As the U.S. stock market reaches new heights, with major indices like the S&P 500 and Nasdaq hitting record levels amid strong earnings reports, investors are increasingly eyeing dividend stocks as a reliable source of income in an otherwise volatile economic landscape. In such an environment, selecting dividend stocks with robust yields can offer a steady stream of returns while potentially benefiting from broader market gains.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.63% | ★★★★★☆ |

| Universal (UVV) | 6.02% | ★★★★★★ |

| Huntington Bancshares (HBAN) | 3.71% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.11% | ★★★★★★ |

| Ennis (EBF) | 5.63% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 4.10% | ★★★★★☆ |

| Dillard's (DDS) | 5.63% | ★★★★★★ |

| Credicorp (BAP) | 4.84% | ★★★★★☆ |

| CompX International (CIX) | 4.85% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.91% | ★★★★★★ |

Click here to see the full list of 142 stocks from our Top US Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

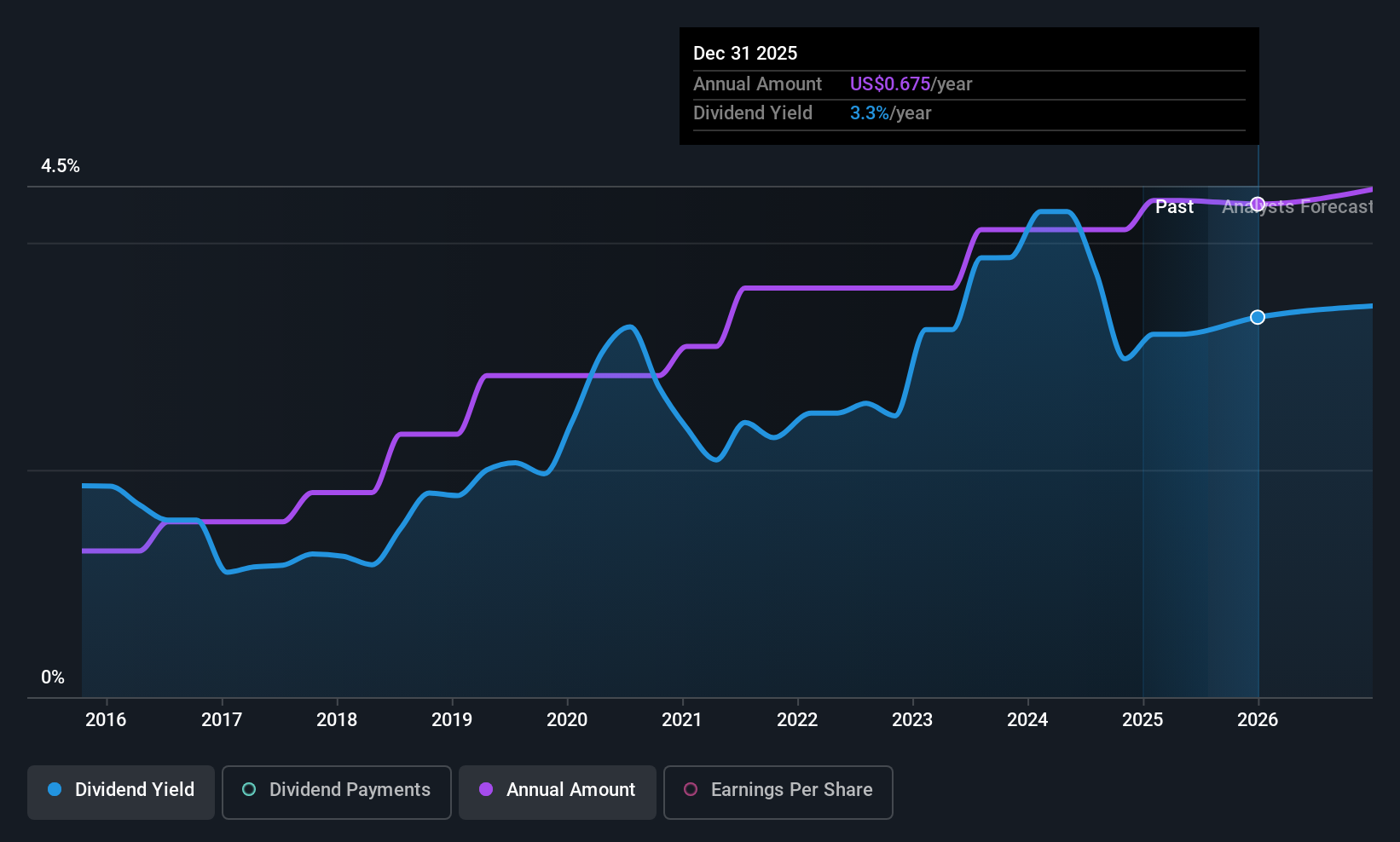

Civista Bancshares (CIVB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Civista Bancshares, Inc. is the financial holding company for Civista Bank, offering community banking services in the United States with a market cap of $411.63 million.

Operations: Civista Bancshares, Inc. generates revenue primarily through its banking segment, which accounts for $153.52 million.

Dividend Yield: 3.2%

Civista Bancshares offers a stable dividend yield of 3.19%, supported by a low payout ratio of 28.7%, indicating coverage by earnings. Despite recent shareholder dilution due to a $70 million equity offering, dividends have been reliable and growing over the past decade with minimal volatility. The company's net income rose significantly in Q1 2025, enhancing its capacity for future payouts, though its yield remains below top-tier US dividend payers.

- Navigate through the intricacies of Civista Bancshares with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Civista Bancshares' share price might be too pessimistic.

