- PBF Energy Inc. posted second quarter results that exceeded prior analyst forecasts, announced a quarterly dividend of US$0.275 per share to be paid on August 28, 2025, and provided updated production guidance for its regional refineries.

- These updates highlighted ongoing operational recovery and stability in shareholder returns, despite reported net losses and lingering impacts from the Martinez refinery incident.

- To understand how these earnings and operational updates influence PBF Energy’s investment appeal, we’ll examine the role of the Martinez refinery restart in reshaping its medium-term outlook.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

PBF Energy Investment Narrative Recap

For PBF Energy shareholders, the critical thesis remains centered on the Martinez refinery’s safe and timely restart, which is essential for restoring operational capacity and improving financial results. Recent second quarter earnings and the announced dividend support a narrative of measured recovery, but the Martinez outage continues to present the largest risk, while its full restart remains the most significant catalyst in the near term. These updates haven’t materially altered that risk-reward equation.

Among recent announcements, PBF Energy’s reaffirmed production guidance for the third quarter stands out, as it signals expected throughput improvements in most regions, including the West Coast segment impacted by Martinez. This guidance offers important context for understanding the pace and ramp-up of operational recovery, directly linking to management’s roadmap for returning the business to sustained profitability as Martinez returns to service.

In contrast, the company’s ability to manage regulatory pressures and the evolving cost landscape is another detail investors should be aware of…

Read the full narrative on PBF Energy (it's free!)

PBF Energy's narrative projects $32.4 billion in revenue and $221.7 million in earnings by 2028. This scenario assumes a 0.9% annual revenue decline and a $1.2 billion increase in earnings from the current -$1.0 billion.

Uncover how PBF Energy's forecasts yield a $21.92 fair value, a 6% downside to its current price.

Exploring Other Perspectives

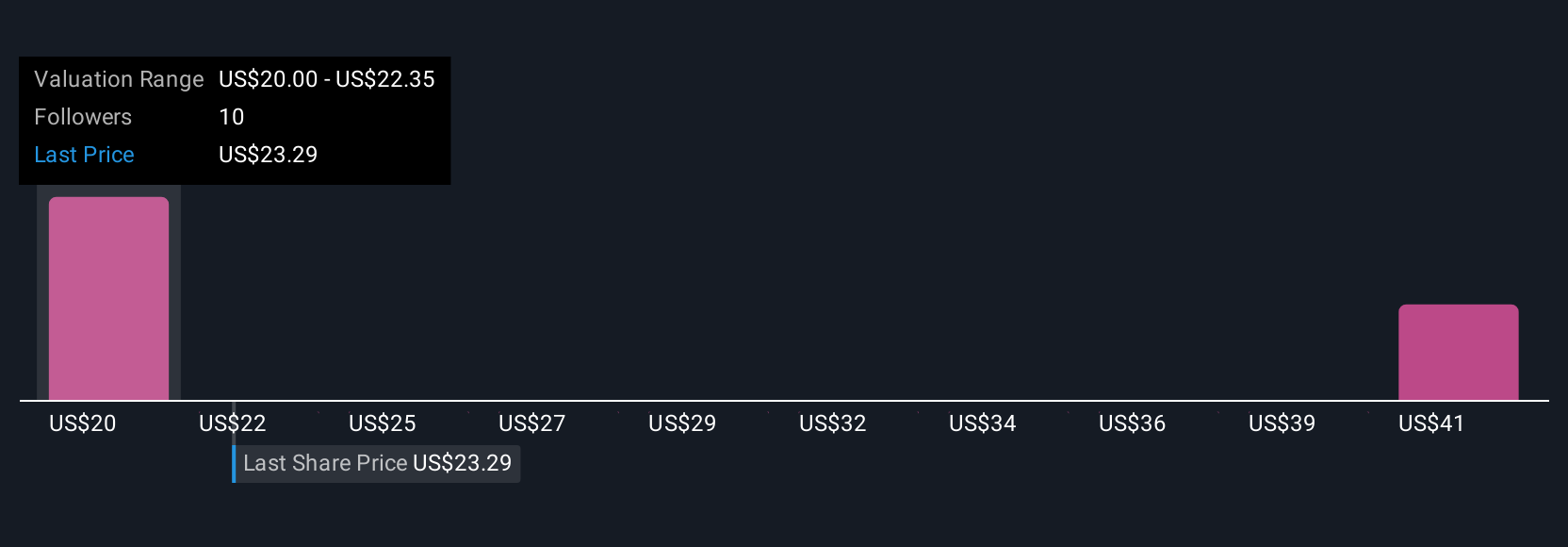

Four investor fair value estimates for PBF Energy from the Simply Wall St Community range from US$20 to US$136, covering ten distinct valuation bands. As you weigh this range, remember the company’s near-term performance hinges on the Martinez refinery’s return to full capacity, reinforcing why community and analyst perspectives can often diverge.

Explore 4 other fair value estimates on PBF Energy - why the stock might be worth 14% less than the current price!

Build Your Own PBF Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PBF Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PBF Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PBF Energy's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com