- Novanta recently announced it will report earnings this Tuesday before the market opens, with analysts predicting flat revenue growth compared to the previous year.

- Following last quarter’s matched expectations but cautious future guidance, investors appear focused on the company’s outlook amid shifting revenue projections.

- Next, we’ll examine how the company’s softer revenue guidance could influence analyst expectations for Novanta’s long-term growth strategy.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Novanta Investment Narrative Recap

To be a Novanta shareholder, you need to believe in the company’s exposure to long-term growth markets like precision robotics and medical devices, balanced against macroeconomic uncertainty and tariff-related volatility. The recent news of flat revenue guidance may dampen near-term optimism, but for now, does not materially alter the near-term catalyst: the ramp-up of new products in surgical robotics. The biggest looming risk remains further weakness in capital investment from customers if economic headwinds persist.

The company's latest earnings guidance for Q3, setting expectations for US$244 million to US$247 million in revenue, ties directly into the focus on consistent performance despite uneven market conditions. This update is particularly relevant as investors look to future quarters for concrete signals that innovation and product launches can offset macro and sector pressures and restore revenue momentum.

However, in contrast to the optimism around product launches, investors should be aware of potential risks if trade tensions...

Read the full narrative on Novanta (it's free!)

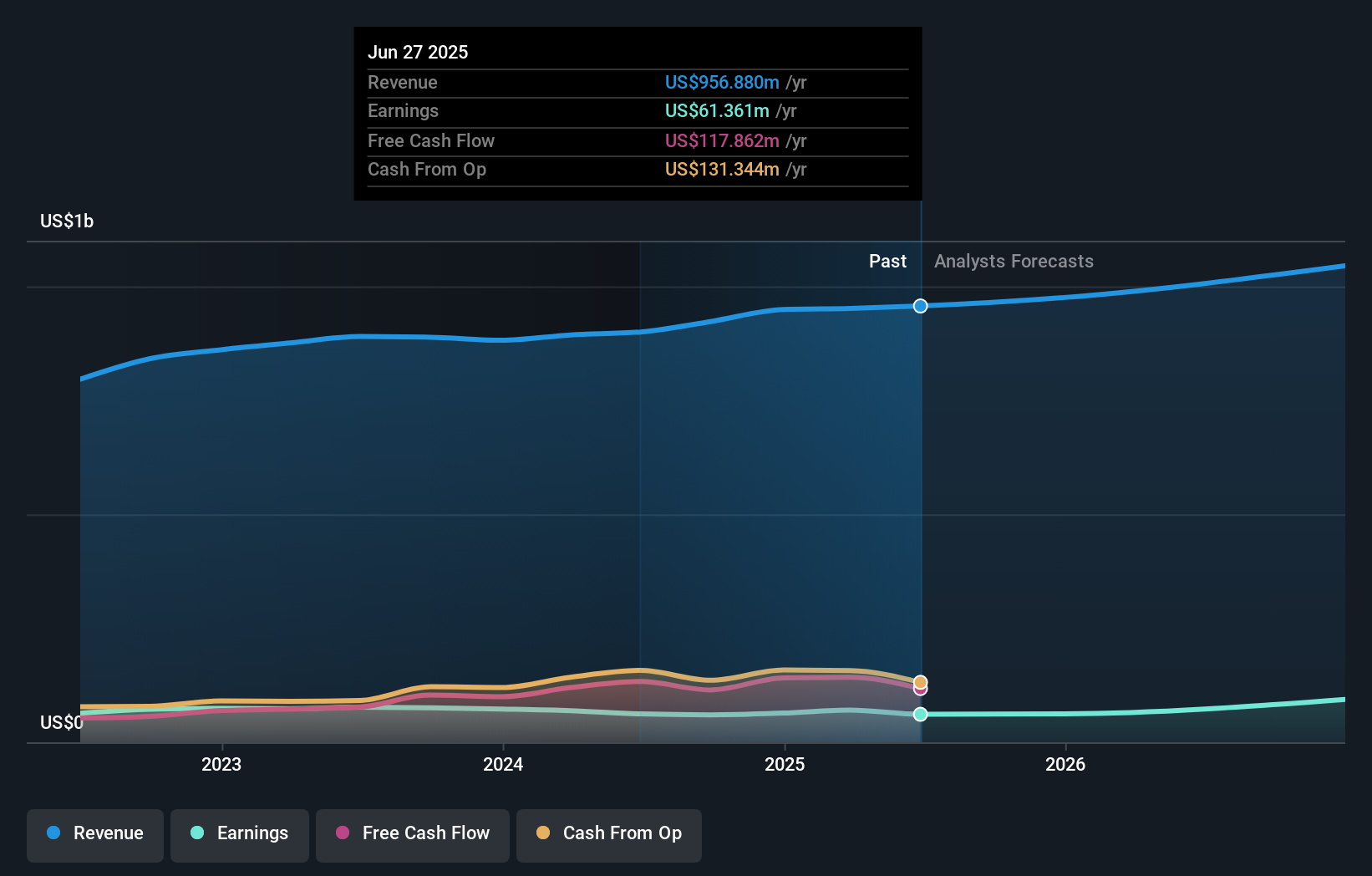

Novanta's outlook calls for $1.1 billion in revenue and $159.3 million in earnings by 2028. This is based on an expected 5.8% annual revenue growth and an $88.7 million increase in earnings from the current $70.6 million.

Uncover how Novanta's forecasts yield a $149.50 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Community member fair value estimates on Novanta range widely from US$91.64 to US$149.50 based on two perspectives. Some expect continued growth from new products, but ongoing tariff uncertainties could make it harder to predict earnings with confidence, so you may want to consider other viewpoints before deciding.

Explore 2 other fair value estimates on Novanta - why the stock might be worth as much as 21% more than the current price!

Build Your Own Novanta Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Novanta research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Novanta research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Novanta's overall financial health at a glance.

No Opportunity In Novanta?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com