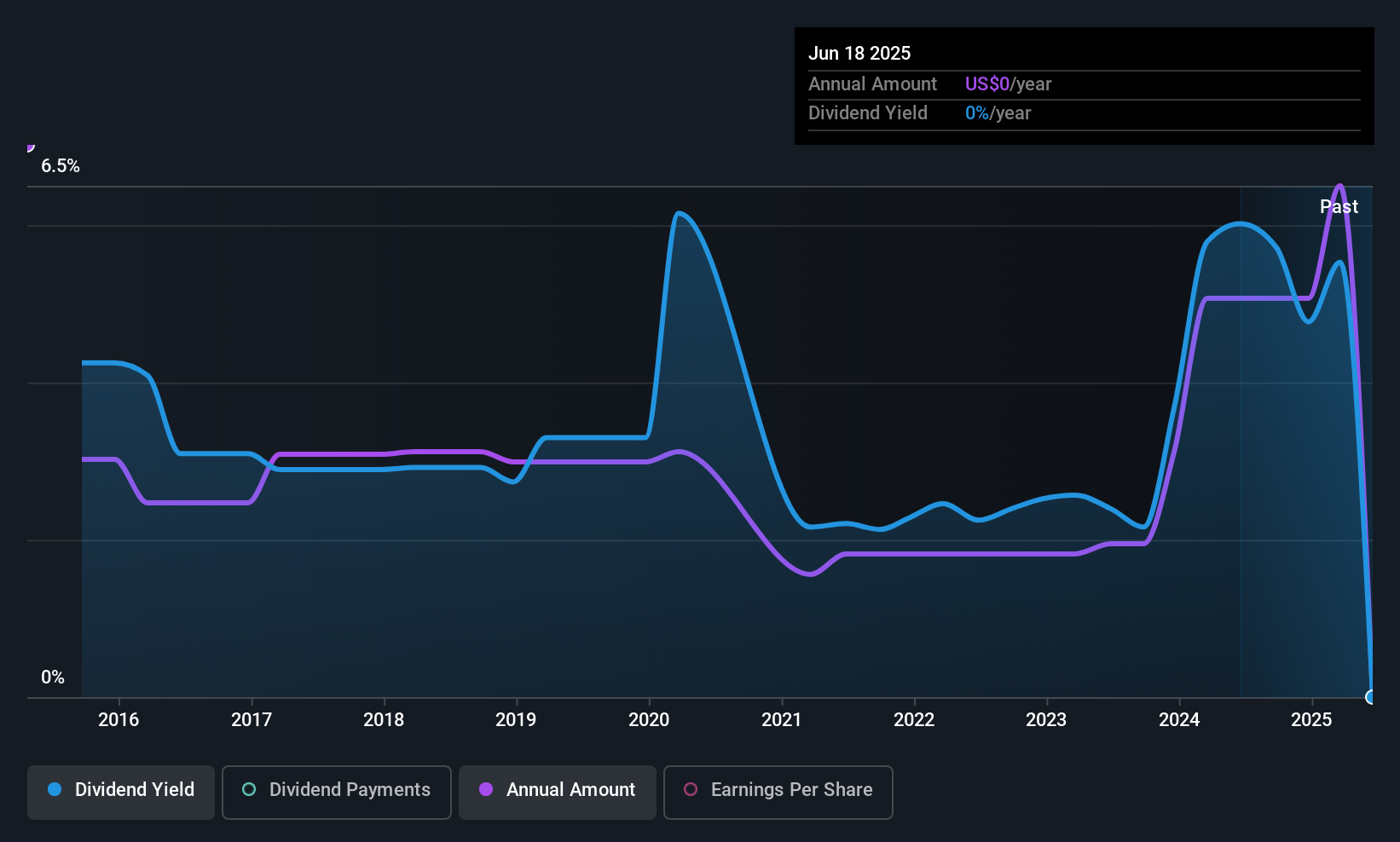

Ituran Location and Control (ITRN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ituran Location and Control Ltd. offers location-based telematics services and machine-to-machine telematics products in Israel, Brazil, and internationally, with a market cap of $773.06 million.

Operations: Ituran Location and Control Ltd. generates revenue from two main segments: Telematics Products, contributing $93.95 million, and Telematics Services, accounting for $243.74 million.

Dividend Yield: 5.1%

Ituran Location and Control's dividend yield is among the top 25% in the US market, supported by a payout ratio of 64.1%, indicating coverage by both earnings and cash flows. Despite recent earnings growth, dividends have been volatile over the past decade, lacking consistent reliability. The company recently declared a US$0.50 per share dividend totaling approximately US$10 million, while strategic partnerships with BMW Motorrad Brazil and Stellantis may bolster future revenue streams.

- Take a closer look at Ituran Location and Control's potential here in our dividend report.

- Our expertly prepared valuation report Ituran Location and Control implies its share price may be lower than expected.

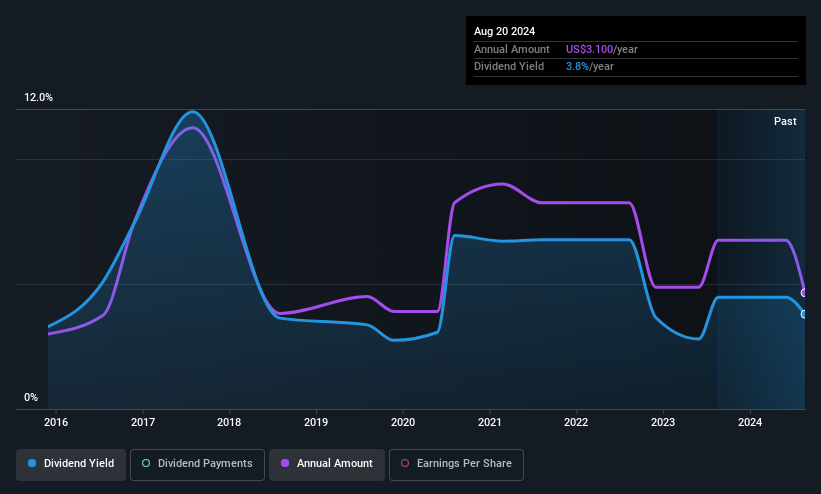

John B. Sanfilippo & Son (JBSS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: John B. Sanfilippo & Son, Inc., operating through its subsidiary JBSS Ventures, LLC, processes and distributes tree nuts and peanuts in the United States with a market cap of approximately $779.02 million.

Operations: The company's revenue primarily comes from selling various nut and nut-related products, totaling $1.11 billion.

Dividend Yield: 4.7%

John B. Sanfilippo & Son's recent dividend announcement includes a regular annual cash dividend of US$0.90 per share and a special dividend of US$0.60 per share, both payable on September 11, 2025. Despite being in the top 25% of US market dividend payers with a yield of 4.68%, dividends are not covered by free cash flows and have been volatile over the past decade, raising concerns about their sustainability and reliability.

- Click here and access our complete dividend analysis report to understand the dynamics of John B. Sanfilippo & Son.

- Our comprehensive valuation report raises the possibility that John B. Sanfilippo & Son is priced lower than what may be justified by its financials.

Where To Now?

- Click through to start exploring the rest of the 139 Top US Dividend Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com