Visa (NYSE:V) recently expanded its partnership with FIS to offer advanced payment solutions to financial institutions, introducing services that enhance customer control and experience. This move aligns with ongoing market trends to provide innovative financial services. Additionally, the appointment of Tareq Muhmood as regional president for CEMEA underscores Visa's focus on strengthening its market presence. Despite these developments, Visa's 1.43% price increase last week was consistent with the overall market trend, which rose by 1.7%. These events likely added supportive weight to Visa’s performance, reflecting broader market optimism rather than generating unique movement.

Buy, Hold or Sell Visa? View our complete analysis and fair value estimate and you decide.

Visa's recent collaboration with FIS aims to enhance payment solutions, aligning with industry trends for improved customer experiences. This partnership could support Visa’s strategy in expanding tokenization and stablecoin settlements, potentially impacting the company’s revenue and earnings positively over time. The introduction of Tareq Muhmood as regional president is a significant move towards reinforcing Visa's presence in key international markets, which may lead to increased transaction volumes.

Over the past five years, Visa has achieved a total return of 84.62%, reflecting strong long-term performance. Despite the recent news and initiatives, Visa's share price increase of just 1.43% last week was relatively modest compared to broader market dynamics. Within the last year, Visa’s performance surpassed the US Diversified Financial industry, which saw a return of 19.7%, and it exceeded the US Market's 12% return.

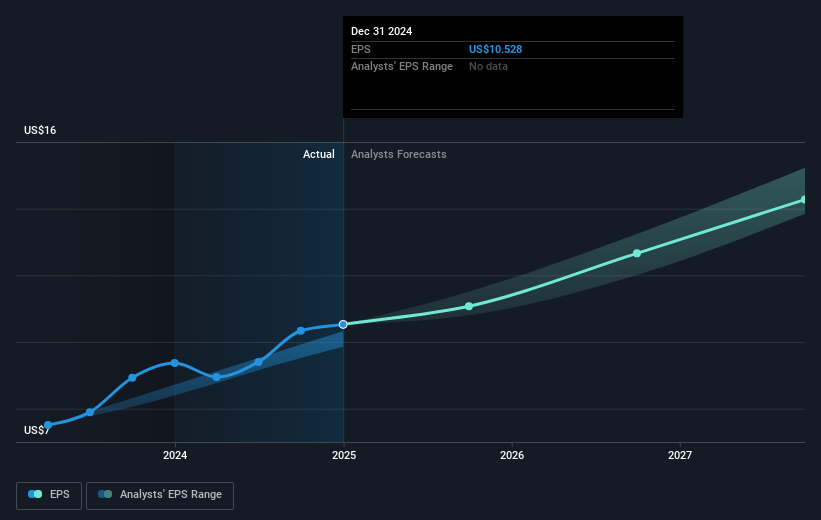

In terms of revenue and earnings forecasts, the recent strategic moves could bolster Visa's growth potential, supporting analyst expectations of revenue reaching US$51.3 billion by 2028, with earnings projected at US$27.2 billion. The current share price of US$347.70 shows a 7.1% gap to the analyst consensus price target of US$374.25, suggesting some room for appreciation if the anticipated growth materializes. However, with Visa's current price-earnings ratio considerably higher than industry averages, the stock may already reflect robust future expectations, necessitating careful analysis against these forecasts.

Understand Visa's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com