- Kiniksa Pharmaceuticals International recently reported second quarter 2025 results, with revenue rising to US$156.8 million from US$108.63 million a year ago and net income turning positive at US$17.83 million, alongside an upward revision of full-year revenue guidance to US$625–640 million.

- The company’s shift from a net loss to profitability, combined with raised guidance and strong ARCALYST sales, underlines meaningful business momentum and operational execution across its product portfolio.

- We’ll review how Kiniksa’s earnings beat and increased guidance influence the company’s long-term investment narrative and growth potential.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Kiniksa Pharmaceuticals International Investment Narrative Recap

Being a shareholder in Kiniksa Pharmaceuticals International means believing in its ability to maintain strong commercial momentum for ARCALYST while operationally executing on its expanding product pipeline. The recent Q2 results, which show a transition to profitability and raised revenue guidance, add further confidence to the short-term outlook for ARCALYST sales, the key near-term driver, though the biggest current risk remains any unexpected shifts in Medicare Part D patient transitions, which may introduce revenue variability in future quarters.

Among recent company announcements, the updated 2025 revenue guidance to US$625–640 million, up from the prior range, is most relevant, signaling continued optimism about sustained commercial performance following the earnings beat. This forward-looking revision comes as new Medicare Part D policies and commercial execution remain focal points for growth, even as the company must address ongoing uncertainties linked to these shifts.

However, as positive as these developments appear for ARCALYST's immediate outlook, investors should keep in mind that abrupt changes affecting the patient payor mix could impact revenue trends in ways that ...

Read the full narrative on Kiniksa Pharmaceuticals International (it's free!)

Kiniksa Pharmaceuticals International is projected to reach $879.7 million in revenue and $151.3 million in earnings by 2028. This forecast requires a 22.3% annual revenue growth rate and a $168.3 million increase in earnings from the current level of -$17.0 million.

Uncover how Kiniksa Pharmaceuticals International's forecasts yield a $45.17 fair value, a 41% upside to its current price.

Exploring Other Perspectives

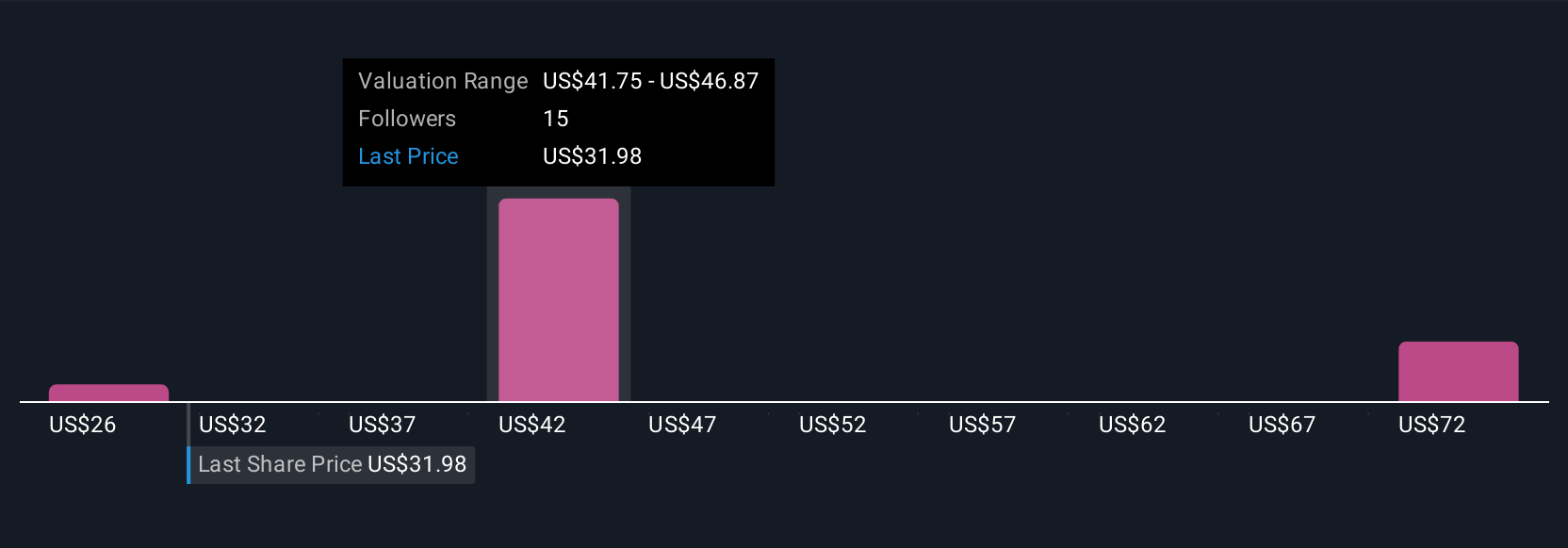

Four fair value estimates from the Simply Wall St Community for Kiniksa Pharmaceuticals International span a wide US$26.39 to US$77.60 range. With the company's future growth prospects closely tied to ARCALYST's prescriber expansion and policy shifts, consider how differing assumptions may alter your forecast and explore several viewpoints here.

Explore 4 other fair value estimates on Kiniksa Pharmaceuticals International - why the stock might be worth 17% less than the current price!

Build Your Own Kiniksa Pharmaceuticals International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kiniksa Pharmaceuticals International research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Kiniksa Pharmaceuticals International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kiniksa Pharmaceuticals International's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com