- Ashland Inc. recently reported third-quarter results reflecting a sharp drop in sales to US$463 million and a net loss of US$742 million, mainly driven by a US$706 million non-cash goodwill impairment charge.

- This significant write-down and lower sales prompted Ashland to update its full-year guidance toward the lower end of its projected sales range, highlighting ongoing headwinds and elevated uncertainty in its core markets.

- We'll examine how the substantial goodwill impairment highlights challenges to Ashland's investment narrative based on sustainable, resilient earnings growth.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

Ashland Investment Narrative Recap

To be an Ashland shareholder, you really have to believe in the company's ability to deliver stable earnings and margin expansion in resilient end-markets like personal care and life sciences, especially as it pivots toward specialty, sustainable ingredients. The Q3 earnings miss and significant goodwill impairment now underscore that the biggest near-term risk lies in persistent demand softness and earnings uncertainty, while the most important catalyst, Ashland's margin improvement and innovation initiatives, faces more scrutiny after these results.

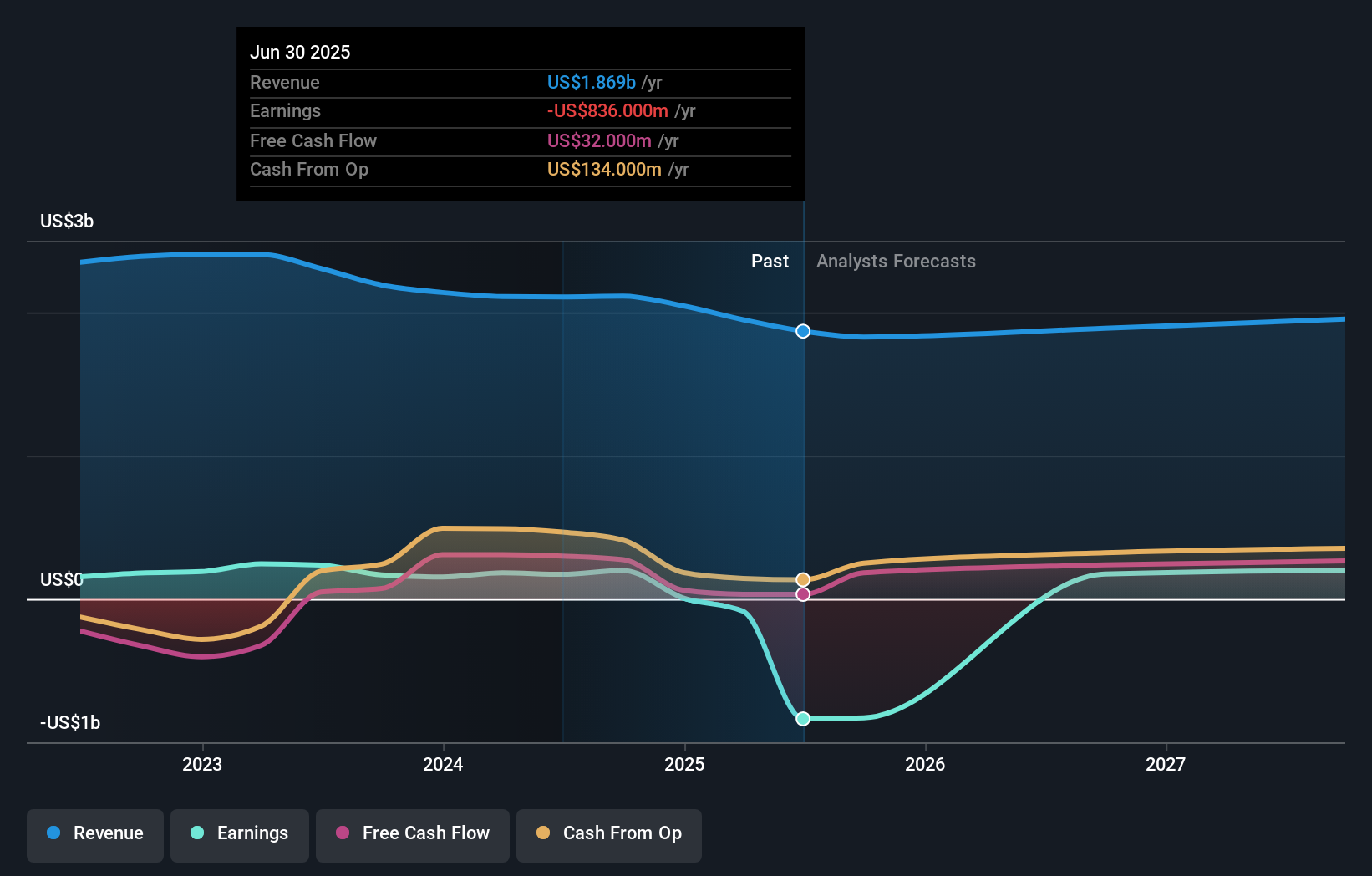

Among recent announcements, the revised full-year sales guidance is especially relevant, as it directly addresses the scale of ongoing market headwinds reflected in Q3's weak sales. The company's move to narrow its outlook to US$1.825–1.850 billion, weighted toward the lower end, signals both caution and management’s effort to reset baseline expectations as demand challenges persist.

Yet, what investors should watch for is whether the scale of goodwill impairment hints at deeper and more durable pressure on Ashland's...

Read the full narrative on Ashland (it's free!)

Ashland's outlook forecasts $1.9 billion in revenue and $271.9 million in earnings by 2028. This assumes 0.0% annual revenue growth and a $357.9 million increase in earnings from the current -$86.0 million.

Uncover how Ashland's forecasts yield a $65.22 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$65 to US$122 across two analyses. While opinions vary, many participants are focused on revenue and margin headwinds that may limit turnaround potential, reminding you to consider how sentiment swings can impact outlooks.

Explore 2 other fair value estimates on Ashland - why the stock might be worth over 2x more than the current price!

Build Your Own Ashland Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ashland research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ashland research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ashland's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com