- Laureate Education recently raised its full-year 2025 revenue guidance by US$55 million due to more favorable foreign currency rates, now projecting revenues between US$1.62 billion and US$1.63 billion and organic constant currency revenue growth of 6%-7% versus 2024.

- This updated outlook follows the release of the company’s second-quarter results, which showed higher sales year-over-year but lower net income and earnings per share compared to the previous year.

- We’ll consider how the company’s improved revenue forecast, driven by currency gains, may affect Laureate Education’s broader investment narrative.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Laureate Education Investment Narrative Recap

To back Laureate Education as a shareholder, you would likely need confidence in its ability to expand higher education offerings in Latin America, deliver local currency growth, and manage currency risks. The recent upward revision in 2025 revenue guidance, attributed to favorable foreign currency rates, temporarily reduces the currency headwind risk but does not fundamentally change the biggest catalyst, enrollment growth, or the key risk from further peso volatility. This positive update may help smooth earnings trajectories for now, but the primary operational and macroeconomic uncertainties remain material.

The company’s Q2 2025 earnings release is most relevant here, showing year-over-year sales growth but declines in net income and earnings per share compared to the previous year. While the updated revenue outlook brightens the short-term picture, the earnings metrics highlight that underlying profitability pressures are still present and reinforce the ongoing importance of managing costs and margins as the business pursues growth targets.

However, with currency impacts providing only temporary relief, investors will want to watch for signs that enrollment trends or operating margins might...

Read the full narrative on Laureate Education (it's free!)

Laureate Education's outlook anticipates $1.9 billion in revenue and $297.8 million in earnings by 2028. This implies a 7.1% annual revenue growth and a $11 million increase in earnings from the current $286.8 million.

Uncover how Laureate Education's forecasts yield a $26.50 fair value, a 16% upside to its current price.

Exploring Other Perspectives

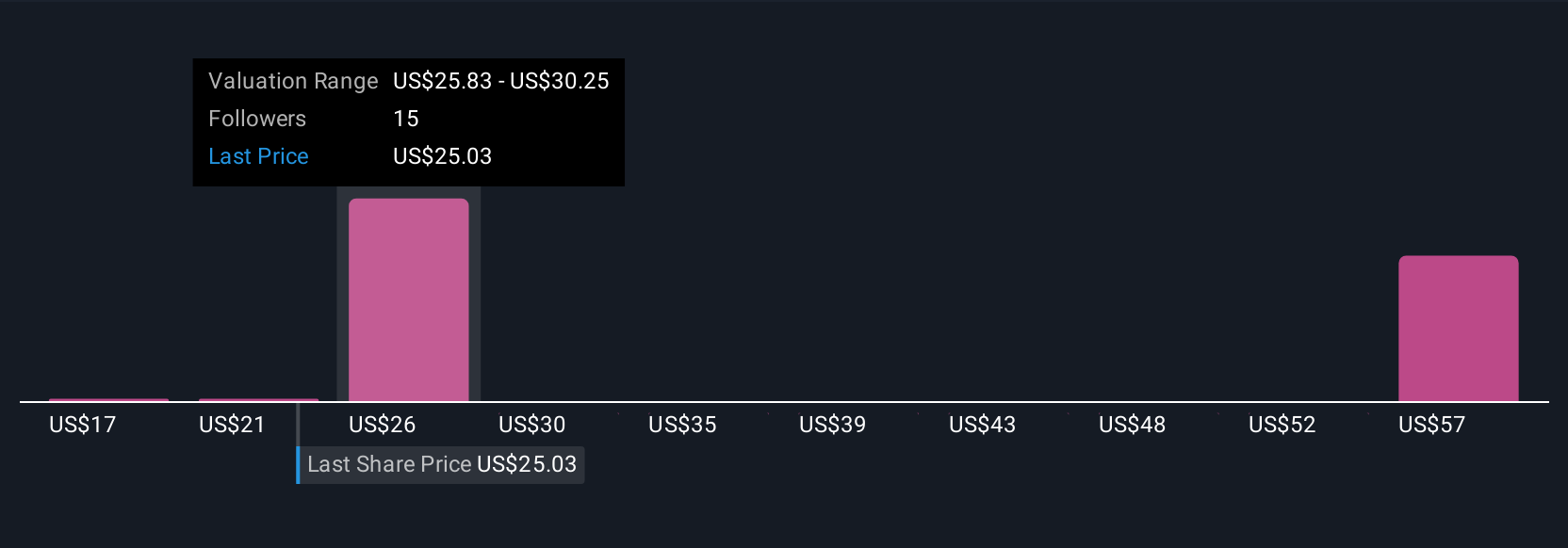

Simply Wall St Community members published 4 fair value estimates for Laureate Education, with projections ranging from US$17 to US$66.38. While the largest catalyst centers on new campus openings and enrollment momentum, the wide spectrum of these peer opinions shows how outlooks can diverge, see what other investors are forecasting and why they may disagree.

Explore 4 other fair value estimates on Laureate Education - why the stock might be worth 26% less than the current price!

Build Your Own Laureate Education Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Laureate Education research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Laureate Education research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Laureate Education's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com