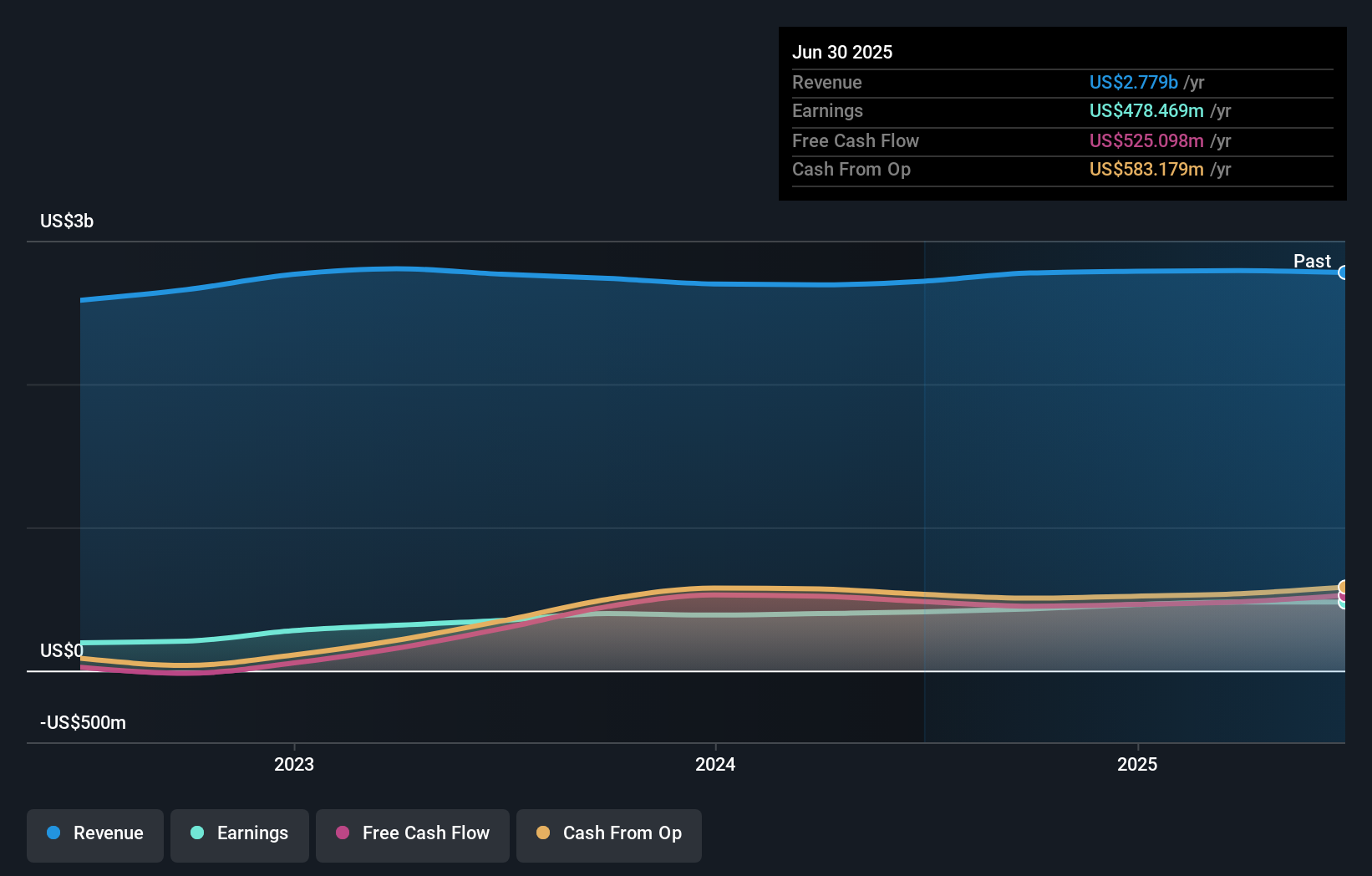

- NewMarket Corporation recently reported its second-quarter 2025 results, showing sales of US$698.51 million and net income of US$111.24 million, both slightly lower than a year ago, but with earnings per share rising to US$11.84.

- This stable profitability, despite a marginal decrease in sales, highlights the company's ability to sustain earnings in a challenging market.

- We’ll explore how NewMarket’s resilience in maintaining solid earnings despite softer sales shapes its investment narrative going forward.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 24 companies in the world exploring or producing it. Find the list for free.

What Is NewMarket's Investment Narrative?

To believe in NewMarket as a shareholder, it’s important to focus on the company’s proven ability to deliver stable earnings in mixed market conditions. The recent second-quarter results, while showing sales and net income just below last year’s levels, demonstrated that NewMarket continues to translate even modest revenues into increased earnings per share, supported by solid net profit margins and cost control. This kind of earnings resilience, coupled with an attractive dividend and ongoing share buybacks, has been key to the investment story here. Based on the muted reaction in NewMarket’s share price after the quarterly update, the slight dip in sales doesn’t signal a meaningful shift in short-term catalysts or the overall risk profile. The biggest concerns still appear to be high debt levels and any future swings in chemical demand, which could affect the company’s ability to maintain profit margins. On balance, this earnings update fits the pattern of steady financial performance, which may help soothe immediate worries about operational volatility, though any reversal in industry demand remains the issue to watch.

However, elevated debt is still a risk that investors should keep in mind.

Exploring Other Perspectives

Explore 2 other fair value estimates on NewMarket - why the stock might be worth over 2x more than the current price!

Build Your Own NewMarket Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NewMarket research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NewMarket research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NewMarket's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com