This Wayfair Analyst Turns Bullish; Here Are Top 5 Upgrades For Tuesday

Benzinga · 08/05 12:44

Share

Listen to the news

Top Wall Street analysts changed their outlook on these top names. For a complete view of all analyst rating changes, including upgrades, downgrades and initiations, please see our analyst ratings page.

- JP Morgan analyst Rajat Gupta upgraded Penske Automotive Group, Inc. (NYSE:PAG) from Underweight to Neutral and raised the price target from $155 to $175. Penske Automotive shares closed at $168.40 on Monday. See how other analysts view this stock.

- Deutsche Bank analyst Brad Zelnick upgraded the rating for Palantir Technologies Inc. (NASDAQ:PLTR) from Sell to Hold and boosted the price target from $80 to $160. Palantir Technologies shares closed at $160.66 on Monday. See how other analysts view this stock.

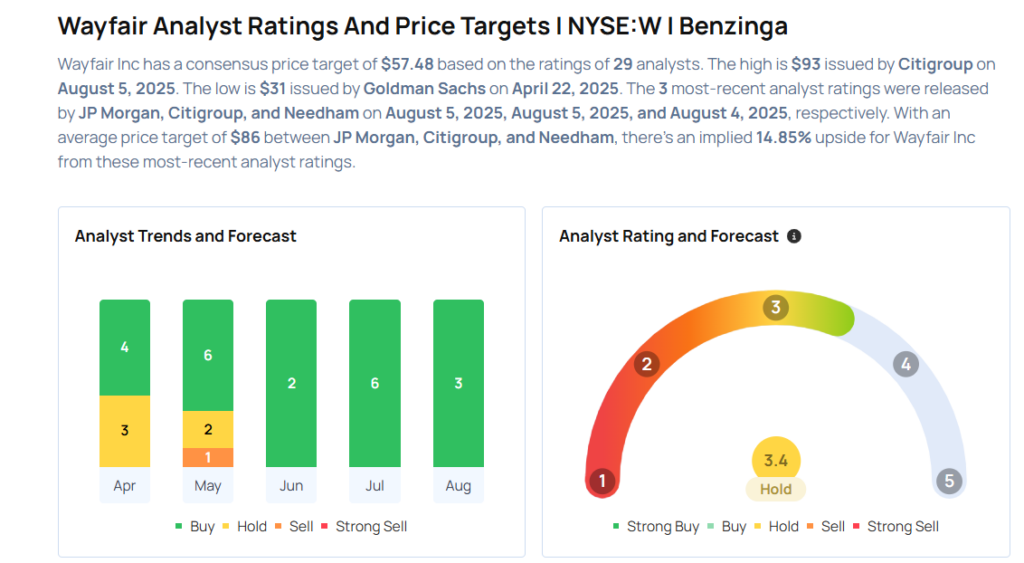

- Citigroup analyst Ygal Arounian upgraded Wayfair Inc. (NYSE:W) from Neutral to Buy and raised the price target from $32 to $93. Wayfair shares closed at $73.48 on Monday. See how other analysts view this stock.

- Morgan Stanley analyst Meta Marshall upgraded CommScope Holding Company, Inc. (NASDAQ:COMM) from Underweight to Equal-Weight and raised the price target from $4 to $17. CommScope shares closed at $14.51 on Monday. See how other analysts view this stock.

- Wells Fargo analyst Edward Kelly upgraded Sprouts Farmers Market, Inc. (NASDAQ:SFM) from Equal-Weight to Overweight and raised the price target from $175 to $180. Sprouts Farmers Market shares closed at $153.81 on Monday. See how other analysts view this stock.

Considering buying W stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Disclaimer:This article represents the opinion of the author only. It does not represent the opinion of Webull, nor should it be viewed as an indication that Webull either agrees with or confirms the truthfulness or accuracy of the information. It should not be considered as investment advice from Webull or anyone else, nor should it be used as the basis of any investment decision.

What's Trending

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2025 Webull. All Rights Reserved