Comfort Systems USA (FIX) saw its share price rise by 63% over the last quarter, a period marked by significant corporate achievements and a challenging external market environment. The company's strong quarterly earnings report, featuring a sales increase to $2,173 million and a net income rise to $231 million, likely contributed to investor confidence. Additionally, the announcement of a $0.05 increase in their quarterly dividend to $0.50 per share enhanced shareholder appeal. Despite these positive signals, the broad market experienced volatility due to geopolitical uncertainties and weakening labor data, but Comfort Systems USA's robust financial performance seemingly countered these broader economic concerns.

We've spotted 1 possible red flag for Comfort Systems USA you should be aware of.

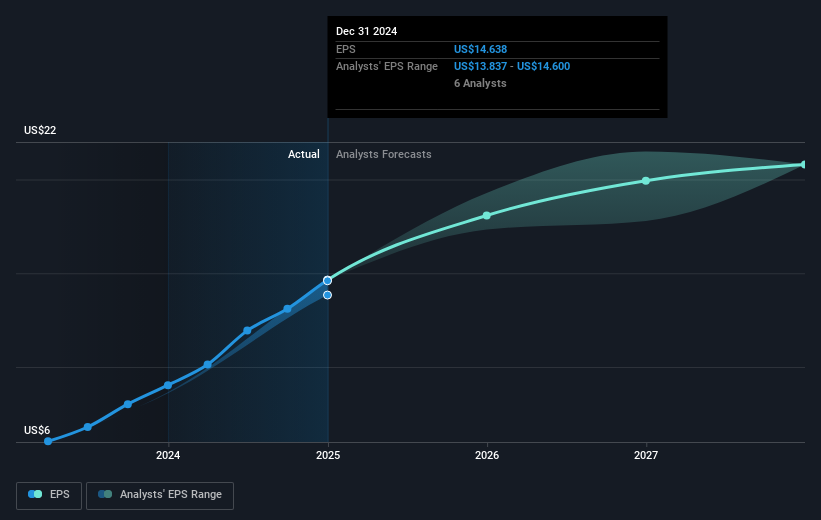

The recent corporate achievements and impressive earnings and dividend announcement for Comfort Systems USA (FIX) have bolstered its narrative of expansion and increased market presence, with the potential to enhance earnings and revenue forecasts. The growth in modular construction and demand in technology and healthcare sectors align with the company's strategic initiatives, reflecting positively on its financial projections. In this context, the share price surge of 63% over the last quarter ties into these broader growth drivers, suggesting a continued trajectory towards the consensus analyst price target of US$767.20. However, with the current share price closely aligned with the price target, there may be limited room for upside without further performance breakthroughs.

Over the longer-term, Comfort Systems USA's total shareholder return, including dividends, has been very large at 1302.11% over the past five years. Comparatively, over the last year alone, its earnings growth of 62.1% outpaced the US Construction industry growth of 43.4%, underscoring its strong performance relative to peers. This robust historical performance provides context for evaluating its future potential amid current market conditions. With a steady increase in service revenues and expansion in specialized sectors, the company could see sustained revenue and earnings growth, subject to execution risks highlighted by its reliance on technology sectors and potential cost pressures.

Assess Comfort Systems USA's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com