- In the past quarter, Valero Energy completed a share buyback program repurchasing over 25 million shares for nearly US$3.65 billion and reported second-quarter earnings with sales of US$28.2 billion and net income of US$714 million, both lower compared to the previous year.

- Despite softer earnings, the company garnered renewed analyst confidence due to its strong market positioning and potential growth in renewable fuels.

- Next, we'll examine how the endorsement of Valero's renewable strategy may influence its investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

Valero Energy Investment Narrative Recap

To be a Valero Energy shareholder today, you need to believe the company can maintain its strong position in U.S. refining while effectively unlocking value from renewable fuels, despite ongoing market and regulatory challenges. The recent earnings report, showing softer profits and revenue declines, did little to shift the near-term catalyst, which remains the company's ability to improve margins in the face of high operational costs; risks related to asset impairments and policy shifts continue to be front of mind but were largely unaffected by the latest quarter’s updates.

Among recent announcements, the completed US$3.65 billion share buyback stands out, as it directly supports per-share earnings growth and reflects Valero's ongoing prioritization of shareholder returns. This move fits closely with the catalyst of capital discipline and balance sheet strength, though its long-term impact will depend on how successfully the company manages cost pressures and delivers on planned optimization projects.

Yet, despite efforts to boost shareholder value, investors should be mindful that margin improvements could be constrained if operational costs rise or...

Read the full narrative on Valero Energy (it's free!)

Valero Energy's outlook points to $116.8 billion in revenue and $3.9 billion in earnings by 2028. This reflects a 0.2% annual revenue decline and a $3.14 billion increase in earnings from the current $760 million.

Uncover how Valero Energy's forecasts yield a $155.67 fair value, a 15% upside to its current price.

Exploring Other Perspectives

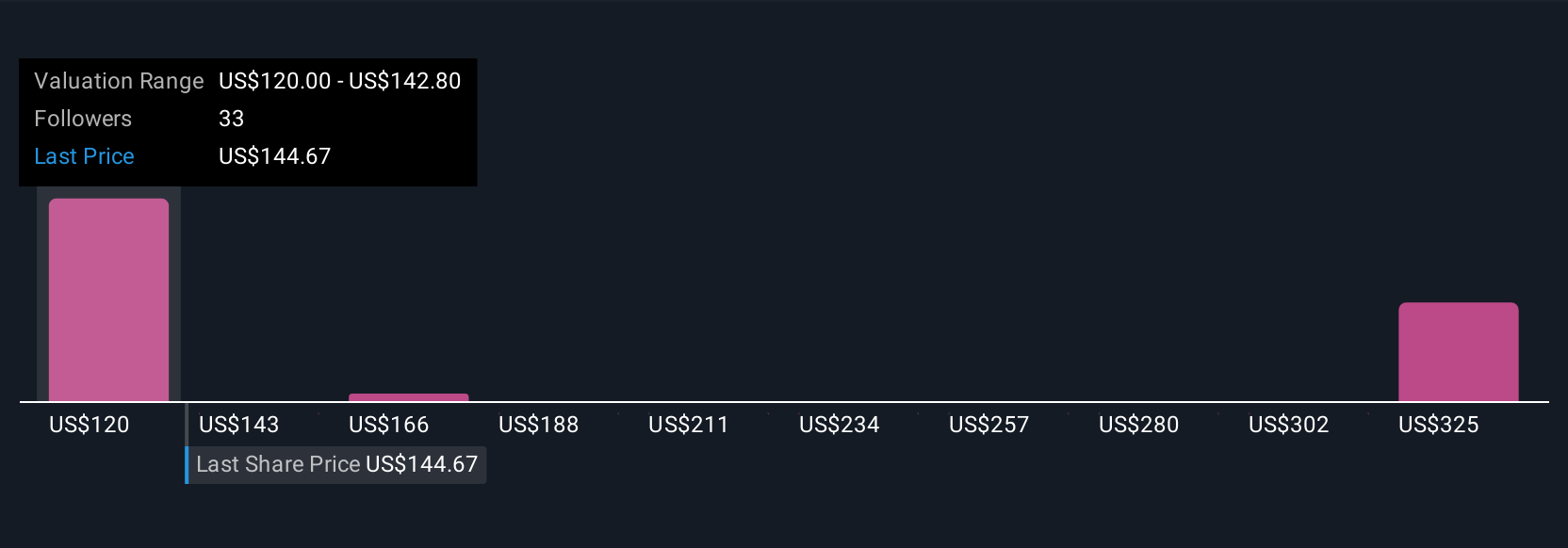

Five Community members value Valero Energy between US$115.01 and US$328.07 per share, showing a wide range of forecasts. With high operational costs potentially limiting near-term margins, you can explore several alternative viewpoints to better understand how different market participants assess Valero's outlook.

Explore 5 other fair value estimates on Valero Energy - why the stock might be worth 15% less than the current price!

Build Your Own Valero Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valero Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Valero Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valero Energy's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com