- Patrick Industries released its second quarter and half-year 2025 results, with quarterly sales rising to US$1.05 billion but net income falling to US$32.44 million, compared to the same periods last year.

- Despite year-over-year revenue growth, lower net income and reduced earnings per share hint at margin compression and operational cost pressures for the company.

- We'll now consider how the higher sales but lower profitability in the latest report may reshape Patrick Industries’ investment narrative going forward.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

Patrick Industries Investment Narrative Recap

To be a shareholder in Patrick Industries, you need conviction in its ability to outperform as a diversified supplier to cyclical markets like RVs, marine, and housing. The latest results, higher sales but lower earnings, suggest that margin compression and operational cost pressures may now be the most important short-term challenges, eclipsing the near-term benefit from sales growth. While dealers replenishing inventory and pent-up consumer demand were previously seen as key catalysts, the current margin trends could blunt their positive impact unless managed carefully.

One recent announcement to watch is the company’s continuing share buyback program, including almost 4 million shares repurchased, or about 11.5% of the program, last updated in May. Although buybacks are typically a sign of confidence in underlying value, the reduced profitability from the latest earnings release casts new uncertainty over whether capital return remains a strong offset to operational and margin risks.

But with margins now under pressure, investors should also be aware that ...

Read the full narrative on Patrick Industries (it's free!)

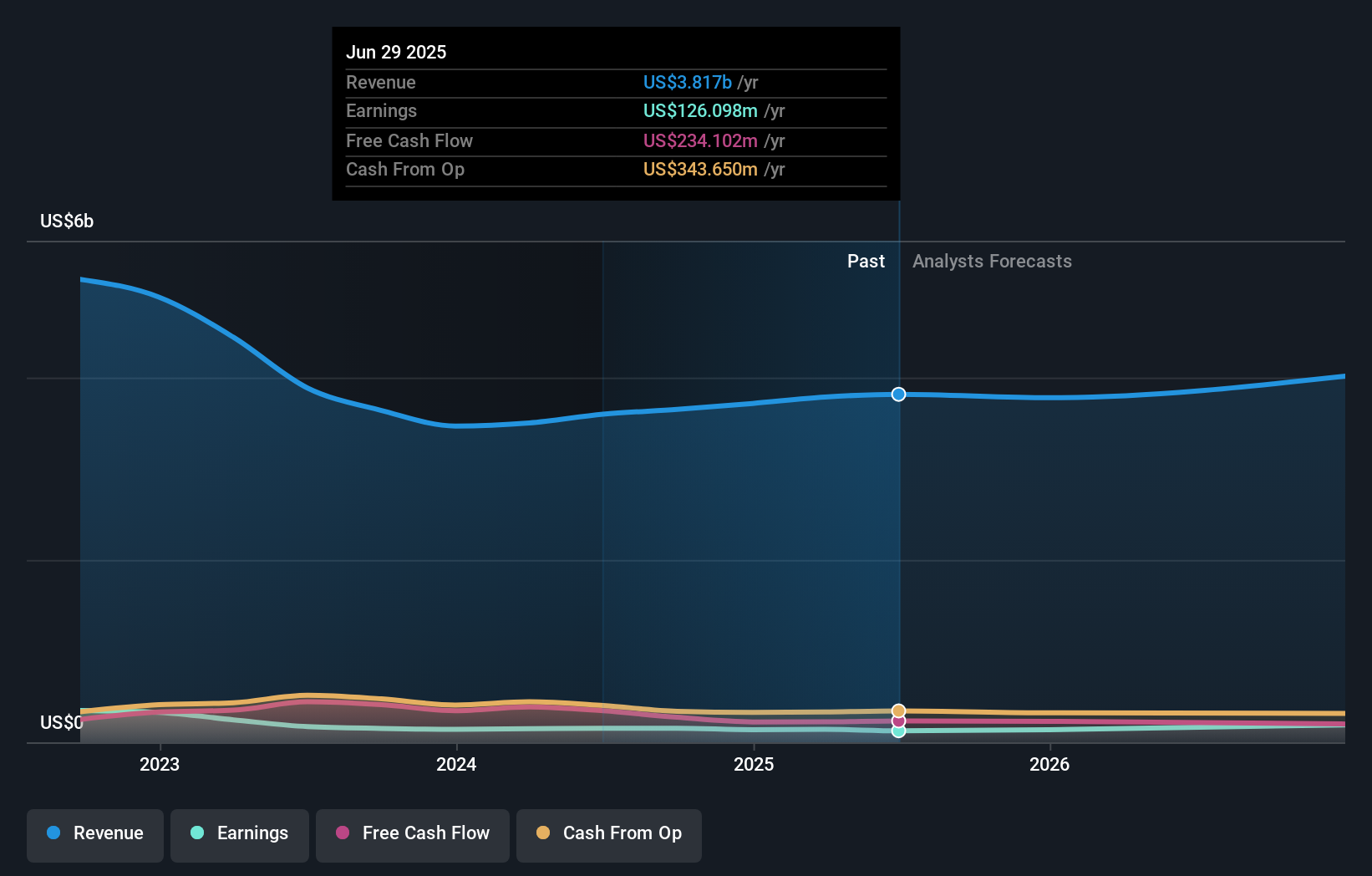

Patrick Industries' outlook anticipates $4.1 billion in revenue and $216.4 million in earnings by 2028. This is based on annual revenue growth of 2.4% and an increase in earnings of $74.9 million from the current $141.5 million.

Uncover how Patrick Industries' forecasts yield a $98.00 fair value, in line with its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community estimate Patrick Industries’ fair value between US$84.53 and US$98.00. While these diverge from current analyst targets, many participants also weigh ongoing concerns about margin compression as crucial to the company’s performance, so it is worth considering several viewpoints before forming your own.

Explore 2 other fair value estimates on Patrick Industries - why the stock might be worth as much as $98.00!

Build Your Own Patrick Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Patrick Industries research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Patrick Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Patrick Industries' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com