- In early August 2025, Teradyne introduced the Magnum 7H, a next-generation memory tester designed to meet the rigorous testing needs of high bandwidth memory devices used in advanced AI servers, with volume shipments already underway to major manufacturers.

- This launch highlights Teradyne's expanding role in supporting the complex testing requirements for cutting-edge AI hardware, reinforcing its position as a leader in semiconductor testing technology.

- We'll explore how the Magnum 7H's advanced HBM testing capabilities contribute to Teradyne's longer-term growth strategy and investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Teradyne Investment Narrative Recap

To own Teradyne stock, you need to believe in the company’s ability to capture long-term demand for advanced semiconductor and AI-related testing, even as unpredictable macro and trade factors may weigh on shorter-term results. The Magnum 7H launch augments Teradyne’s growth story in AI and HBM device testing but does not materially reduce the biggest risk, uncertainty from tariffs, trade policy, and shifting customer demand, which could still lead to earnings volatility in the near term.

Among recent announcements, Teradyne’s third-quarter 2025 revenue guidance of US$710 million to US$770 million, alongside its Magnum 7H rollout, signals management’s confidence that demand for AI and HBM test solutions is translating into visible bookings, potentially supporting short-term revenue catalysts even as broader end market demand remains hard to predict.

Yet, it is essential for investors to recognize that, in contrast, uncertainty from global trade policy and volatile customer order patterns remains a risk that …

Read the full narrative on Teradyne (it's free!)

Teradyne's narrative projects $4.0 billion revenue and $941.6 million earnings by 2028. This requires 11.3% yearly revenue growth and a $364.5 million earnings increase from $577.1 million today.

Uncover how Teradyne's forecasts yield a $113.06 fair value, a 7% upside to its current price.

Exploring Other Perspectives

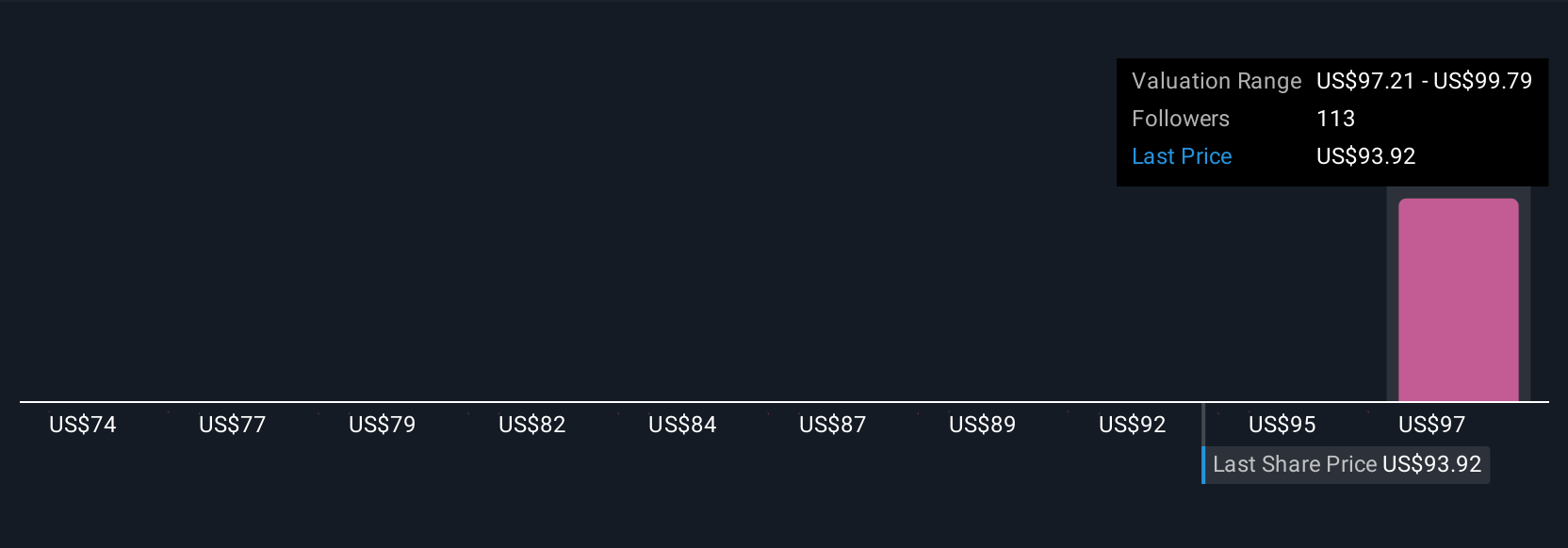

Simply Wall St Community members offered six separate fair value estimates for Teradyne ranging from US$91.14 to US$126.95 per share. With revenue guidance linked to growing AI test demand, your view on the company’s upside might differ sharply from others, explore several viewpoints before deciding.

Explore 6 other fair value estimates on Teradyne - why the stock might be worth 14% less than the current price!

Build Your Own Teradyne Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teradyne research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Teradyne research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teradyne's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com