- NewMarket Corporation recently reported its second quarter 2025 results, showing US$698.51 million in sales and US$111.24 million in net income, alongside plans to invest up to US$100 million to expand AMPAC's ammonium perchlorate capacity by over 50%.

- The significant AMPAC capital investment reflects growing demand for rocket propulsion additives, even as petroleum additives performance was mixed this quarter.

- Next, we'll look at how NewMarket's major AMPAC expansion investment shapes the company’s broader investment narrative and growth prospects.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

What Is NewMarket's Investment Narrative?

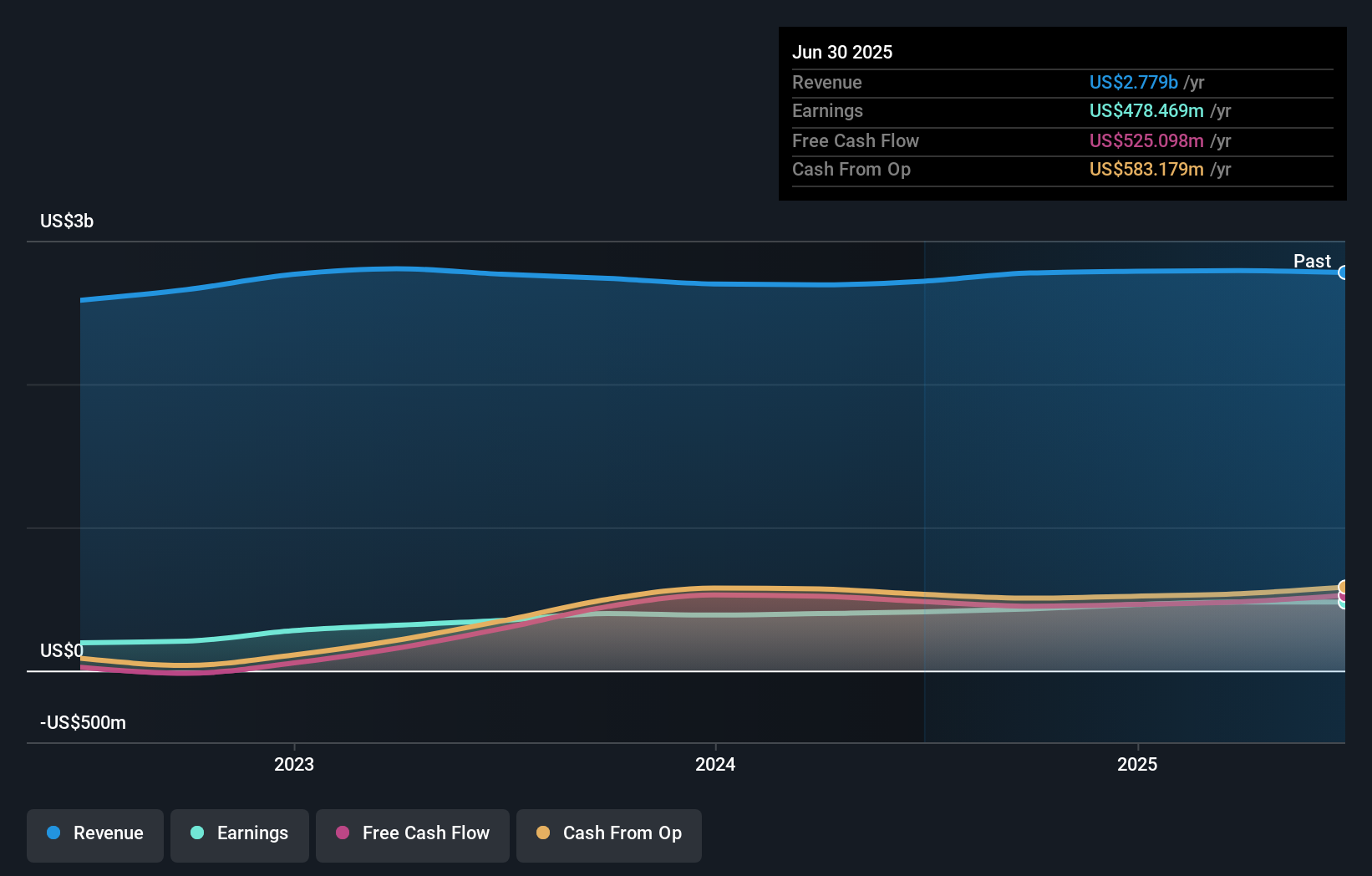

To own NewMarket stock, it helps to believe in the company’s ability to balance steady cash flows from its core petroleum additives segment with the growth potential of its specialty chemicals businesses. The headline Q2 2025 results showed stable earnings and a drop in revenue, reflecting softer demand for petroleum additives, but also highlighted significant momentum in the specialty materials area. The US$100 million expansion of AMPAC’s ammonium perchlorate capacity is particularly striking, as it addresses rising demand in rocket propulsion chemicals, potentially shifting NewMarket’s near-term growth narrative and giving it more exposure to specialty markets. This sizable investment signals a willingness to pursue targeted opportunities, even as overall market headwinds for petroleum additives persist. The recent modest share price gain lines up with this, suggesting investors are weighing growth prospects and risks as they digest the news.

But underneath these expansion plans sits an ongoing risk tied to NewMarket's high level of debt. NewMarket's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on NewMarket - why the stock might be worth just $739.86!

Build Your Own NewMarket Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NewMarket research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NewMarket research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NewMarket's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com