Walmart (NYSE:WMT) experienced a price move of 14% over the last quarter, reflecting various developments, including ArcticCollagen's entry into the Walmart.com platform. This collaboration likely aligned with the company's broader wellness initiatives. Additionally, Walmart's earnings report showed increased sales, despite a decline in net income, which might have provided mixed signals to investors. Other initiatives, such as AIWA's speaker launch and Megan Thee Stallion's swimwear brand could have contributed positively to public perception. Despite a $222 million jury award in a trade secrets case, the company's diverse client offerings and market adaptation supported its price movement in line with broader market gains.

We've spotted 2 warning signs for Walmart you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The recent developments mentioned in your introduction reflect Walmart's alignment with its broader strategies, potentially impacting its revenue and earnings forecasts. The introduction of ArcticCollagen to Walmart.com and initiatives like AIWA's speaker launch and Megan Thee Stallion's swimwear could boost customer engagement, supporting top-line growth and potentially improving net margins. Despite the $222 million jury award, these efforts aim to mitigate related financial impacts.

Over the past five years, Walmart's total shareholder return was 161.80%, highlighting substantial longer-term value creation. When compared to the short-term, this performance underscores the company's resilience and adaptability. However, while Walmart exceeded the US market's 12% return over the past year, it lagged the US Consumer Retailing industry's 25% return, suggesting room for growth relative to peers.

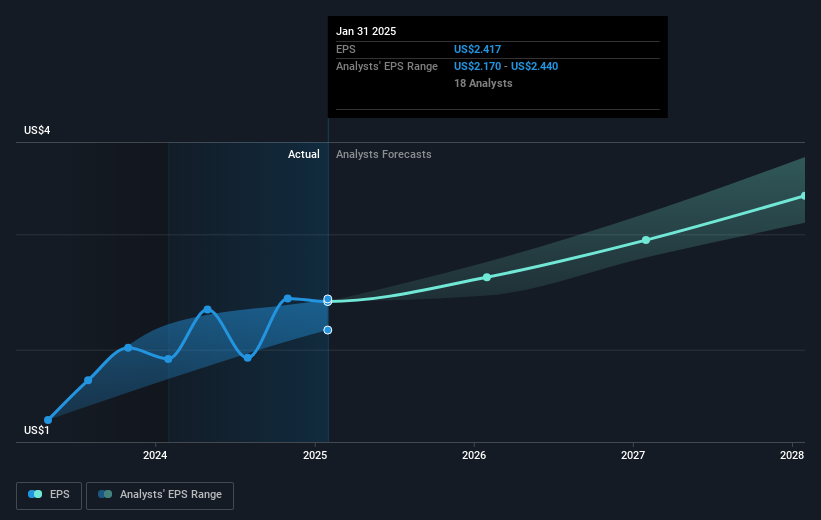

The recent price movement of a 14% increase aligns closely with the broader market gains and sets Walmart's current share price at US$98.55, which falls short of the analyst consensus price target of US$107.01. This indicates a potential upside of 7.9%, suggesting the market might be undervaluing some of the company's future earnings potential driven by initiatives like the PhonePe IPO and supply chain automation. However, investors should critically assess how these factors and other risks align with their expectations and own research.

Click here to discover the nuances of Walmart with our detailed analytical financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com