- Autoliv recently reported second-quarter 2025 earnings, posting sales of US$2,714 million and net income of US$167 million, both above prior-year levels, and reaffirmed its full-year 2025 organic sales growth guidance at around 3%.

- The earnings update underlines both solid operational performance and management’s confidence in demand, supported by effective cost control and tariff compensation measures.

- We'll explore how the stronger earnings and confirmed guidance signal underlying momentum in Autoliv's investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Autoliv Investment Narrative Recap

To be a shareholder in Autoliv, you need to believe that rising global demand for automotive safety and the company’s efficiency improvements will continue to drive earnings, despite risks from trade tariffs and slowing vehicle production. The latest results, with Q2 2025 sales and profits both higher year over year and guidance repeated, reinforce management’s operational confidence but do not materially shift the near-term catalyst, which remains tied to sustained margin recovery. Downside risks from unfavorable shifts in global manufacturing or renewed pricing pressure have not been eliminated by these results.

Among the recent updates, the company’s confirmation of full-year 2025 organic sales growth at around 3%, helped by tariff compensation, directly supports its narrative of managing trade headwinds. This focus on passing through costs aligns with the short-term catalyst of margin recovery, even as questions remain around end-market demand growth and the company’s ability to withstand pressure from OEMs or consumers in key geographies.

Yet, even as these positive trends grab attention, investors should be aware that ongoing pricing pressure from large automotive manufacturers in China and other major regions …

Read the full narrative on Autoliv (it's free!)

Autoliv's narrative projects $11.8 billion in revenue and $895.6 million in earnings by 2028. This requires 4.1% yearly revenue growth and a $180.6 million earnings increase from $715.0 million currently.

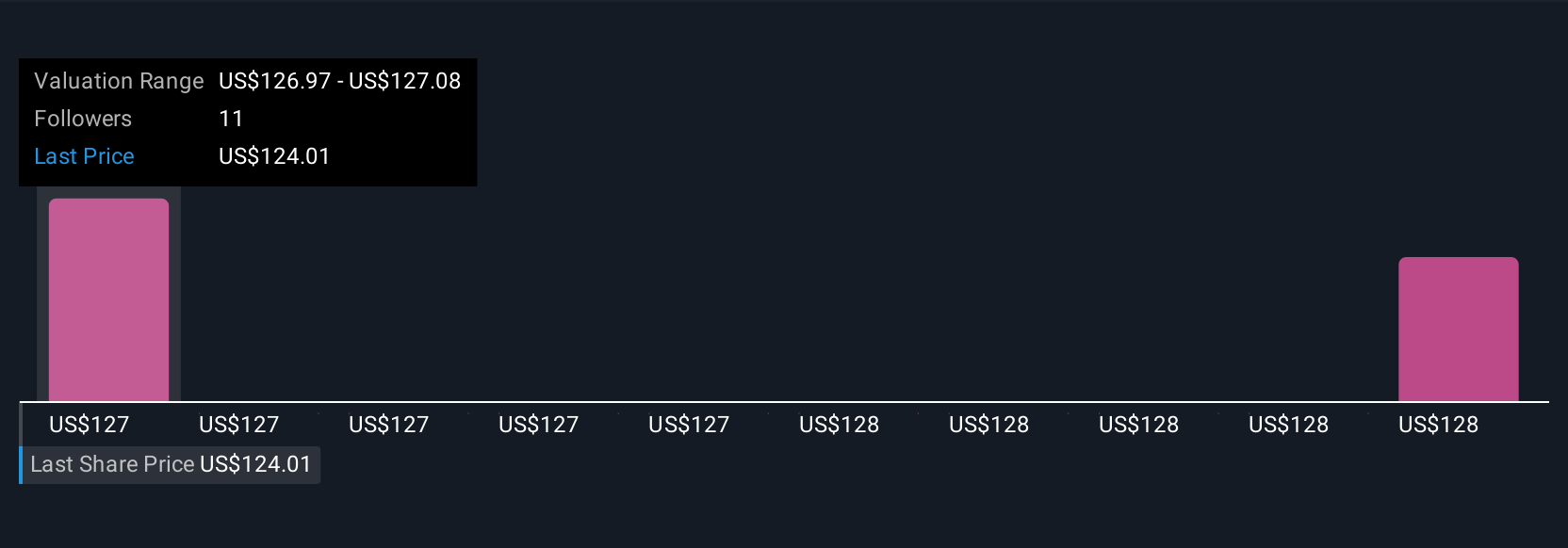

Uncover how Autoliv's forecasts yield a $126.33 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 2 fair value estimates for Autoliv, ranging from US$126.33 to US$127.71 per share. While opinions vary, efficient cost control and tariff compensation could support sustained margin improvement, although challenges in vehicle production growth might still impact performance, review multiple viewpoints to see the full picture.

Explore 2 other fair value estimates on Autoliv - why the stock might be worth just $126.33!

Build Your Own Autoliv Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Autoliv research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Autoliv research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Autoliv's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com