Wall Street's Most Accurate Analysts Give Their Take On 3 Tech Delivering High-Dividend Yields

Benzinga · 08/05 11:39

Share

Listen to the news

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the information technology sector.

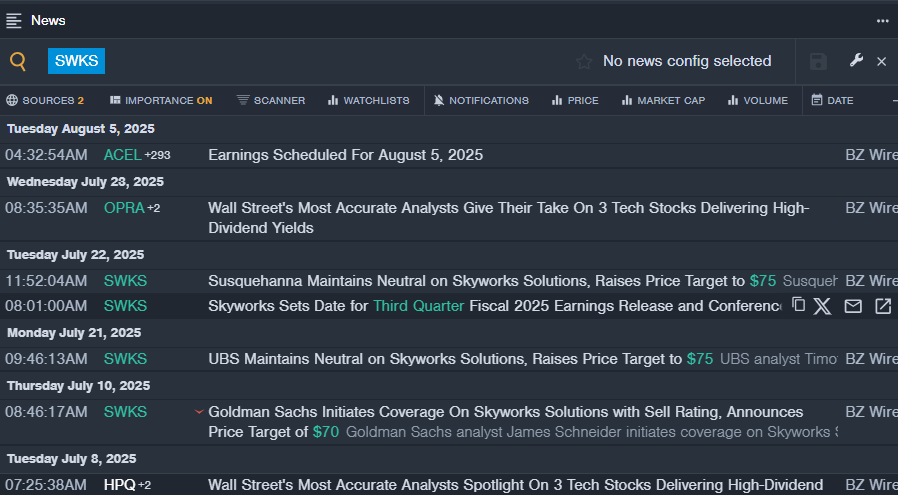

Skyworks Solutions, Inc. (NASDAQ:SWKS)

- Dividend Yield: 4.12%

- Susquehanna analyst Christopher Rolland maintained a Neutral rating and raised the price target from $60 to $75 on July 22, 2025. This analyst has an accuracy rate of 76%.

- UBS analyst Timothy Arcuri maintained a Neutral rating and boosted the price target from $65 to $75 on July 21, 2025. This analyst has an accuracy rate of 80%.

- Recent News: The company will release quarterly earnings today.

- Benzinga Pro’s real-time newsfeed alerted to latest SWKS news.

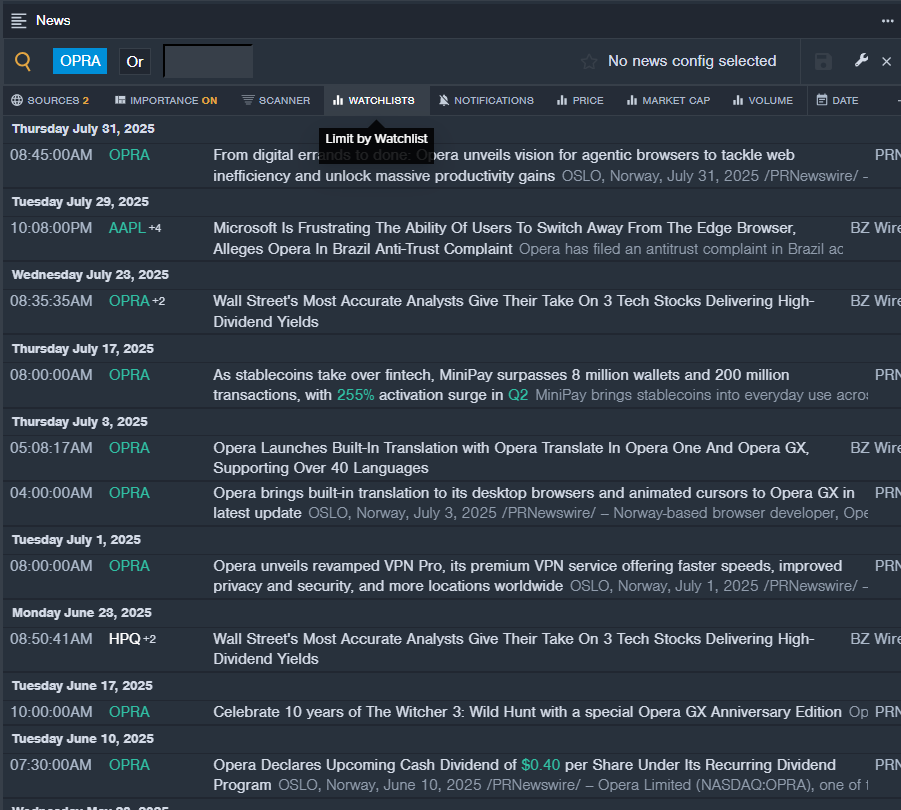

Opera Limited (NASDAQ:OPRA)

- Dividend Yield: 4.93%

- Goldman Sachs analyst Eric Sheridan maintained a Buy rating and slashed the price target from $26 to $22.5 on April 14, 2025. This analyst has an accuracy rate of 78%.

