- Cleveland-Cliffs Inc. recently announced its second-quarter 2025 results, reporting sales of US$4.93 billion and a net loss of US$483 million, compared to net income in the prior year period.

- This reversal from profitability highlights a pronounced shift in the company's earnings performance, underscoring challenges in maintaining revenue and managing costs amid industry headwinds.

- We'll examine how Cleveland-Cliffs' significant quarterly loss may alter the company's investment narrative and future outlook.

Cleveland-Cliffs Investment Narrative Recap

To be a shareholder in Cleveland-Cliffs today, one must believe in the continued strength of U.S. steel protectionism and the company’s ability to restore profitability through domestic demand, operational efficiencies, and portfolio improvements. However, the recent US$483 million net loss in Q2 2025 creates near-term uncertainty, prompting questions about cost management and whether recovery catalysts, such as tariff enforcement and automotive demand, will materialize quickly enough. The central risk remains the company’s exposure to shifts in trade policy and the slow pace of decarbonization investments; for now, Q2’s results do little to change that risk-reward balance in a material way. Among Cleveland-Cliffs’ recent announcements, the commissioning of a new Vertical Stainless Bright Anneal Line in Ohio stands out as most relevant to the current earnings story. This US$150 million facility supports the company’s bid for higher-margin, environmentally-friendlier steel products, potentially offering some revenue and product-mix relief in future quarters, though immediate impacts may be limited given persistent industry pressures and loss trends. Yet in contrast to the opportunities posed by product innovation, investors should be aware that Cleveland-Cliffs’ reliance on legacy blast furnace operations continues to expose it to...

Read the full narrative on Cleveland-Cliffs (it's free!)

Cleveland-Cliffs is projected to reach $22.8 billion in revenue and $567.8 million in earnings by 2028. This outlook requires annual revenue growth of 7.3% and a $2.27 billion increase in earnings from current earnings of -$1.7 billion.

Exploring Other Perspectives

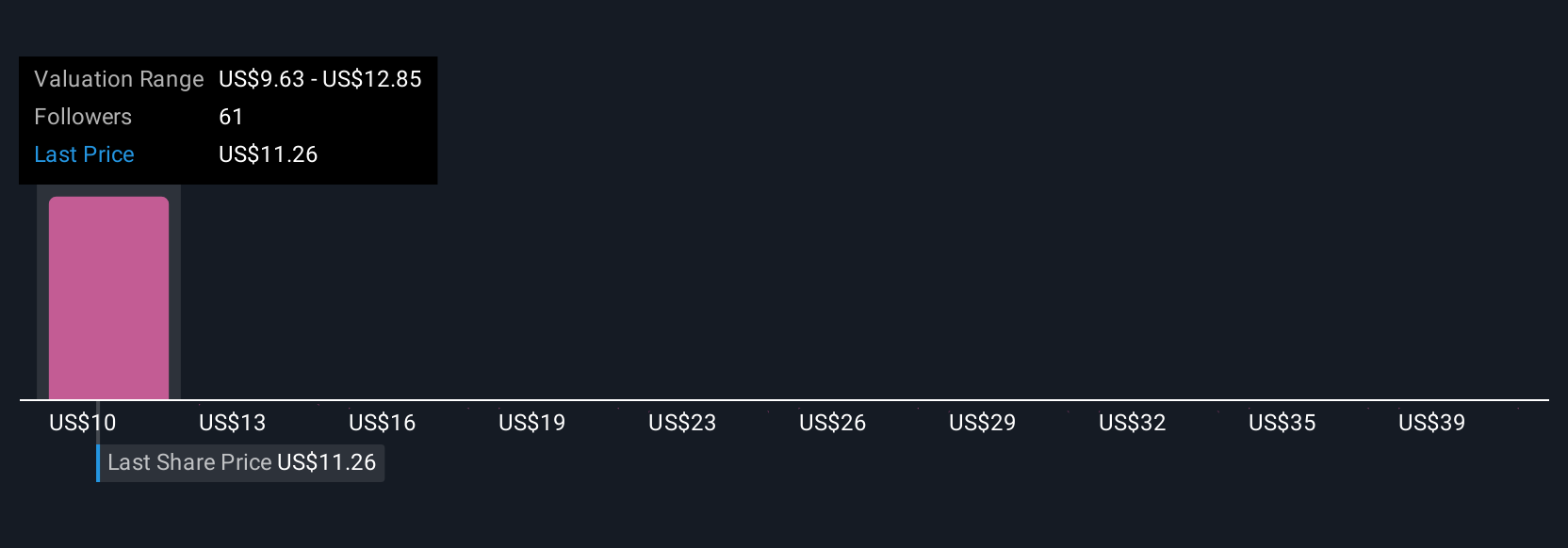

Eight individual fair value estimates from the Simply Wall St Community for Cleveland-Cliffs range from US$9.42 to as high as US$41.89 per share. Many market participants remain focused on the fundamental risk of future tariff changes and how this could influence cash flow and profitability; you can explore these broader implications across community viewpoints.

Build Your Own Cleveland-Cliffs Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cleveland-Cliffs research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Cleveland-Cliffs research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cleveland-Cliffs' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com