- Alexandria Real Estate Equities recently received a temporary certificate of occupancy for its 701 Dexter life-science tower, the first phase in its five-building Mercer Blocks development in South Lake Union.

- This milestone highlights Alexandria’s active expansion in a major life sciences cluster, reflecting ongoing investment in purpose-built laboratory and research facilities.

- With the 701 Dexter tower completed, we’ll consider how this expansion could influence Alexandria’s investment case and growth prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Alexandria Real Estate Equities Investment Narrative Recap

To be a shareholder in Alexandria Real Estate Equities, you generally need to believe in the long-term demand for purpose-built laboratory space in key innovation clusters, despite ongoing pressure on earnings from high vacancy and slower leasing. The temporary occupancy at 701 Dexter is a positive development but is not likely to materially alter the main near-term catalyst, the pace of new leasing across Alexandria’s active pipeline, or offset the risk posed by a prolonged high-interest rate environment affecting tenant activity.

Recently, Alexandria signed a 16-year lease with a global pharmaceutical company for 466,598 RSF in San Diego, marking the largest lease in its history. This announcement, closely tied to expansion milestones like 701 Dexter, shows continued traction with high-quality tenants, which remains central to supporting future rental income growth amid ongoing financial headwinds.

However, against these advances, investors should be aware of the potential downside if tenant decision-making remains slow and leasing velocity continues to...

Read the full narrative on Alexandria Real Estate Equities (it's free!)

Alexandria Real Estate Equities is projected to reach $3.2 billion in revenue and $311.7 million in earnings by 2028. This outlook is based on a forecast annual revenue decline of 0.8% and an increase in earnings of approximately $333 million from the current earnings of -$21.5 million.

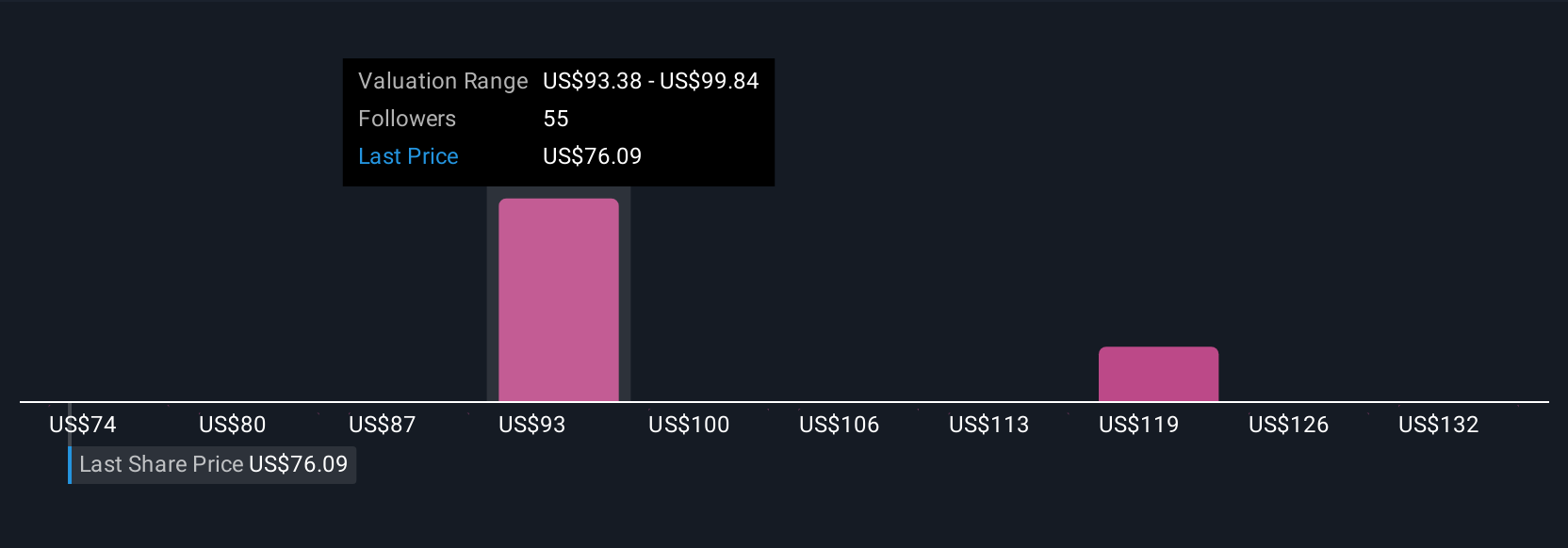

Uncover how Alexandria Real Estate Equities' forecasts yield a $98.83 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community range widely from US$56.31 to US$138.90 per share. As you compare these diverse viewpoints, remember that slower leasing and rising vacancy rates could test the company’s ability to deliver on growth expectations.

Explore 7 other fair value estimates on Alexandria Real Estate Equities - why the stock might be worth 27% less than the current price!

Build Your Own Alexandria Real Estate Equities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alexandria Real Estate Equities research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Alexandria Real Estate Equities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alexandria Real Estate Equities' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com