Top 3 Real Estate Stocks That May Fall Off A Cliff This Month

Benzinga · 6d ago

Share

Listen to the news

As of July 11, 2025, three stocks in the real estate sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Opendoor Technologies Inc (NASDAQ:OPEN)

- Opendoor Technologies will report second quarter financial results for the period ended June 30, after the closing bell on Tuesday, Aug. 5. The company's stock jumped around 53% over the past five days and has a 52-week high of $3.09.

- RSI Value: 74.9

- OPEN Price Action: Shares of Opendoor Technologies jumped 19.7% to close at $0.88 on Thursday.

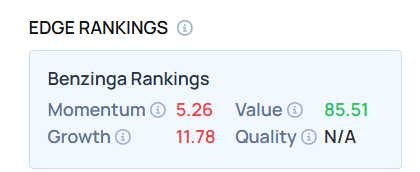

- Edge Stock Ratings: 5.26 Momentum score with Value at 85.51.

Outfront Media Inc (NYSE:OUT)

- On June 24, OUTFRONT Media announced a restructuring and reduction in force plan, looking to reduce workforce by about 120 employees. The company's stock gained around 6% over the past month and has a 52-week high of $19.98.

- RSI Value: 73.7

- OUT Price Action: Shares of Outfront Media gained 2.5% to close at $17.53 on Thursday.

Zillow Group Inc (NASDAQ:Z)

- On May 7, Zillow posted better-than-expected quarterly earnings. “Our strong Q1 results surpassed our expectations and demonstrate how well we’re executing. We are on track to meet our full-year 2025 goals, and we’re well-positioned to deliver sustainable profitable growth,” said Zillow Chief Executive Officer Jeremy Wacksman. The company's stock gained around 11% over the past five days and has a 52-week high of $89.39.

- RSI Value: 76.1

- Z Price Action: Shares of Zillow gained 4.5% to close at $78.91 on Thursday.

Curious about other BZ Edge Rankings? Click here to discover how similar stocks measure up.

Read This Next:

Photo via Shutterstock

Disclaimer:This article represents the opinion of the author only. It does not represent the opinion of Webull, nor should it be viewed as an indication that Webull either agrees with or confirms the truthfulness or accuracy of the information. It should not be considered as investment advice from Webull or anyone else, nor should it be used as the basis of any investment decision.

What's Trending

No content on the Webull website shall be considered a recommendation or solicitation for the purchase or sale of securities, options or other investment products. All information and data on the website is for reference only and no historical data shall be considered as the basis for judging future trends.

Copyright © 2025 Webull. All Rights Reserved