- Earlier this week, Sunrun began dispatching more than 37,000 home batteries to supply emergency power to Puerto Rico's grid operator during periods of high electricity demand, while also announcing the completion of a US$431 million securitization of leases and power purchase agreements backed by over 63,000 systems across the US.

- This dual development highlights Sunrun's growing impact on both local grid resilience through distributed energy resources and its access to capital markets for continued expansion.

- We'll explore how Sunrun’s expanded grid service role in Puerto Rico could influence its overall investment narrative and future outlook.

Sunrun Investment Narrative Recap

To be a Sunrun shareholder, you need confidence in the company’s leadership in home solar-plus-storage and its ability to turn grid services into reliable revenue streams. While the recent dispatch of over 37,000 home batteries in Puerto Rico showcases operational scale and grid integration, it does not materially resolve Sunrun’s biggest short-term catalyst, expansion of profitable grid services, or its main risk, which remains exposure to volatile interest rates and capital costs.

Of the recent announcements, the US$431 million securitization of leases is most relevant here. This transaction reinforces Sunrun’s continuous access to capital markets, which is vital for funding expansion and managing cash flows, both necessary for delivering on growth plans as grid service programs become a larger revenue focus.

Yet, despite this progress, investors should recognize the risk that fluctuating financing costs could...

Read the full narrative on Sunrun (it's free!)

Sunrun's outlook projects $2.9 billion in revenue and $288.1 million in earnings by 2028. This requires 11.2% annual revenue growth and an earnings increase of approximately $3.0 billion from current earnings of -$2.7 billion.

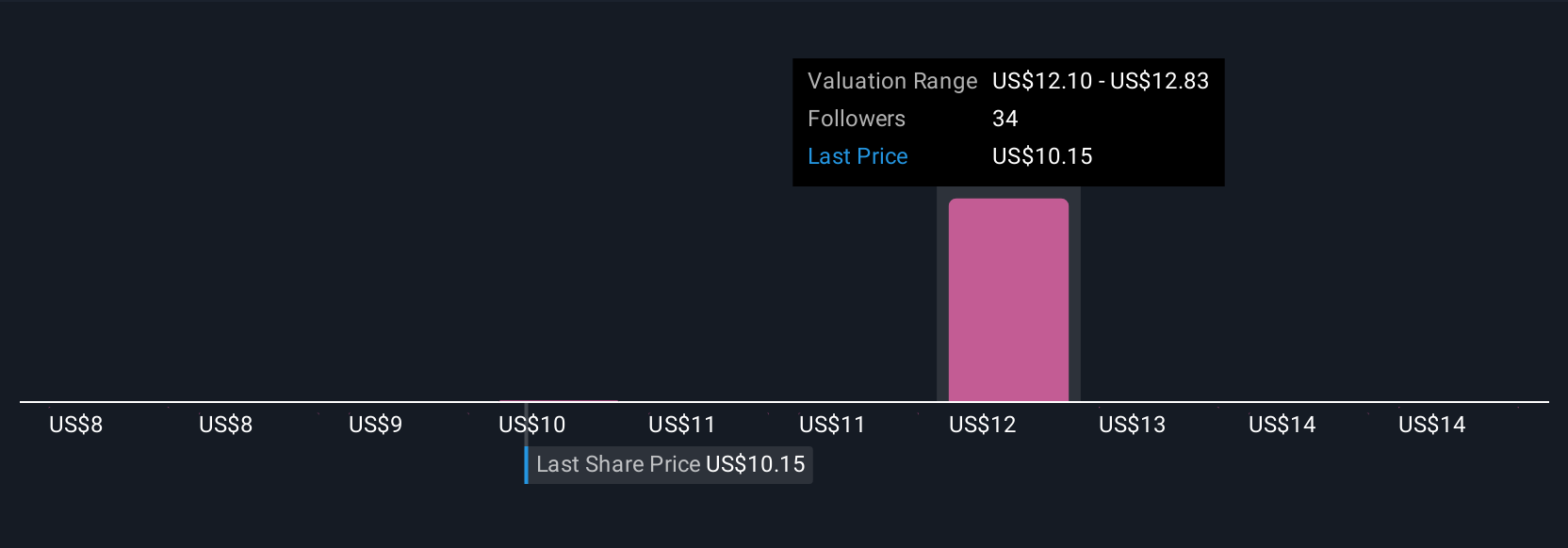

Uncover how Sunrun's forecasts yield a $12.71 fair value, a 18% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Sunrun’s fair value anywhere from US$7.76 to US$15, reflecting five differing analyses. In light of Sunrun’s reliance on capital markets, these contrasting perspectives highlight how funding costs could shape future performance and are essential to compare.

Build Your Own Sunrun Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sunrun research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Sunrun research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sunrun's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com