- PPG Industries recently extended its joint venture agreement in India with Asian Paints Ltd., solidifying their partnership for another 15 years starting in 2026 to address industrial, automotive, and packaging coatings demand.

- This renewal reflects a focused effort to strengthen PPG's presence in a fast-growing market while leveraging both companies' technical and local expertise.

- Next, we'll explore how the renewed Indian joint venture impacts PPG's global growth prospects and overall investment outlook.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

PPG Industries Investment Narrative Recap

To be a shareholder in PPG Industries, you need conviction in the company's ability to expand profitably in global coatings markets despite earnings volatility and regional headwinds. The renewed joint venture with Asian Paints in India signals a focus on high-growth regions but does not immediately change the dominant catalysts, such as potential share gains in industrial coatings, or address the ongoing risk of soft automotive demand in the U.S. and Europe.

Among recent announcements, the latest earnings report stands out: sales and earnings for the second quarter slipped year-over-year. While the Indian JV could contribute to longer-term growth, the near-term investor focus remains on whether efficiency improvements can offset recent revenue declines and margin pressure.

By contrast, investors should be aware that persistent softness in U.S. and European auto production still threatens short-term performance and ...

Read the full narrative on PPG Industries (it's free!)

PPG Industries' outlook anticipates $16.8 billion in revenue and $1.9 billion in earnings by 2028. This scenario relies on annual revenue growth of 2.4% and a $0.6 billion earnings increase from the current $1.3 billion.

Uncover how PPG Industries' forecasts yield a $127.80 fair value, a 22% upside to its current price.

Exploring Other Perspectives

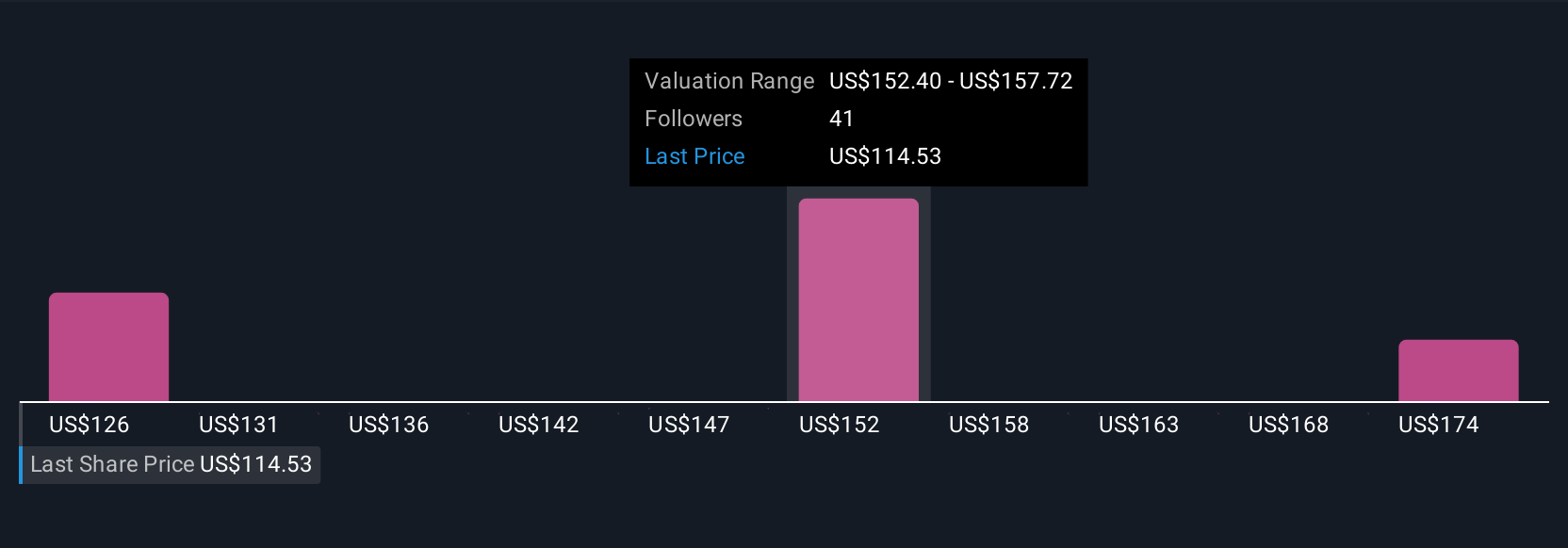

Three members of the Simply Wall St Community estimate PPG’s fair value between US$127.80 and US$181.31 per share. While some expect global expansion to help margins recover, these opinions show investors can widely differ, consider several perspectives before deciding.

Explore 3 other fair value estimates on PPG Industries - why the stock might be worth just $127.80!

Build Your Own PPG Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PPG Industries research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PPG Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PPG Industries' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com