- Kiniksa Pharmaceuticals reported second-quarter 2025 earnings, highlighting a jump in revenue to US$156.8 million and a shift from a quarterly net loss to a net income of US$17.83 million, with raised full-year revenue guidance now between US$625 million and US$640 million.

- This demonstrates the company's rapid transformation to profitability and management's confidence in stronger revenue momentum for the remainder of the year.

- With full-year revenue guidance raised, we'll examine how increased confidence in future sales impacts Kiniksa Pharmaceuticals' investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Kiniksa Pharmaceuticals International Investment Narrative Recap

To be a shareholder in Kiniksa Pharmaceuticals, you have to believe in the ongoing adoption of ARCALYST and the strength of management’s execution as the core drivers of future earnings. While the surge in Q2 profits and higher full-year revenue guidance point to sharp short-term momentum, these results do not materially alter the need for consistent revenue growth as more Medicare Part D patients transition from free to paid therapy, a key catalyst that also introduces volatility if patient uptake slows.

Of the recent announcements, Kiniksa’s decision to raise its 2025 revenue guidance to US$625 million–US$640 million stands out as most relevant. This move signals increased management confidence in their near-term sales pipeline but does not eliminate operational risks, particularly those tied to evolving Medicare policy and the sustainability of transition-driven growth.

Yet, it is just as important for investors to recognize that, if the one-time Medicare Part D transition effect proves temporary...

Read the full narrative on Kiniksa Pharmaceuticals International (it's free!)

Kiniksa Pharmaceuticals International is projected to achieve $879.7 million in revenue and $151.3 million in earnings by 2028. This outlook assumes a 22.3% annual revenue growth rate and an earnings increase of $168.3 million from the current earnings of -$17.0 million.

Uncover how Kiniksa Pharmaceuticals International's forecasts yield a $40.83 fair value, a 35% upside to its current price.

Exploring Other Perspectives

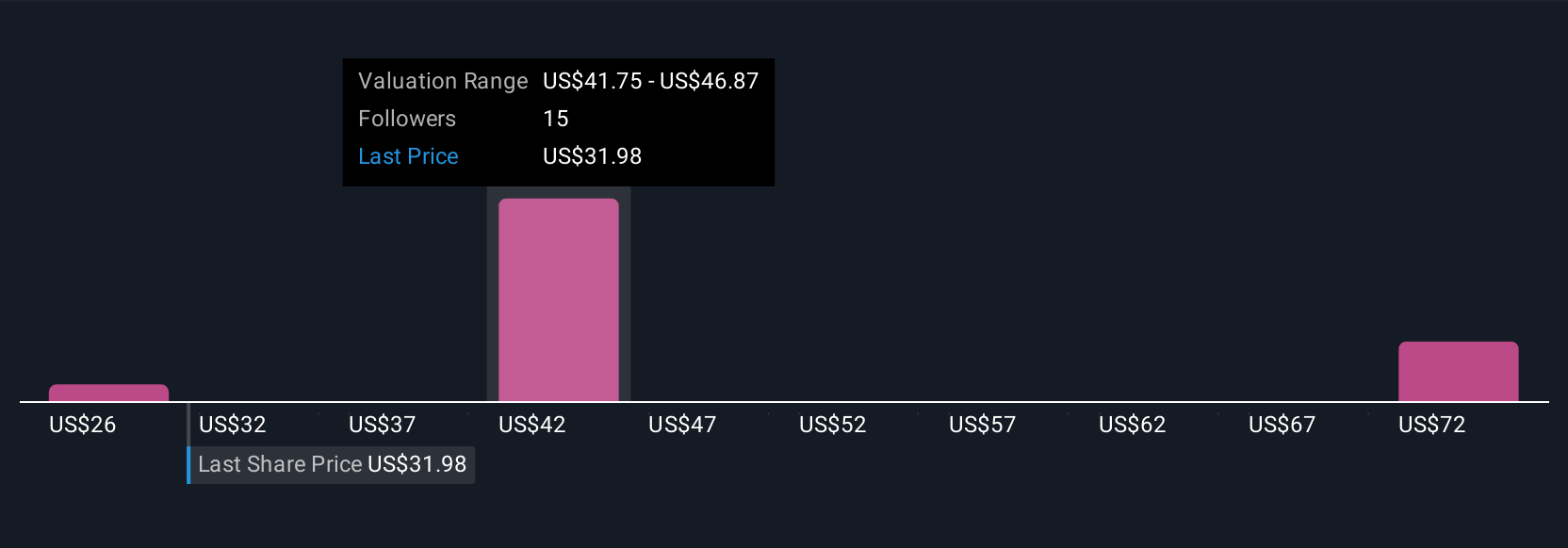

Four individual estimates from the Simply Wall St Community put Kiniksa’s fair value between US$26.39 and US$77.60. With management now lifting guidance, sustained ARCALYST adoption remains a central theme that could reshape these viewpoints, so make sure to consider multiple perspectives before drawing conclusions.

Explore 4 other fair value estimates on Kiniksa Pharmaceuticals International - why the stock might be worth over 2x more than the current price!

Build Your Own Kiniksa Pharmaceuticals International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kiniksa Pharmaceuticals International research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Kiniksa Pharmaceuticals International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kiniksa Pharmaceuticals International's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com