Nasdaq (NasdaqGS:NDAQ) recently announced a partnership to enhance its digital infrastructure, showcasing its commitment to integrating blockchain technology, which aligns well with its financial growth goals. This, coupled with a 15% rise in share price over the last quarter, reflects its robust performance amidst a broader market increase of 12% over the past year. Key contributors to this price movement include strong Q1 earnings, a dividend increase, and significant share buybacks. These developments likely supported the stock's performance, strengthening investor confidence and potentially countering any broader market fluctuations.

We've discovered 1 weakness for Nasdaq that you should be aware of before investing here.

Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

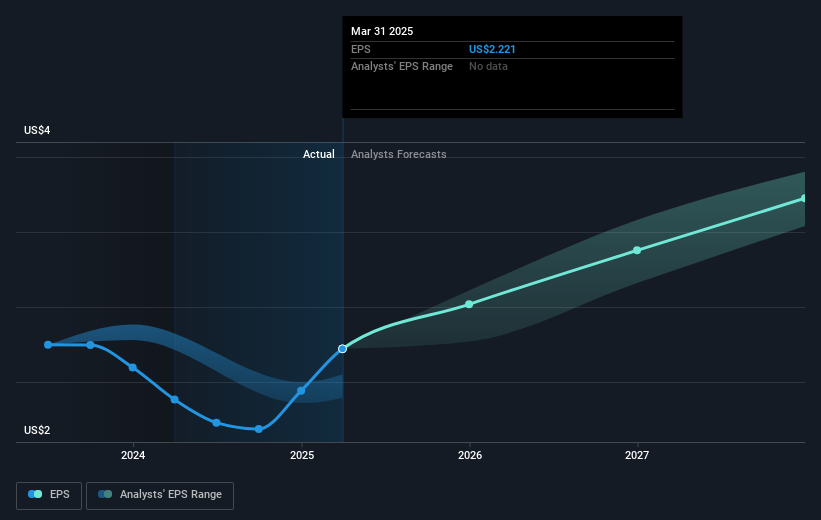

The recent announcement by Nasdaq regarding its partnership to enhance digital infrastructure reinforces the narrative of its ongoing investments in technology and market expansion. Such moves are anticipated to bolster operational efficiency and potentially drive revenue growth through enhanced customer engagement. Analysts forecast a decline in revenue by 5.9% per year over the next three years, despite expectations of an increase in earnings margins. This partnership could counterbalance some of these headwinds, supporting analyst expectations for improved future net margins and earnings per share.

Over the past five years, Nasdaq's total shareholder return, including dividends, was 134.55%. This performance reflects substantial value creation, compared to a relatively modest 12.2% return by the US market over the last year. Nasdaq's shares experienced a notable 15% rise in the previous quarter, supporting investor confidence amidst broader market changes. Despite recent gains, the current share price of US$78.08 sits below the analyst consensus price target of US$83.72, indicating potential room for further appreciation.

Understand Nasdaq's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com