First Solar (FSLR) saw a 34% increase in its stock price over the last quarter, with a key factor being the updated earnings guidance on July 31, 2025. The company's revised expectations for net sales and operating income likely added positive momentum, supporting its stock price amidst broader market movements. Additionally, an exclusive agreement with UbiQD to enhance solar panel efficiency may have reinforced investor confidence. While the Dow faced challenges from tariffs and weak jobs data, First Solar's strategic advancements positioned it for growth, keeping its gains aligned with market optimism about corporate earnings.

We've identified 2 risks for First Solar (1 is a bit unpleasant) that you should be aware of.

First Solar's recent 34% share price increase, driven by updated earnings guidance and a strategic agreement with UbiQD, suggests positive investor sentiment. This momentum aligns with the company's long-term goals of boosting revenue and earnings through domestic capacity expansion and technology enhancements. Over the past five years, First Solar's total shareholder return was 171.07%, highlighting substantial growth during this period. However, the company underperformed the US market and semiconductor industry over the past year, returning lower than the broader market's 16.8% and the industry's 45.6% returns.

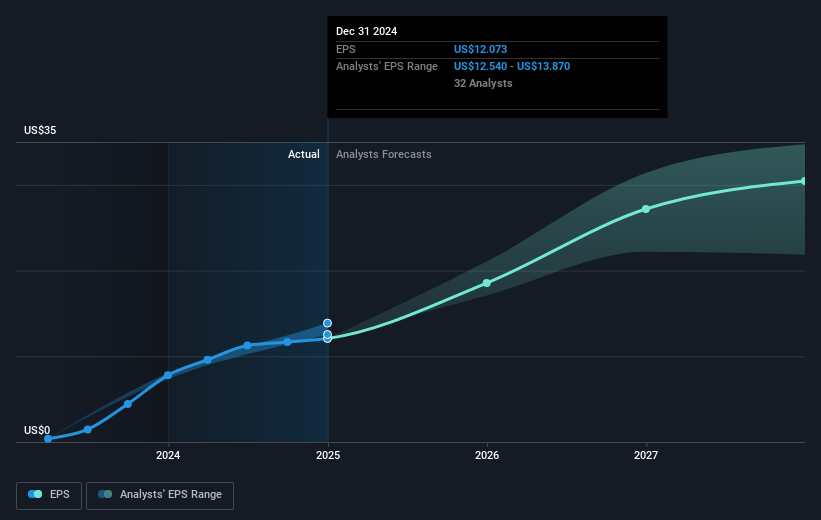

The agreement with UbiQD and new earnings guidance could bolster revenue and earnings forecasts. Analysts project First Solar's revenue to climb 12.4% annually and earnings to rise 22.46% per year. These initiatives, coupled with potential margin improvements, position First Solar for enhanced future performance. The company's stock is currently trading at US$174.73, representing a 17% discount to the consensus price target of US$204.38. This valuation suggests room for potential upside, assuming the market aligns with analysts' expectations and the company navigates trade-related risks effectively.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com