- On July 31, 2025, Air Products and Chemicals reported third quarter results, with sales of US$3,022.7 million and net income of US$713.8 million, both higher than the previous year, and earnings per share from continuing operations rising to US$3.24.

- An interesting aspect is management’s projection of 6.5% average annual revenue growth over the next three years, which surpasses the growth outlook for the broader U.S. Chemicals industry.

- Next, we’ll explore how the positive earnings surprise and ambitious growth guidance shape the company’s overall investment narrative.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Air Products and Chemicals Investment Narrative Recap

To own shares of Air Products and Chemicals, you have to believe in the company's ability to deliver on its multi-year transition toward core industrial gas projects, while navigating the challenges of capital allocation and execution risk in large, complex investments. The latest quarterly results, which outpaced expectations and included a 6.5% revenue growth projection, may lend confidence to bulls, but these results alone do not significantly alter the major short-term catalyst: timely execution and commercialization of its flagship clean energy projects. The key risk, cost overruns or delays in these ambitious undertakings, remains firmly in focus.

Among recent updates, the most relevant to the current earnings surprise is management’s repeated affirmation of the company’s capital allocation strategy and commitment to shareholder returns, as evidenced by the declared quarterly dividend of US$1.79 per share. This ongoing dedication reinforces the narrative that even during periods of operational transition and rising investment, stable returns and disciplined capital management are central to the investment thesis. Yet, as with any evolving story, investors must watch closely for...

Read the full narrative on Air Products and Chemicals (it's free!)

Air Products and Chemicals' narrative projects $14.7 billion revenue and $3.6 billion earnings by 2028. This requires 7.0% yearly revenue growth and a $2.1 billion earnings increase from $1.5 billion today.

Uncover how Air Products and Chemicals' forecasts yield a $320.70 fair value, a 12% upside to its current price.

Exploring Other Perspectives

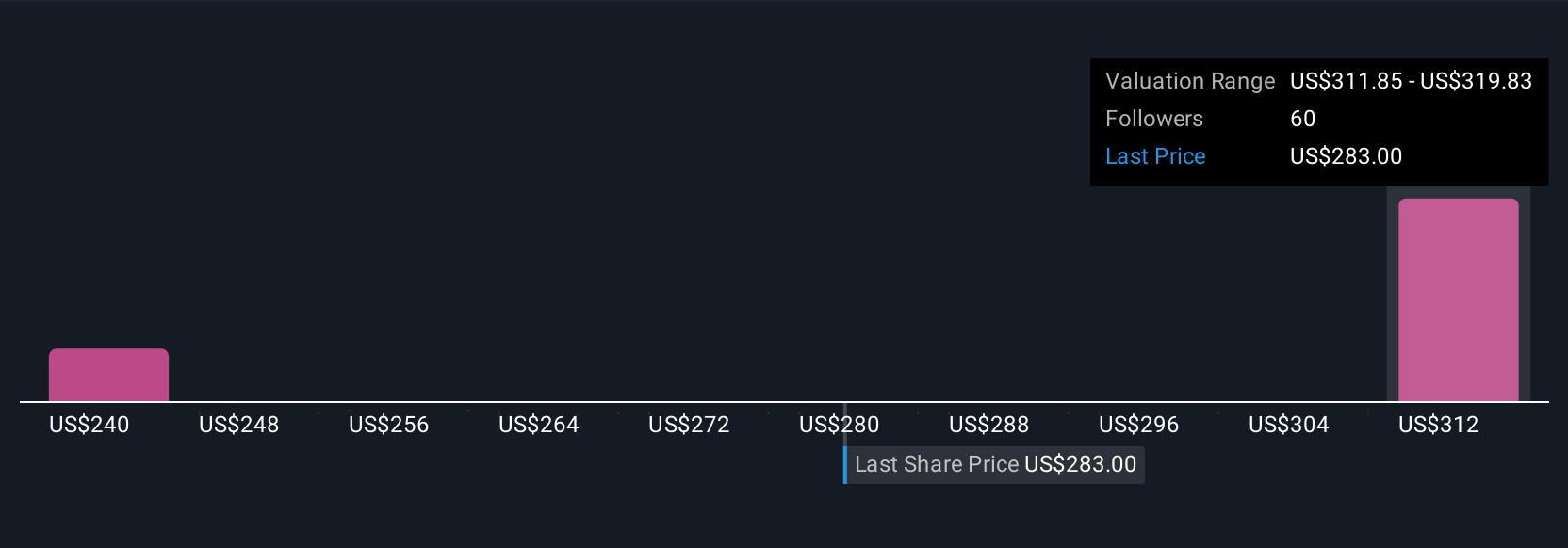

Three Simply Wall St Community estimates place Air Products’ fair value between US$271.39 and US$320.70 per share, showing considerable diversity. While many focus on execution of mega-projects as a critical earnings risk, others urge readers to weigh these viewpoints carefully before forming an opinion.

Explore 3 other fair value estimates on Air Products and Chemicals - why the stock might be worth 6% less than the current price!

Build Your Own Air Products and Chemicals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Air Products and Chemicals research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Air Products and Chemicals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Air Products and Chemicals' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com