- TD Cowen analyst Lance Vitanza maintained a Buy rating and raised the price target from $25 to $28 on Oct. 30, 2024. This analyst has an accuracy rate of 77%.

- Recent News: On May 28, Opera announced Opera Neon, the first AI agentic browser.

- Benzinga Pro's real-time newsfeed alerted to latest OPRA news

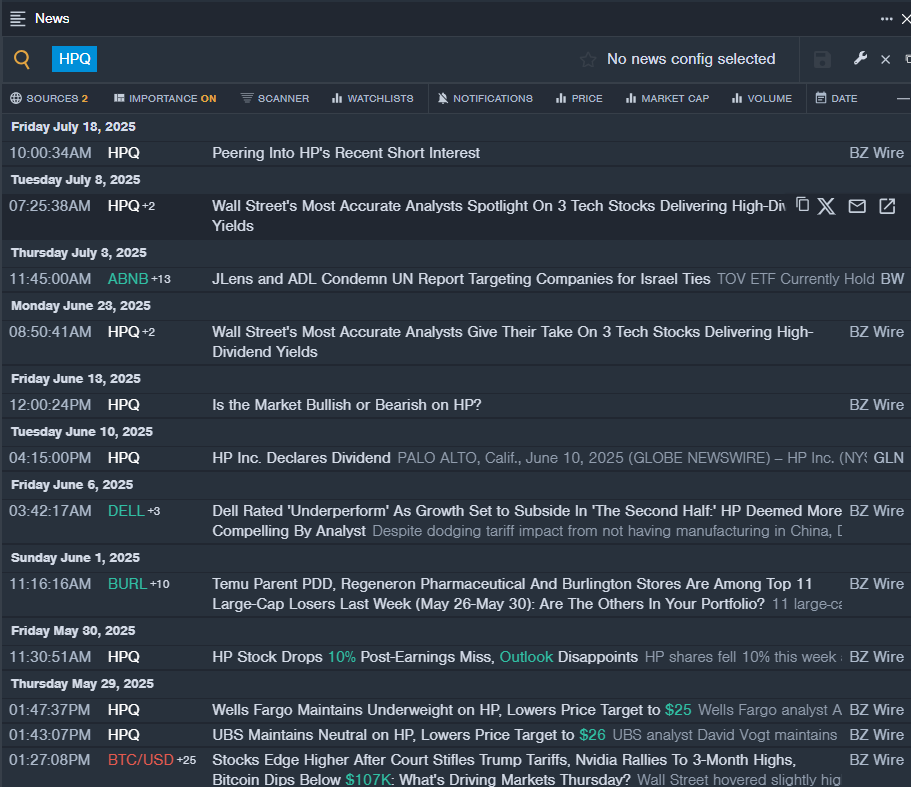

HP Inc. (NYSE:HPQ)

- Dividend Yield: 4.65%

- Wells Fargo analyst Aaron Rakers maintained an Underweight rating and cut the price target from $35 to $25 on May 29, 2025. This analyst has an accuracy rate of 85%.

- Citigroup analyst Asiya Merchant maintained a Neutral rating and cut the price target from $29 to $27.5 on May 29, 2025. This analyst has an accuracy rate of 82%.

- Recent News: On May 28, HP reported worse-than-expected second-quarter adjusted EPS results and issued third-quarter adjusted EPS guidance below estimates.

- Benzinga Pro’s real-time newsfeed alerted to latest HPQ news

Read More:

Photo via Shutterstock

Disclaimer:This article represents the opinion of the author only. It does not represent the opinion of Webull, nor should it be viewed as an indication that Webull either agrees with or confirms the truthfulness or accuracy of the information. It should not be considered as investment advice from Webull or anyone else, nor should it be used as the basis of any investment decision.

What's Trending

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2025 Webull. All Rights Reserved