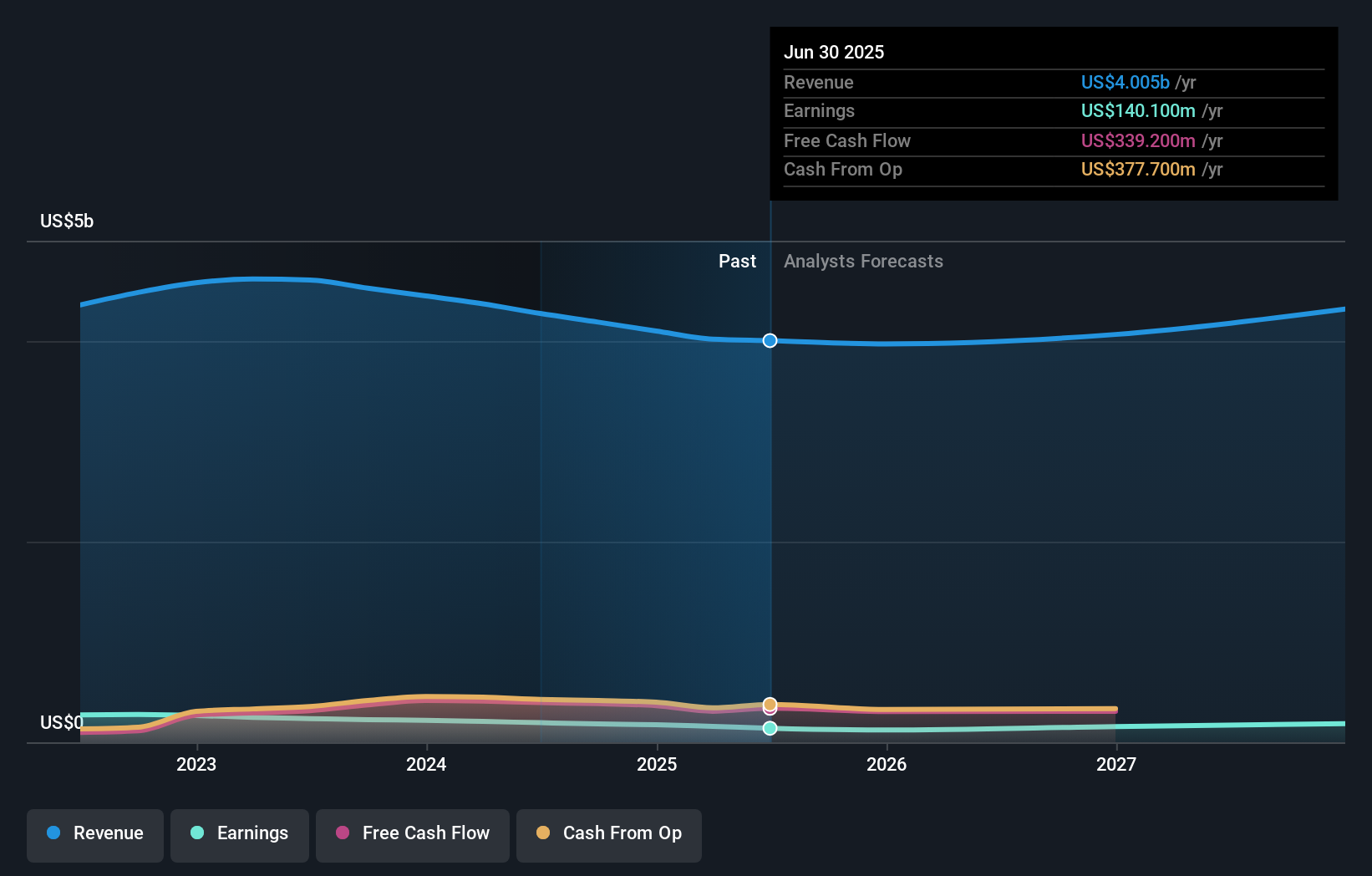

ASGN's narrative projects $4.3 billion in revenue and $193.8 million in earnings by 2028. This requires 2.5% yearly revenue growth and a $53.7 million earnings increase from the current $140.1 million.

Uncover how ASGN's forecasts yield a $57.50 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members calculated ASGN’s fair value estimates, ranging from US$30.33 to US$81.46. With assignment revenues under pressure from automation and macroeconomic conditions, this wide range invites you to consider how differing views shape the investment outlook.

Explore 3 other fair value estimates on ASGN - why the stock might be worth as much as 59% more than the current price!

Build Your Own ASGN Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ASGN research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ASGN research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ASGN's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com