- Arm Holdings plc recently reported first quarter earnings for the period ended June 30, 2025, with revenue increasing to US$1.05 billion from US$939 million a year prior, though net income decreased to US$130 million from US$223 million.

- Analyst optimism continues to build around Arm's significant growth in AI data centers, with a sharp rise in Arm-based server CPU shipments pointing to strengthening demand in this fast-evolving sector.

- We'll examine how analyst confidence in Arm’s AI-related royalty growth, signaled by recent earnings and guidance, shapes its investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Arm Holdings Investment Narrative Recap

To be a long-term shareholder in Arm Holdings, you need confidence in the company's ability to capture sustained AI-driven demand across cloud and data center markets, especially as analyst sentiment grows around its AI server opportunity. While the latest quarter’s strong revenue growth underscores Arm’s potential as an AI solutions provider, the drop in net income highlights ongoing margin pressures, so this update does not materially change the immediate importance of balancing ambitious R&D with profitability, the core catalyst and key risk for the stock today.

The most relevant announcement to consider is Arm's recent Q2 2026 guidance, with revenue expected between US$1.01 billion and US$1.11 billion. This directly ties into investor focus on whether growth in AI licensing and deployments can offset pressure on net margins and justify near-term optimism surrounding data center expansion.

However, it’s worth remembering that, while upbeat on growth, some risks, like deal timing and execution hurdles, remain, especially if...

Read the full narrative on Arm Holdings (it's free!)

Arm Holdings is projected to reach $6.9 billion in revenue and $2.2 billion in earnings by 2028. This outlook requires annual revenue growth of 20.1% and an increase in earnings of about $1.4 billion from current earnings of $792.0 million.

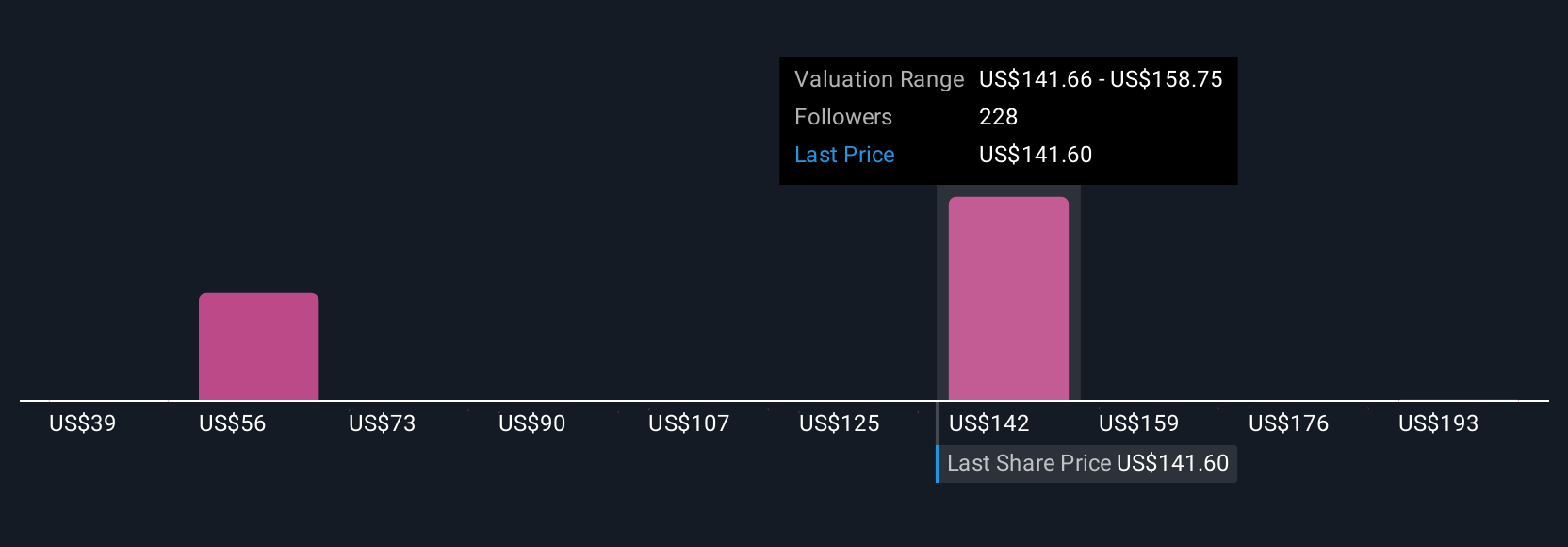

Uncover how Arm Holdings' forecasts yield a $150.29 fair value, a 7% upside to its current price.

Exploring Other Perspectives

The most optimistic analysts forecast US$8.4 billion in revenue and US$2.8 billion in earnings by 2028, projecting much faster growth if AI momentum accelerates. These forecasts highlight just how sharply expectations can differ depending on how risks and opportunities, such as the Qualcomm licensing uncertainty, are weighed. You may want to see how this quarter’s results could shift those high-end outlooks, so keep reading for more viewpoints.

Explore 19 other fair value estimates on Arm Holdings - why the stock might be worth as much as 50% more than the current price!

Build Your Own Arm Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Arm Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Arm Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Arm Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com