- In late July 2025, CenterPoint Energy completed a US$900 million offering of 3.00% senior unsecured convertible notes due August 2028, accompanying the release of its second quarter earnings showing higher revenues but lower net income compared to the prior year.

- The company’s robust track record of consistent dividend increases and expectations for further earnings and dividend growth have captured investor interest.

- We'll examine how the successful convertible note offering may reinforce CenterPoint Energy's outlook for supporting long-term dividend growth.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

CenterPoint Energy Investment Narrative Recap

To be confident in CenterPoint Energy as a shareholder, you have to believe in stable utility demand and management’s ability to translate ongoing capital investments and recent fundraising, such as the US$900 million convertible note offering, into reliable long-term dividend growth. While this capital raise strengthens financial flexibility and may address short-term funding needs, it does not materially alter the immediate impact of higher interest expenses, which remain a key concern for near-term earnings margins.

The company’s most recent earnings announcement highlighted higher revenues but lower net income year over year, reinforcing that offsetting rising financing costs is a pressing challenge. This context makes the July 2025 convertible note completion particularly relevant, since the proceeds could be aimed at future growth initiatives or refinancing, but the effect on overall profitability and cash flow coverage is still a central question for investors tracking catalysts like regulatory progress or earnings stabilization.

Yet, in contrast to steady dividend growth, the risk of elevated interest payments remains information investors should be aware of...

Read the full narrative on CenterPoint Energy (it's free!)

CenterPoint Energy's outlook anticipates $10.5 billion in revenue and $1.5 billion in earnings by 2028. This scenario is based on a 5.3% annual revenue growth rate and an increase in earnings of $564 million from the current $936.0 million.

Uncover how CenterPoint Energy's forecasts yield a $40.14 fair value, a 3% upside to its current price.

Exploring Other Perspectives

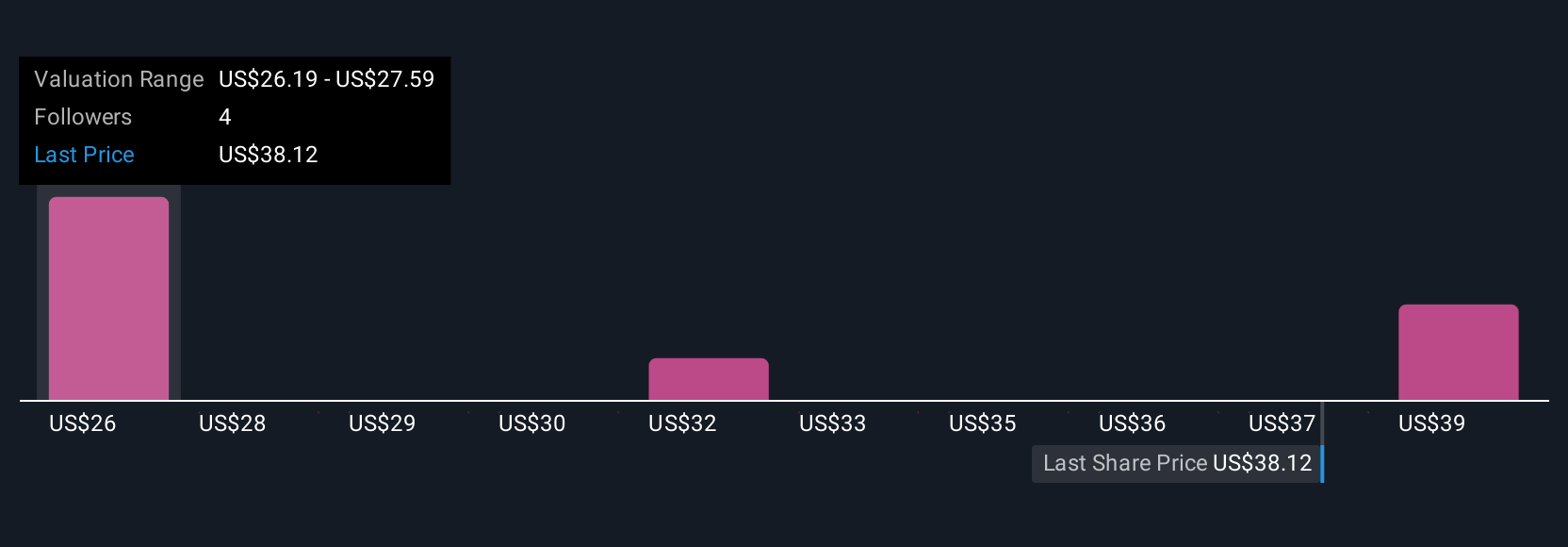

Three Simply Wall St Community members placed fair value estimates for CenterPoint Energy between US$28.22 and US$40.14 per share. With many keeping an eye on the company’s capital expenditure needs and the potential impact on future earnings, it is clear that opinions differ widely and you are invited to explore these alternative viewpoints yourself.

Explore 3 other fair value estimates on CenterPoint Energy - why the stock might be worth as much as $40.14!

Build Your Own CenterPoint Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CenterPoint Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free CenterPoint Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CenterPoint Energy's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com