- CONMED Corporation recently reported its second quarter 2025 results, with sales rising to US$342.35 million and net income from continuing operations dropping to US$21.42 million compared to the prior year.

- While operational profitability was mixed, CONMED signaled measured optimism by modestly raising its full-year revenue guidance for 2025.

- We'll examine how CONMED's decision to increase its revenue outlook shapes the company's broader investment case and growth trajectory.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

CONMED Investment Narrative Recap

To be a CONMED shareholder, you need to believe in the company's ability to grow its top line while tackling operational hurdles, particularly within its Orthopedic segment and broader supply chain. The latest modest raise in CONMED’s 2025 revenue guidance is a signal of cautious optimism, but it is not a material shift and leaves the biggest near-term catalyst, effective resolution of supply challenges, unchanged, along with the ongoing risks tied to margin pressure and execution. Among the recent announcements, the update to full-year revenue guidance stands out as most relevant. While the revised range is only slightly higher, it reflects some confidence in demand and operational progress, though it does not yet resolve questions around longer-term margin recovery or execution in key growth areas like AirSeal and BioBrace. In contrast, ongoing reliance on single-source supply chains remains an issue that investors should be aware of, since…

Read the full narrative on CONMED (it's free!)

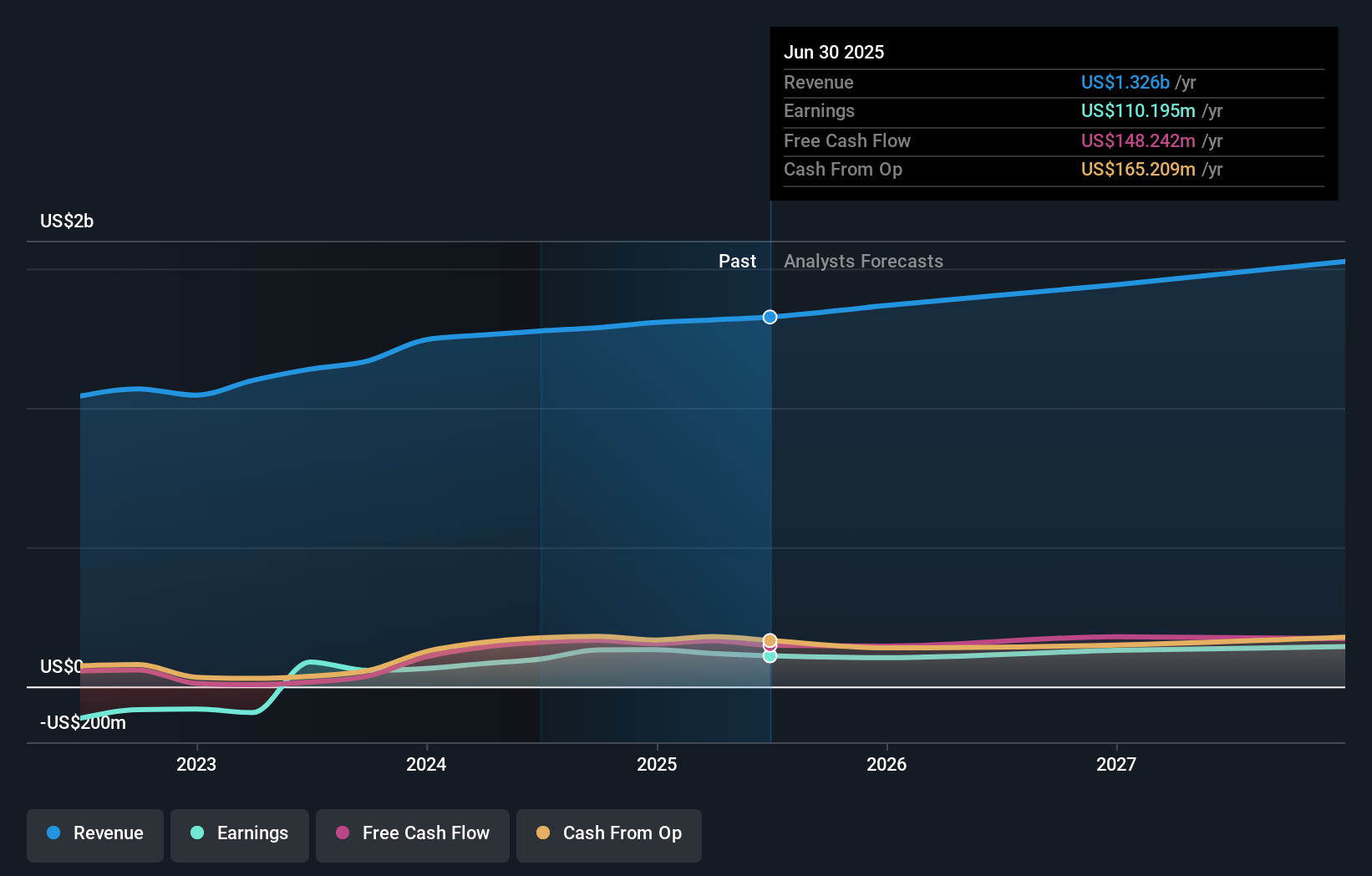

CONMED's narrative projects $1.5 billion revenue and $137.4 million earnings by 2028. This requires 5.3% yearly revenue growth and a $18.6 million earnings increase from $118.8 million today.

Uncover how CONMED's forecasts yield a $66.60 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Only one fair value estimate from the Simply Wall St Community values CONMED at US$66.60 per share. With the company’s supply chain challenges still front and center, you may find value in comparing a range of peer forecasts and perspectives.

Explore another fair value estimate on CONMED - why the stock might be worth as much as 30% more than the current price!

Build Your Own CONMED Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CONMED research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

- Our free CONMED research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CONMED's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com