- Illinois Tool Works recently increased its quarterly dividend by 7% to US$1.61 and raised its full-year 2025 earnings guidance, following the release of second-quarter results and ongoing share repurchases.

- The simultaneous update to both dividend policy and earnings expectations highlights management’s confidence in the business and ongoing commitment to returning capital to shareholders.

- We’ll now explore how the upgraded earnings guidance, supported by a dividend increase, could influence Illinois Tool Works’ investment outlook.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Illinois Tool Works Investment Narrative Recap

To be a shareholder in Illinois Tool Works today, you need to believe in the company’s capacity for consistent cash generation and disciplined capital returns, even as organic growth faces pressure in several end-markets. The recent dividend boost and raised 2025 earnings guidance may lend added assurance to those seeking income reliability, but are unlikely to materially shift attention from the immediate concern of soft organic growth, particularly in more cyclical segments like automotive and construction.

One of the most relevant recent announcements is the updated 2025 earnings guidance, now projecting full-year GAAP EPS of US$10.35–US$10.55 per share with revenue growth of 1%–3%. This guidance underlines management’s confidence in stabilizing profit margins and countering tariff impacts, though it arrives as some business segments still contend with regional demand challenges that could affect short-term results.

On the other hand, investors should keep in mind the lingering risk from persistent softness in organic growth, especially given ongoing issues in key verticals…

Read the full narrative on Illinois Tool Works (it's free!)

Illinois Tool Works is projected to reach $17.3 billion in revenue and $3.5 billion in earnings by 2028. This outlook is based on an anticipated 3.1% annual revenue growth and a modest $0.1 billion increase in earnings from the current $3.4 billion level.

Uncover how Illinois Tool Works' forecasts yield a $254.09 fair value, in line with its current price.

Exploring Other Perspectives

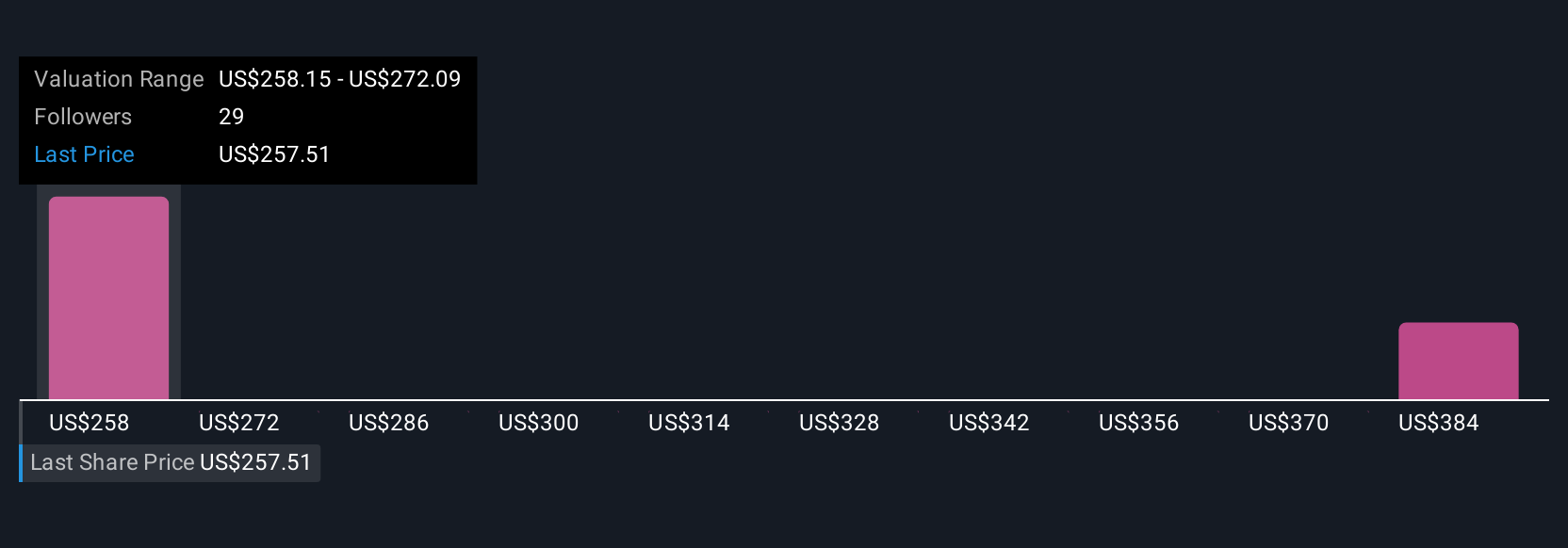

Fair value estimates from two Simply Wall St Community members range from US$254.09 to US$430.80 per share. Diverging views aside, margin resilience and tariff exposure remain central to the company’s ongoing performance story, consider exploring a range of viewpoints before making any decisions.

Explore 2 other fair value estimates on Illinois Tool Works - why the stock might be worth just $254.09!

Build Your Own Illinois Tool Works Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Illinois Tool Works research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Illinois Tool Works research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Illinois Tool Works' overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com