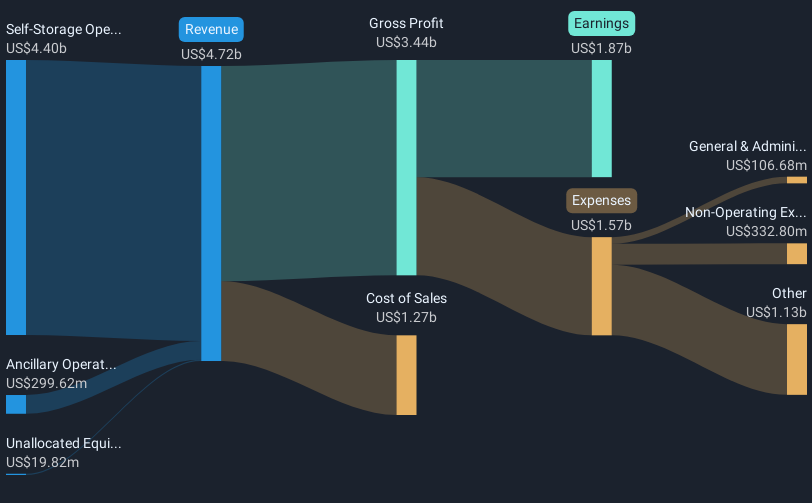

Public Storage (PSA) recently experienced executive changes with the appointment of Luke Petherbridge to its Board, expanding it to thirteen members. Additionally, the company's earnings announcement revealed a mixed financial performance, with increases in sales and revenue but a decline in net income. The company also updated its earnings guidance, presenting a revision that slightly improved expectations. Amidst these developments, the company's stock performance remained flat over the past week, mirroring broader market trends. The events surrounding Public Storage could have added weight to the modest fluctuations observed within the stock's performance.

Be aware that Public Storage is showing 1 weakness in our investment analysis.

The recent executive changes at Public Storage, alongside the company's updated earnings guidance and mixed financial performance, could influence its strategic direction. The new board member may bring fresh perspectives that support the company's ongoing global acquisitions and digital transformation efforts. These moves are essential components of its narrative, targeting revenue growth and cost optimization, but challenges such as declining move-in rents and regulatory constraints remain. These developments could impact analysts' revenue and earnings forecasts, potentially influencing the share price trajectory.

Over the past five years, Public Storage has delivered a total return of 81.09% for shareholders, combining both share price appreciation and dividends. This reflects a solid performance over the long term, despite recent market volatility. In contrast, over the past year, Public Storage underperformed the US market and the US Specialized REITs industry, which saw returns of 17.5% and 0.2%, respectively. This comparison highlights the company's relative struggles in a challenging environment.

With Public Storage's current share price at US$288.65 and a consensus analyst price target of US$332.42, the stock trades at a discount of approximately 15% to its target, indicating potential upside if earnings and revenue forecasts are met. The forward-looking narrative, driven by international expansion and digital efforts, aims to bridge this gap, yet economic headwinds and market volatility could complicate these ambitions. Investors should consider these dynamics when evaluating the company's future potential and return prospects.

Dive into the specifics of Public Storage here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com