Labcorp Holdings (LH) has recently celebrated a significant milestone with the CE-marking approval of its PGDx elio tissue complete test in the EU, a breakthrough that enhances access to personalized cancer care. This achievement, alongside the announcement of a $0.72 dividend per share and solid Q2 financial results, likely supported the company's 8.93% price increase over the last quarter. Additionally, Labcorp’s aggressive share buyback program and strategic client partnerships may have further buoyed the stock's performance, paralleling the broader market's positive sentiment driven by strong corporate earnings and economic indicators.

You should learn about the 2 risks we've spotted with Labcorp Holdings.

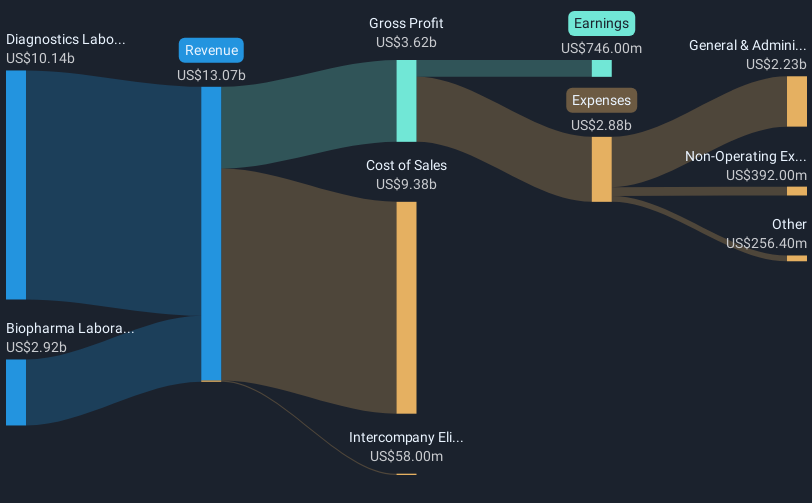

The recent CE-marking approval for Labcorp Holdings' PGDx elio tissue complete test in the EU marks a significant advancement in cancer diagnostics, aligning well with its ongoing collaborations and acquisitions aimed at high-growth areas. This milestone might bolster future revenue streams and justify current optimistic earnings forecasts, as the company continues to innovate in oncology and other segments. The introduction of this test could enhance operational efficiency and margins, potentially affecting the forecasted 5.2% annual revenue growth and earnings reaching US$1.3 billion by 2028.

Over the past five years, Labcorp has delivered a total shareholder return of 61.94%, highlighting its robust long-term performance. In the shorter term, Labcorp outpaced the US Healthcare industry's return, which saw a steep decline over the past year. This resilience could be attributed to its initiatives like the share buyback program and maintaining strategic partnerships, further fortifying investor confidence.

The stock's price increase of 8.93% over the last quarter brings it closer to the consensus price target of US$291. While it represents a potential upward trajectory, the current share price of US$261.88 indicates that the market continues to evaluate Labcorp’s advancements and risk factors, including regulatory impacts and competitive pressures. Investors may need to assess whether the company's innovations and strategic moves will sustain this momentum towards reaching and possibly exceeding the analysts' target.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com